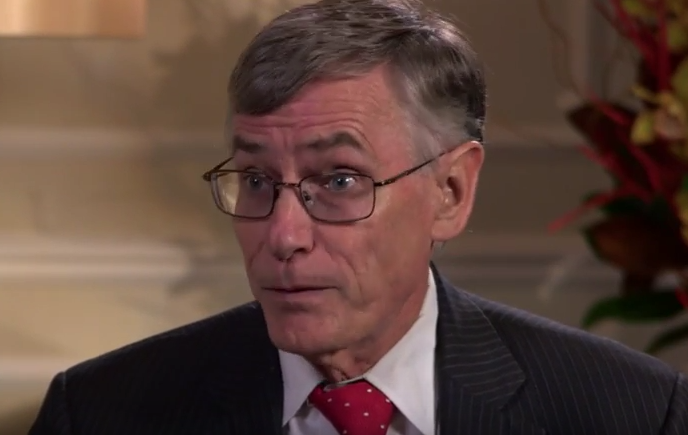

The Financial Industry Regulatory Authority (FINRA) said on Friday that Chairman and CEO Richard Ketchum, 64, has announced his plan to retire in the second half of 2016. The Board of Governors will conduct a search for his successor that will take into consideration internal and external candidates.

Mr. Ketchum has been one of the foremost industry regulators for more than three decades. He came to FINRA from the NYSE where he was CEO of NYSE Regulation. He also spent 12 years at NASD and The Nasdaq Stock Market, Inc., where he served as president of both organizations. Prior to that, he was the director of the SEC’s division of Market Regulation.

“I’m proud of FINRA’s achievements over the past six years,” said Mr. Ketchum. “We have been at the forefront of investor protection in our aggressive efforts to help enforce the rules that are so crucial to fair financial markets. Our accomplishments are founded on a commitment to excellence in our core competencies: examinations, enforcement, rulemaking, market transparency and market surveillance. Investor protection is our principal reason for being, and I have been honored to work with an incredibly dedicated and talented group of professionals who take this vital mission seriously. FINRA is well-placed to continue to play an important role in educating and protecting investors in the years ahead.”

“FINRA has thrived under Rick’s leadership, and we look forward to his continued guidance over the next many months,” said Lead Governor Jack Brennan, former CEO of Vanguard Group. “His stewardship began in the aftermath of the financial crisis when public trust in the financial system was at an historic low. As a champion of initiatives such as the High Risk Broker program, improvements in BrokerCheck, the expansion of TRACE reporting of asset-backed securities, and the expansion of FINRA’s responsibilities across stock and options trading, Rick has put FINRA on the front line of the movement for stronger investor protections and greater market integrity. Under Rick’s management, FINRA has emerged as a leader in the reshaping of American financial regulation and helped to restore the faith in the capital markets that forms the bedrock of our financial system.”

FINRA is the largest independent regulator for all securities firms doing business in the United States. FINRA is dedicated to investor protection and market integrity through effective and efficient regulation and complementary compliance and technology-based services. FINRA touches virtually every aspect of the securities business – from registering and educating all industry participants to examining securities firms, writing rules, enforcing those rules and the federal securities laws, and informing and educating the investing public. In addition, FINRA provides surveillance and other regulatory services for equities and options markets, as well as trade reporting and other industry utilities. FINRA also administers the largest dispute resolution forum for investors and firms.