A few days before it became mandatory for Peruvian citizens to choose between the Private Pension System (SPP) and the National Pension System (SNP) to provide for their retirement, the Superintendence of Banking and Insurance (SBS) and the Peruvian President Ollanta Humala Tasso announced that they will seek to streamline investment in the stock market by private managers.

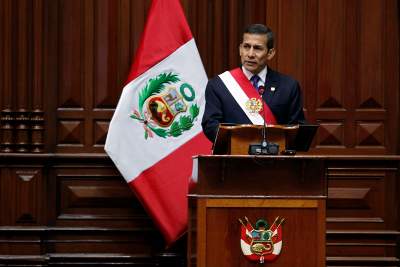

In his speech commemorating the 192 nd Anniversary of National Independence last week, the president said “This reform complements the one carried out to our Private Pension System, in order to expand pension coverage, increase the profitability of our funds, and benefit members; to date having achieved the reduction of commissions to a third of the average charged .”

Through a draft resolution, which shall receive input from the public until August 26th, the SBS proposes the “elimination of registration of instruments and fund operations,” thereby seeking to shorten the timeframes for the authorizations issued by the regulatory authority when transferring the registration of “instruments which are considered simple” such as local and foreign fixed income investments, foreign and local equities (stocks), and foreign mutual funds, to the AFPs.

By Fórmate a Fondo

By Fórmate a Fondo