The US high yield market delivered strong returns in the first half of 2023, with the ICE BofA US High Yield Constrained Index gaining 5.42%. Solid economic data to start the year helped credit spreads tighten in the initial weeks of 2023. However, a round of bank failures including Silicon Valley and First Republic triggered a flight to quality later in 1Q23.

After the market digested another manufactured debt ceiling crisis in the US, signs of deflation and improving odds of a “softish” landing for the economy drove a vigorous rally in risk assets to end the first six months. Continued year-over-year growth of high yield issuers’ operating earnings in the first quarter and supportive market technicals also helped to lift high yield bond prices.

While high yield has delivered robust performance thus far in 2023, yields remain close to 8.5%, and Nomura maintains a constructive outlook for the asset class in the second half of the year. Key drivers of our favorable perspective include:

An Attractive Entry Point

Looking back on 30 years of data, when investors have put money to work with market yields between 8-9%, the median 12-month forward return for high yield was better than 11%. Similarly, the end of a tightening cycle has been an excellent time to deploy capital to risk assets, including high yield bonds. There have been five tightening cycles in the US over the last 30-years. High yield’s average 12-month forward return from the date of the last rate increase was over 12%. The Fed will likely hike one more time in July, but the end of the tightening cycle is rapidly approaching.

Solid Fundamentals

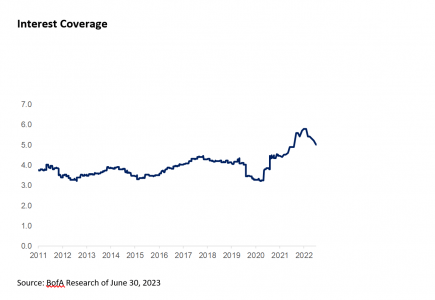

While it is too early to gauge second quarter results, operating earnings continued to grow in 1Q23, and more high yield issuers have guided 2023 earnings higher vs. those who revised expectations lower. High yield companies continue to generate cash flow, and they are using those resources to prepare for a slower economy. Leverage is close to a decade low. Interest coverage, arguably the best harbinger of the future default rate, is holding above 5x, the first instance in over 30 years of historical data that coverage has breached that threshold. BB-rated bonds currently represent close to 50% of the high yield market, while CCCs weigh in at just above 10%. Given the market’s healthy cash flows and higher quality tilt, Nomura expects the default rate to increase but not spike as the economy slows, rising from 1.6% over the last 12 months to a peak near the 3.2% long term average default rate.

Supportive Technicals

In 2022 the US high yield market contracted by roughly $200bil, a sizeable reduction relative to total market cap of close to $1.5tril. In the first half of 2023, the market saw more than $70bil of calls, tenders and maturities, and nearly $65bil of net rising star upgrades out of high yield. New issuance totaled about $95bil, thus the market contracted by approximately $40bil in 1H23, bolstering the supply/demand dynamic that drives prices. We expect the market to continue contracting over the balance of 2023, as a greater volume of high yield bonds are rising star candidates relative to investment grade issues that could drop to high yield. With less than $75bil of high yield bonds maturing before the end of 2024, we expect issuance to remain relatively light.

Flows Improving

According to Lipper data, high yield mutual funds and ETFs saw net outflows in excess of -$10bil in the first half of 2023. June net flows were positive $2.5bil, as investors perceived a favorable opportunity to add exposure to high yield. Nomura has experienced a comparable flow pattern in 2023. Net flows were relatively flat in the first five months of the year, masking a host of large subscriptions and redemptions, before flows turned meaningfully positive in June. Clients added to high yield for a variety of reasons including a more favorable tactical outlook for the asset class and portfolio rebalancing back to fixed income as a result of the heady equity returns in 1H23.

Favorable Outlook vs. Investment Grade

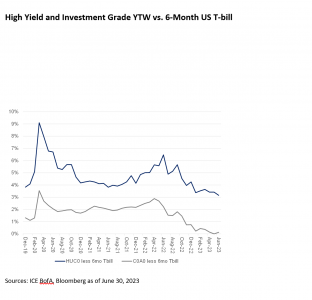

Based on our conversations with clients and prospects around the world, we believe that many investors have parked cash on the sidelines, enjoying T-bill yields approaching 5.5% while accepting reinvestment risk. A moderating growth and inflation outlook could prompt investors to re-risk portfolios by adding credit and duration exposure. When faced with the option of transitioning fixed income allocations into investment grade or high yield credit, we expect more clients to opt for the latter. Due to the steep inversion of the US Treasury yield curve, investors moving from 6-month T-bills to investment grade corporates (as proxied by the ICE BofA US Corporate Index – C0A0), picked up only 13bps of additional yield as of June 30. Investors would increase yield by more than 300bps moving from 6-month T-bills to the ICE BofA US High Yield Constrained Index (HUC0).

As of June 30, high yield (HUC0) offers a yield to worst of 8.6% with a duration less than 4 years. Investment grade (C0A0) yields 5.6% with a duration of 6.9 years. In a sideways market, high yield’s carry will likely help the asset class outperform. In a rising rate environment, shorter duration will advantage high yield relative to investment grade. High yield’s credit spread close to 400bps is not excessively cheap, but there is room for spread tightening if the US manages to avoid recession and land softly. Investment grade would likely outperform in a harsher than expected recession. However, we view that scenario as unlikely given the strong economic growth ongoing in sectors like travel & leisure, energy, and infrastructure, and the continuing imbalance between labor demand and supply supporting today’s robust job market.

Given these tailwinds, Nomura believes the current environment offers investors a favorable opportunity to increase portfolio allocations to high yield bonds.

Disclosures

This document is prepared by Nomura Corporate Research and Asset Management Inc. (NCRAM) and is for informational purposes only. All information contained in this document is proprietary and confidential to NCRAM. All opinions and estimates included herein constitute NCRAM’s judgment, unless stated otherwise, as of this date and are subject to change without notice. There can be no assurance nor is there any guarantee, implied or otherwise, that opinions related to forecasts will be met. Certain information contained herein is obtained from various secondary sources that are believed to be reliable, however, NCRAM does not guarantee its accuracy and such information may be in-complete or condensed. Historical investment performance is no guarantee of future results. There is a risk of loss.

Certain information contained in this document contains forward-looking statements including future-oriented financial information and financial forecasts under applicable securities laws (collectively referred to herein as forward-looking statements). Except for statements of historical fact, information contained herein constitutes forward-looking statements. Although NCRAM believes that the expectations reflected in such forward-looking statements are based on reasonable assumptions, it can give no assurance that forward-looking statements will prove to be accurate. These statements are not guarantees of future performance and undue reliance should not be placed on them. Forward-looking information is subject to certain risks, trends, and uncertainties that could cause actual performance and financial results in future periods to differ materially from those projected. NCRAM undertakes no obligation to update forward-looking statements if circumstances or NCRAM’s estimates or opinions should change.

This document is intended for the use of the person to whom it is delivered. Neither this document nor any part hereof may be reproduced, transmitted or redistributed without the prior written authorization of NCRAM. Further, this document is not to be construed as investment ad-vice, or as an offer to buy or sell any security, or the solicitation of an offer to buy or sell any security. Any reproduction, transmittal or redistribution of its contents may constitute a violation of the U.S. federal securities laws.

An investment in high yield instruments involves special considerations and certain risks, including risk of default and price volatility, and such securities are regarded as being predominantly speculative as to the issuer’s ability to make payments of principal and interest.

A copy of NCRAM’s Code of Ethics and its Part 2A of Form ADV, are available upon request by contacting NCRAM’s Chief Compliance Officer via e-mail at Compliance@nomura-asset.com or via postal mail request at Nomura Corporate Research and Asset Management Inc., World-wide Plaza, 309 West 49th Street, Compliance Department, 9th Floor, Attn: Chief Compliance Officer, New York, NY 10019-7316.

The views and estimates expressed in this material represent the opinions of NCRAM and are subject to change without notice and are not intended as a forecast or guarantee of future results. Such opinions are statements of financial market trends based on current market conditions. The views and strategies described may not be suitable for all investors. This material has been prepared for informational purposes only, and is not intended to provided, and should not be relied upon as legal or tax advice.