During the last week of March, high-quality credit continued to attract money, but it was the inflows into government bonds that really stood out. According to Bank of America (BofA), the good news on the macroeconomic front is that the rotation into European equities has continued, although at a slower pace.

However, the BofA report clarifies that the recent price action in credit in recent days points to a market that is seeking hedges rather than taking advantage of declines to buy. “We are watching closely for any emerging signs of outflows in high-quality credit, which would be a clear catalyst for a more negative price trend across the corporate bond market. With volatility on the rise, we highlight that fixed income investors are starting to show a preference for buying government debt again,” they indicate.

Main Trends

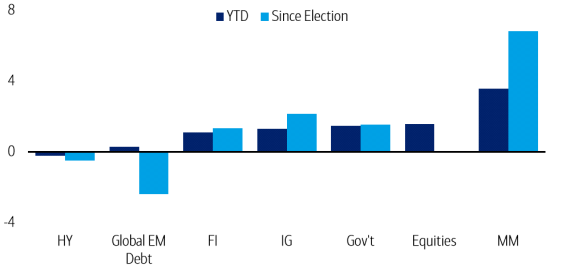

The BofA report shows that high-quality funds recorded significant inflows, with short-term investment-grade funds continuing to attract flows. Specifically, medium-term funds registered outflows, while long-term funds also recorded some inflows. “We continue to highlight our preference for the short end of the credit market. High-yield funds have now suffered four consecutive weeks of outflows after seven weeks of inflows,” the report states.

Similarly, high-yield ETFs also posted outflows last week, marking four consecutive weeks. Regionally, globally focused funds underperformed significantly for the second consecutive week, recording the majority of outflows, while U.S.- and Europe-focused high-yield funds saw similar levels of outflows.

Another interesting point is that government bond funds recorded another week of notable inflows after two weeks of outflows—the largest since June of last year. In addition, money market funds also saw inflows during the past week, and global emerging markets (EM) debt funds also attracted inflows. “Overall, fixed income funds recorded inflows over the past week, driven by inflows into government bonds and investment-grade funds,” BofA notes.

Finally, equity funds posted another inflow, making it eight consecutive weeks of inflows. “However, it is worth noting that, for the second consecutive week, the pace of inflows has slowed to nearly half compared to the previous week,” the experts at the firm conclude.