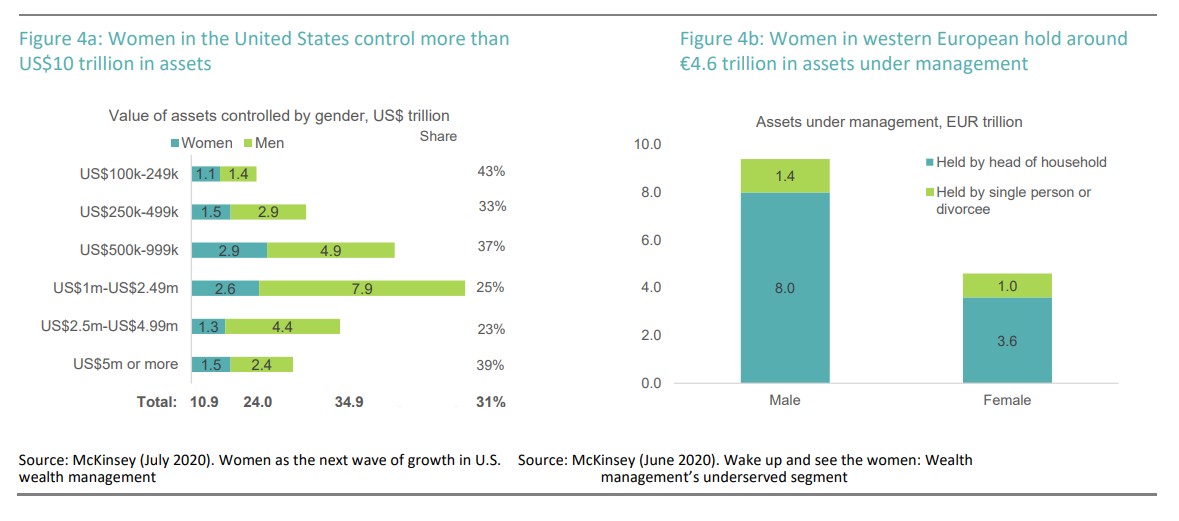

As women’s participation in economic activities grows and their income potential rises, female investors are becoming an increasingly significant force in wealth management. Supporting this trend, about one-third of global wealth is now in the hands of women, with nearly half of it in the U.S., where women control over $10 trillion in assets.

By 2030, the U.S. baby boomer generation will invest over $30 trillion in financial assets, an amount approaching the annual U.S. GDP. Meanwhile, in Western Europe, women own around one-third of managed assets. This wealth growth is also reflected in the percentage of female millionaires and billionaires worldwide, which continues to reach record levels. In 2000, there were only four women on the list of the world’s 100 wealthiest people, but by 2024, this number had reached 15.

“As women become wealthier, their investment opportunities expand, amplifying their importance as investors and equipping them with the right tools and resources. A 2019 report estimated that by 2025, 60% of the UK’s wealth would be in the hands of women, who often take control of family wealth when their husbands pass away,” notes DWS in its latest report.

In Asia, the total wealth of women, excluding Japan, was estimated at $13 trillion in 2019 and is expected to reach $19 trillion this year, making the region the fastest-growing in women’s wealth. “This also means that by the end of 2023, women in Asia are expected to own more wealth assets than women in any other region outside North America,” the asset manager states.

In Asia, women’s investments gain greater importance in cases of divorce or separation, as women are more financially dependent on men than in other parts of the world. In China, over 80% of urban women aspire to become more financially independent, showing a stronger motivation than men for financial empowerment, according to a recent survey. Other surveys show that women expect to become financially independent at 37, four years earlier than men. Additionally, 82% of women surveyed in another study expressed a desire to better control their financial situation.

Investor Profile

Given these facts, there’s no doubt about the potential of women as investors. However, what obstacles do they face? According to academic literature, one of the main factors is risk attitude, as women are more risk-averse than men.

“A 2018 study by Falk et al. showed that, when conditioned on other factors, women are significantly less risk-tolerant than men worldwide. This aligns with similar research by Dohmen et al. in 2011, which found that among the adult German population, not only are women generally more risk-averse than men, but this attitude toward risk is consistent across all aspects of life—sports, driving, financial matters, career, and health—even after controlling for various demographic and economic factors,” DWS explains.

The second notable characteristic is that women not only have the potential to invest more, but their investments also tend to yield higher returns over a 10-year period. The report suggests that several factors may explain these differences, including lower transaction volumes, holding onto investments during market downturns, using stop-loss orders, and more closely following financial advisors’ recommendations compared to men.

Third, the report notes that women aim to align their investments with their goals and are more inclined toward social and environmental objectives. In fact, UBS’s Investor Sentiment Survey highlighted that 71% of women consider sustainability in investment decisions, compared to 58% of men.

“This trend is also evident among investment funds; private equity firms that are at least 50% women-owned are 6.8% more likely to pursue impact investments focused on specific environmental or social factors, according to a study by academics from the UK, Ireland, Belgium, and the U.S. Regarding environmental and social goals, a study found that poverty, healthcare, and climate change were among the top priorities for women,” the report concludes.

Looking at the Industry

What about the industry? According to the report, in the global asset management sector, about 1 in 8 fund managers is a woman. “That proportion has not changed significantly in more than a decade, even as teams have grown and more professionals have joined the sector. In 2022, only about 12.5% of U.S.-based portfolio fund managers were women, nearly unchanged over the past 10 years, while only about 26% of over 10,000 U.S. funds were managed by a team that included at least one woman,” the report states.