The 300 largest pension funds in the world returned to growth in 2023, leaving much of the previous year’s decline behind. However, the assets of the largest pension funds have not yet returned to their historic peaks, according to the Global Top 300 Pension Funds report, prepared by the Thinking Ahead Institute of WTW in collaboration with *Pensions & Investments*, a leading U.S. publication on investments.

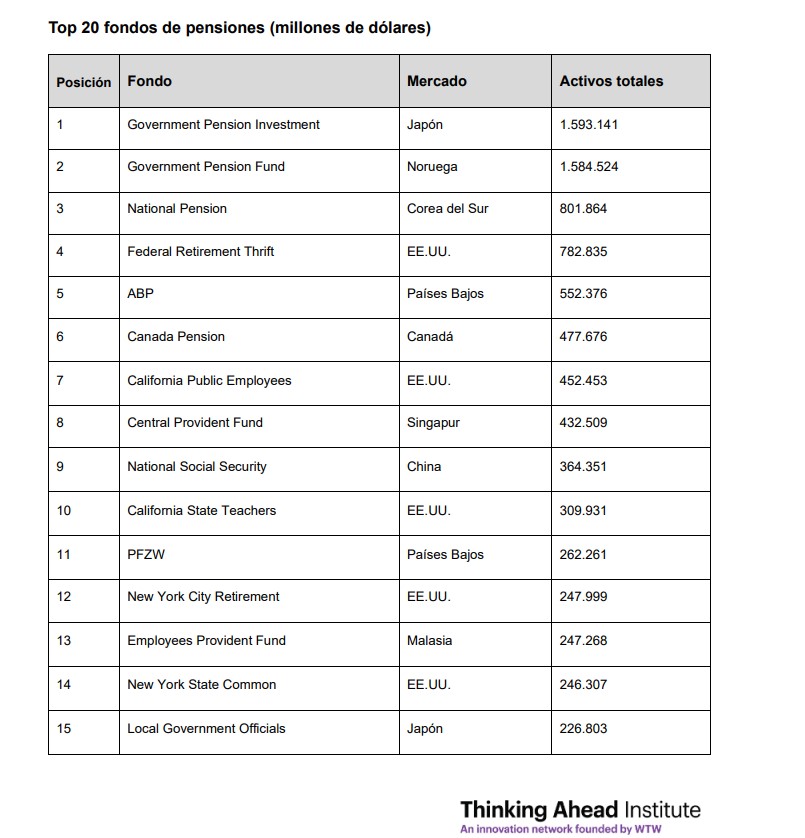

In 2023, the assets of the top 300 pension funds increased by 10%, reaching $22.6 trillion, compared to $20.6 trillion in AUM at the end of 2022. This recovery comes after a 13% drop in assets in 2022, as markets stabilized following the high level of global economic uncertainty from the previous year. According to the report, growth has been faster among the largest plans, with the world’s top 20 pension funds registering a 12% increase in assets over the last year, outperforming their smaller counterparts. This faster growth has also been sustained over time, with a compound annual growth rate (CAGR) of 5.4% for the top 20 pension funds over the last five years, compared to 4.7% for the top 300 as a whole.

Japan’s Government Pension Investment Fund (GPIF) remains the largest pension fund in the world, with $1.59 trillion in assets under management, a position it has held since 2002. However, with $1.58 trillion in assets, Norway’s Government Pension Fund, only 0.5% smaller, could take the top spot next year after recording a 22% growth in assets over the past 12 months. “While it is encouraging to see a return to growth among the world’s major pension funds in 2023, the combination of a more uncertain macroeconomic environment and rising geopolitical instability creates greater complexity in the investment landscape,” said Oriol Ramírez-Monsonis, Director of Investments at WTW, in light of the study’s findings.

WTW also explained that last year was marked by an environment of rising inflation and interest rates, which have since moderated, but the outlook remains uncertain. “While the first half of 2024 has provided some stability, uncertainty remains high, and volatility persists in the global economy, exacerbated by geopolitical events, including major presidential elections in many countries,” they said.

In Europe, the report notes that funds continue to allocate a significant portion of their investments to fixed income, at 47%, followed by equity investments, which account for nearly 40% of the allocation. This distribution marks a significant difference compared to other regions and highlights the need to continue working on diversifying strategies. “To continue making progress, it is crucial to optimize asset allocation in our portfolios, reducing investments in traditional assets. While in North America, investment in alternative assets already reaches nearly 30%, in Europe, we have yet to surpass the 15% threshold, leaving us ample room for improvement and growth,” concludes Ramírez-Monsonis.