Bank of America has published its first global fund manager survey of the year, reflecting a somewhat positive sentiment, particularly regarding the U.S. dollar and equities. However, the survey also reveals nuances that convey a cautious outlook, especially toward Europe, as well as concerns about inflation and monetary policy.

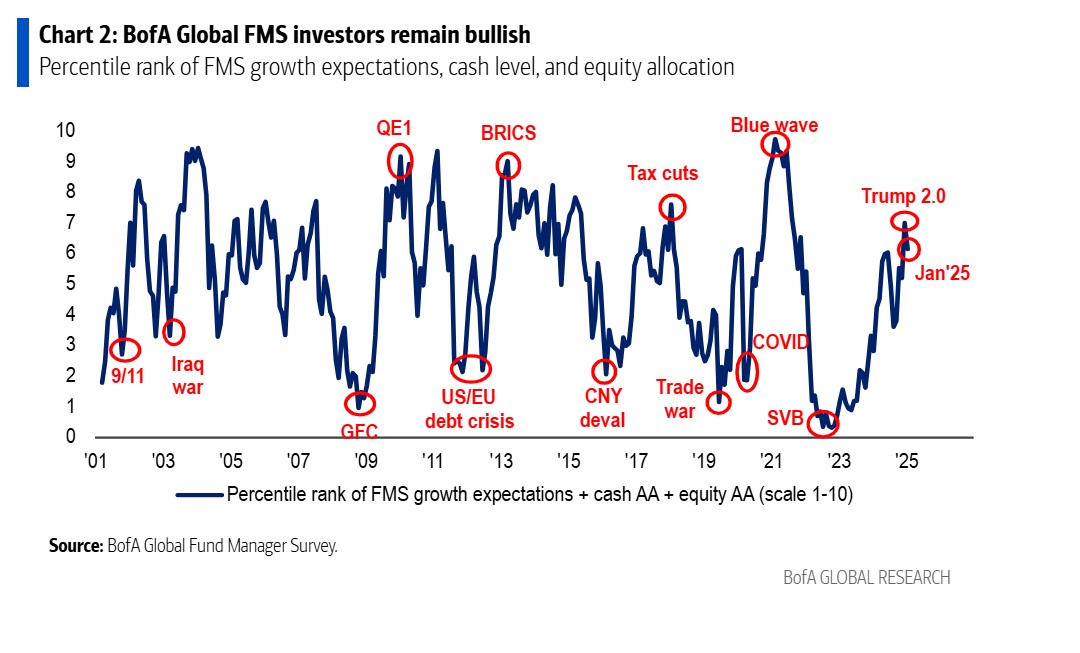

“Our broader sentiment measure from the FMS survey, based on cash levels, equity allocation, and global growth expectations, dropped from 7.0 to 6.1 in January, indicating that some of the ‘excess’ seen in the December 2024 FMS has dissipated. Cash levels in the FMS remained unchanged in January at 3.9%, the lowest level since June 2021. This marks the second consecutive month with a ‘sell’ signal based on the FMS cash rule since 2011. In the 12 previous instances when this ‘sell’ signal was triggered, global equity returns were -2.4% in the following month and -0.7% in the three months after the signal was activated,” the institution notes in its survey.

The most optimistic takeaway from managers is that institutional allocation to equities remains high: 41% of FMS survey investors hold an overweight position in global equities, though this has declined from the 3-year high of 49% recorded in December.

The Nuances

However, retail enthusiasm has waned in early 2025. Furthermore, in this January survey, global growth expectations fell to a net -8% from 7% in December, and optimism declined for both the United States and China.

“Global growth expectations remain moderate, but the percentage of macroeconomic investors anticipating a boom is the highest since April 2022. Inflation expectations are at their highest level since March 2022, and the probability of a ‘no landing’ scenario has increased (38%) at the expense of ‘soft landing’ (50%) and ‘hard landing’ (5%) scenarios,” BofA indicates.

When it comes to risks, the survey reveals that 41% of respondents cite inflation, which could lead the Federal Reserve to raise rates, as the biggest “tail risk,” followed by a trade war with recessionary effects.

A notable statistic is that 79% of investors expect the Federal Reserve to cut rates in 2025, while only 2% anticipate an increase. In fact, the FMS survey shows that investors, entering the first week of Trump 2.0, are most positioned for announcements related to selective tariffs (49%), immigration cuts (20%), and universal tariffs.

“When asked which development would be considered the most bullish for risk assets in 2025, respondents pointed to an acceleration in China’s growth (38%), followed by rate cuts by the Federal Reserve (17%) and AI-driven productivity gains (16%),” the report adds.

Asset Allocation

According to BofA’s interpretation of the January survey results, investors remain optimistic about the U.S. dollar and equities. Conversely, they are pessimistic about nearly everything else. This is evident in the largest underweight in bonds since October 2022 and the low cash levels of 3.9%. “However, if January’s concerns about Trump’s tariffs and messy bonds prove unfounded, asset allocation will remain tilted toward risk, allowing lagging assets to recover,” the institution states.

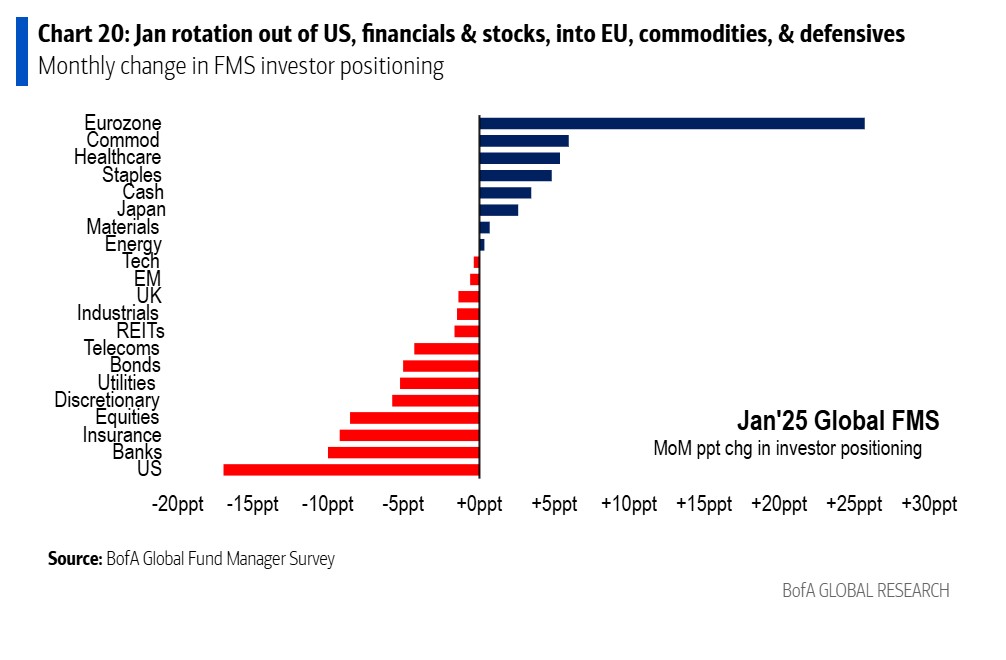

Looking at the asset allocation of fund managers, 41% are overweight equities, compared to an underweight of 6% in commodities, 11% in cash, and 20% in bonds. Notably, January saw a significant rotation into European equities—from a 22% underweight to a net 1% overweight—and out of U.S. equities, from 36% to just 19%. Additionally, global FMS investors rotated back into large caps over small caps and growth over value.

Specifically, investors increased their allocation to the eurozone, commodities, and defensive sectors (healthcare and consumer staples) while reducing their allocation to the U.S., financials (insurance and banks), and equities. According to the survey, investors are most overweight equities, banks, and the U.S., while they are most underweight bonds, the U.K., and energy.