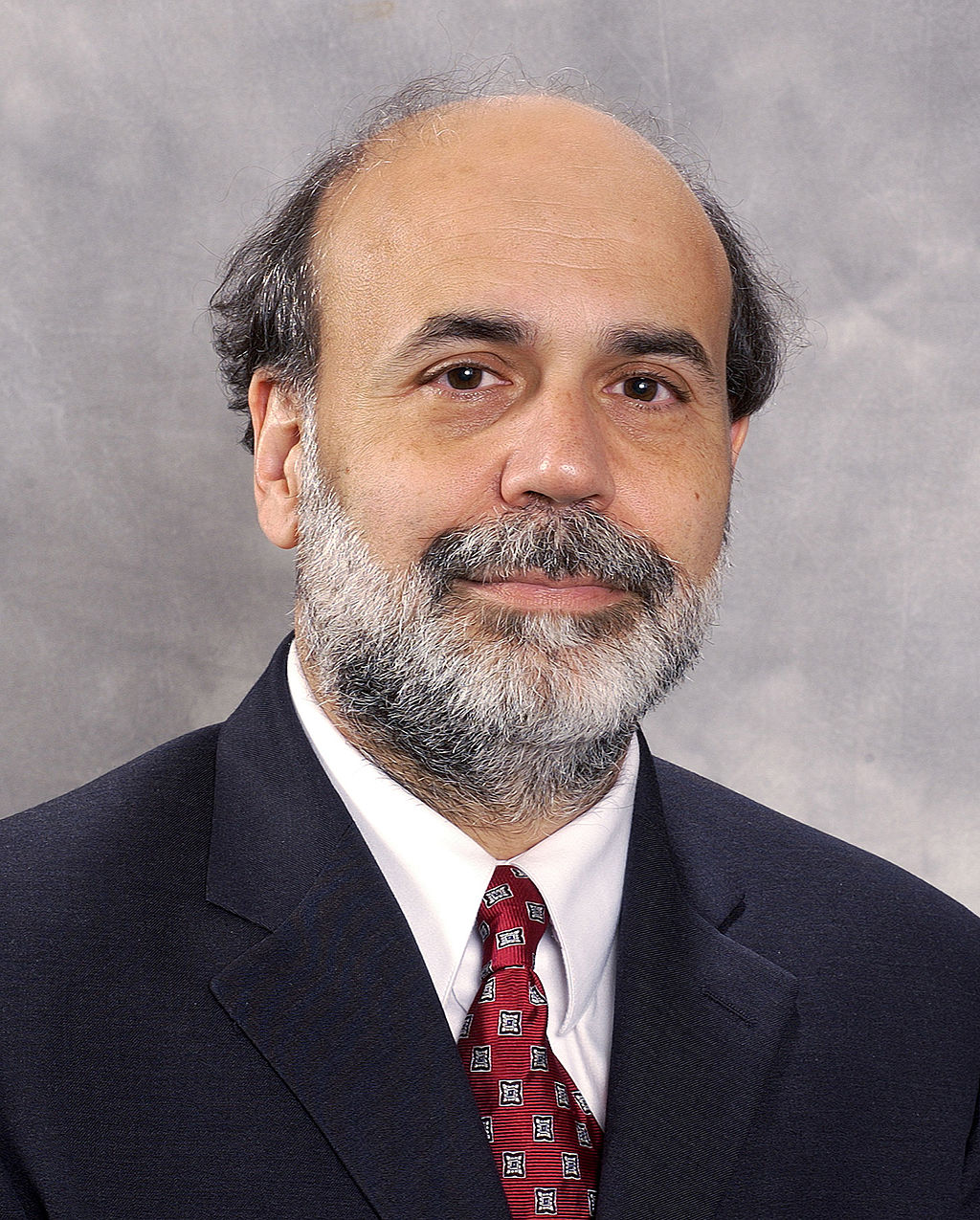

According to a new survey by TradeKing Group, investors are split three ways on whether Chairman of the Federal Reserve Ben Bernanke should continue in his role past January 2014: just 30 percent say they prefer to see him stay, 34 percent say they’d like him to go, and 36 percent are undecided.

The in-house survey of 230 independent investors was conducted July 11-18, 2013 by TradeKing Group.

Weighing-in further on Mr. Bernanke’s tenure, some investors shared these opinions:

- “He was responsible for the reaction and he should see it through till there is steady growth should the plan not work as advertised.”

- “He’s out of bullets.”

- “Although good for markets, Bernanke is…only concerned with re-inflating a bubble that will absolutely devastate the economy when it is burst.”

- “I think some of his policies are politically motivated…but change in this area adds to instability.”

- “The next one might be even worse.”

Bullish Sentiment Bounces Up from April

While not quite returning to the high of TradeKing’s January 2013 survey, “bullish” sentiment among investors surveyed increased five points over April, reaching 42 percent and pulling closer to matching “neutral” sentiment, which is 47 percent. Sixty-five percent of respondents said they believe the market will end up by 5-10 percent for the year. Slightly more investors share this opinion now than in April (65% in July vs. 60% in April).

It’s All About Interest Rates

Interest rates shot to the top of investors’ trading triggers, receiving 55 percent of responses, up 15 points since April. It was followed by quarterly earnings with 39 percent and U.S. housing at 31 percent of responses.

As to when they expect interest rates to increase, most investors indicated they expect to see meaningful increases within the next 18 months. Twenty-five percent are bracing for changes “in the second half of 2013,” 30 percent believe rates will hold steady until “the first half of 2014,” and 20 percent indicate rates won’t meaningfully rise until “the second half of 2014.”

In addition, when asked: “What do you think is more likely in 2014, inflation or deflation?” an overwhelming 75 percent chose inflation.

TradeKing Group consists of companies that provide online brokerage services, social communities for investors, investor education and more. Its subsidiary, TradeKing, is a nationally licensed online broker/dealer dedicated to empowering the independent, self- directed investor. The platform features powerful online equity, options, ETF, mutual fund and fixed-income trading tools accompanied by a rich set of news, research and analysis capabilities.