According to the team at Insight Investment (BNY Investment), as markets reach a mid-point in 2024, now is an ideal time to increase allocations to fixed income.

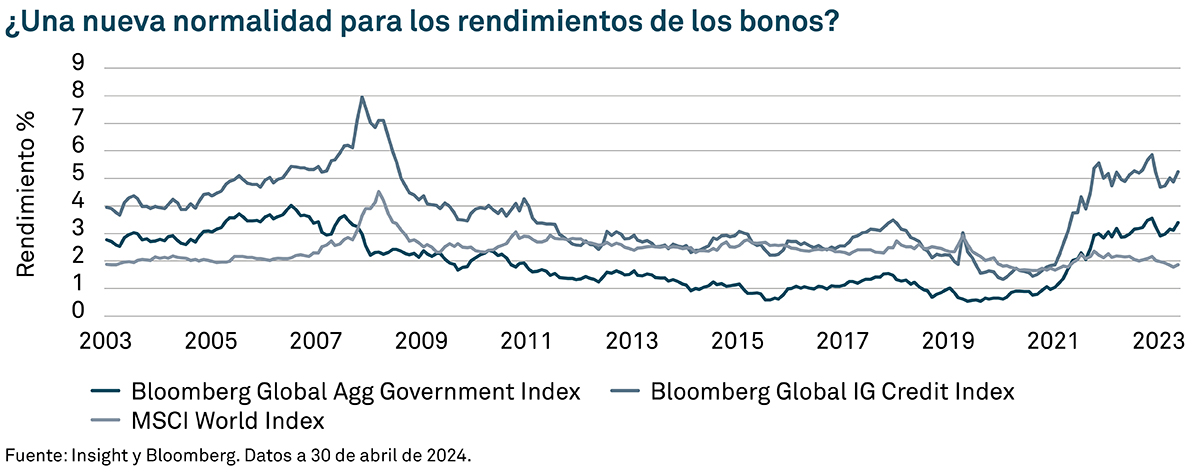

“With bond yields returning to pre-financial crisis levels, investors no longer need to take on the equity-like risks or sacrifice liquidity to meet their investment goals. Simply put, yields are back, and they’re here to stay,” the firm argues.

Their analysis suggests that despite some signs of inflation stabilization and easing rate hikes by mid-year (both the European Central Bank and the Bank of Canada cut rates in June), central banks are expected to operate in higher interest rate ranges over the coming years, which should keep bond yields elevated.

“It’s likely that market participants will take some time to adjust to the idea that extremely low interest rates aren’t coming back. After all, some investors have only known an era dominated by central bank easing and quantitative easing policies. However, we believe that optimism around rate cuts will be tempered by the persistence of inflationary pressures. Globalization, which had exerted significant downward pressure on goods prices, is now giving way to increasingly protectionist rhetoric, and we think this will be one of the factors making it harder for central banks to control inflation sustainably,” Insight Investment adds.

At the longer end of the yield curves, high government debt issuance and the reduced proportion of debt held on central bank balance sheets should keep yields elevated. Over time, this is expected to slowly become ingrained in market psychology, keeping bond yields at levels similar to those seen before the global financial crisis.

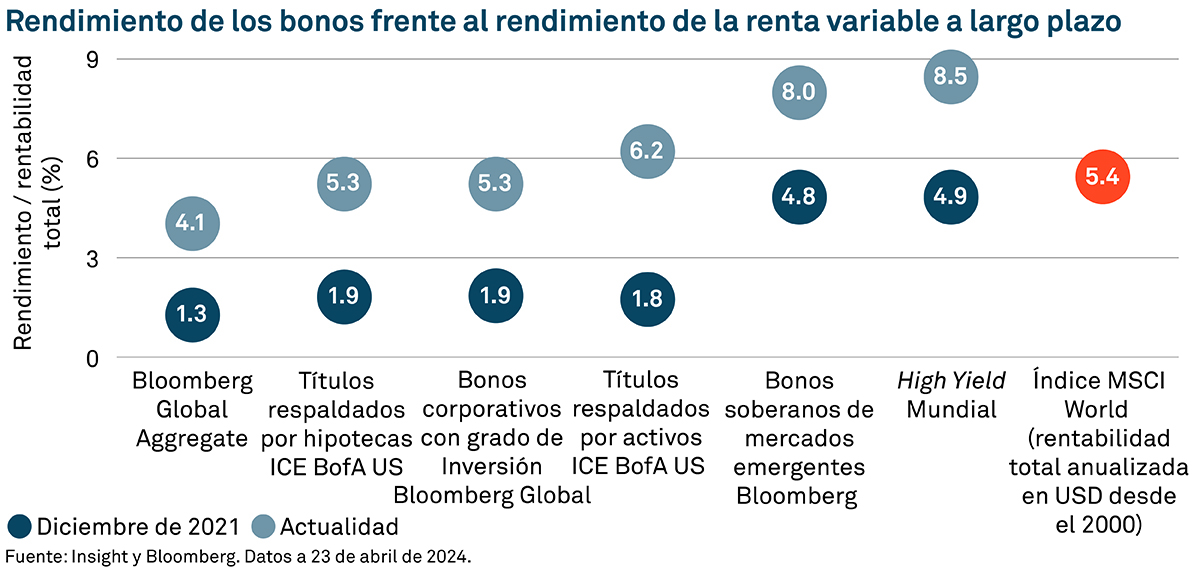

In this context, Insight Investment believes that long-term return objectives can be achieved with fixed income alone. Many segments of fixed income markets currently offer yields comparable or even higher than the long-term returns of the MSCI World Index.

“We believe this creates the opportunity to lock in long-term returns similar to equities but in fixed income markets and sectors like global high yield,” they add.

Volatility Check

Insight Investment points out that fixed income markets, largely income-driven, tend to be less volatile and more predictable than other asset classes like equities. In many cases, this can lead to more reliable returns, lower downside risk, and diversification benefits. “An active management strategy can allow a manager to add value above market yields. With low interest rates and quantitative easing behind us, volatility may be structurally higher in the coming years, providing market disruptions that managers can exploit. The more flexibility a manager has, the broader the range of potential opportunities they can explore,” they argue.

Corporate Health

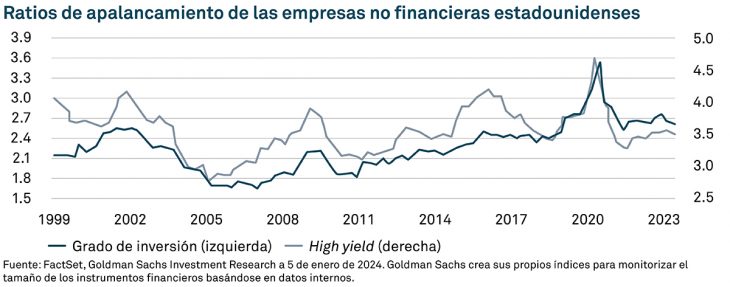

From a corporate perspective, Insight Investment notes that many companies are well-positioned at this stage of the cycle. Corporate balance sheets look healthy, as do debt profiles. Many treasurers took advantage of low interest rates during the pandemic to lock in favorable funding levels for an extended period. This has insulated many companies from rising rates, giving them time to plan for higher financing costs.

“As global investors, we believe an increasingly asymmetric equity world makes a fixed income allocation even more appealing. While the rise of the so-called ‘Magnificent Seven’ reflects a period of exceptional profit growth, their dominance means that many equity investors are now more concentrated than they realize,” Insight Investment experts comment.

Risk Considerations

Finally, Insight Investment highlights risk as a key consideration. “All markets carry some degree of risk. However, while fixed income markets experience periodic declines, they tend to be shallow and brief. For instance, the long-term returns of global high yield have been similar to those of global equity markets. Overall, this asset class has experienced less severe downturns and has recovered more quickly than equities.”

Income Generation

Lastly, they note that as income generated in fixed income markets offsets price declines, this creates natural protection against losses, provided that yields are high enough and the time horizon is long enough.

They also point out that government debt, and to some extent high-grade credit markets, offer another useful attribute. Economic recessions, when equity markets typically fall and economies contract, tend to be some of the best periods for fixed income returns.

“When central banks ease policy to stimulate growth, longer-term bond yields typically fall, and this drop in yields results in capital appreciation in fixed income markets. The negative correlation between fixed income and equities during severe equity market declines means that high-quality fixed income investments can complement holdings in higher-risk assets like equities,” Insight Investment states.

In this regard, the firm’s experts pose the question: What path should fixed income investors take? Their answer is straightforward: “For the remainder of the year, we believe that rising yields have created an opportunity to secure attractive long-term income streams. With yields returning to pre-crisis levels, income should once again dominate fixed income returns. In this context, more customized and sophisticated fixed income portfolios can be built to meet the specific risk/return objectives of a wide range of investors,” Insight Investment concludes.