The world is experiencing a new environment marked by a cycle of interest rate cuts by the major central banks in developed markets, as well as in emerging regions. According to experts, over the past quarter, most monetary institutions have adopted a more cautious stance.

The best example of this is the Fed, which has once again shifted its focus to inflation, as economic activity has remained strong while disinflation has stalled. “The Fed maintains its data-dependent approach and is beginning to shift its attention to the labor market. We believe labor market conditions could shape the path of its future policy decisions. Similarly, the Bank of England and the European Central Bank also cut interest rates by 25 basis points in the third quarter of 2024, emphasizing data dependency without precommitting to any specific interest rate trajectory,” explain experts from Capital Group.

According to Invesco in its outlook for this year, rates remain generally restrictive in major economies but are easing. “On the one hand, the Fed is likely to remain neutral by the end of 2025, but improved growth prospects may delay rate cuts. On the other hand, European central banks are easing their policies, with relatively weaker growth than the U.S.,” they note.

Divergences in Monetary Policy

This reality brings us to a key conclusion: yes, we are in a cycle of rate cuts, but there will be noticeable divergences in the monetary policies of the major central banks. In fact, Capital Group believes that this divergence will play a significant role in the coming months.

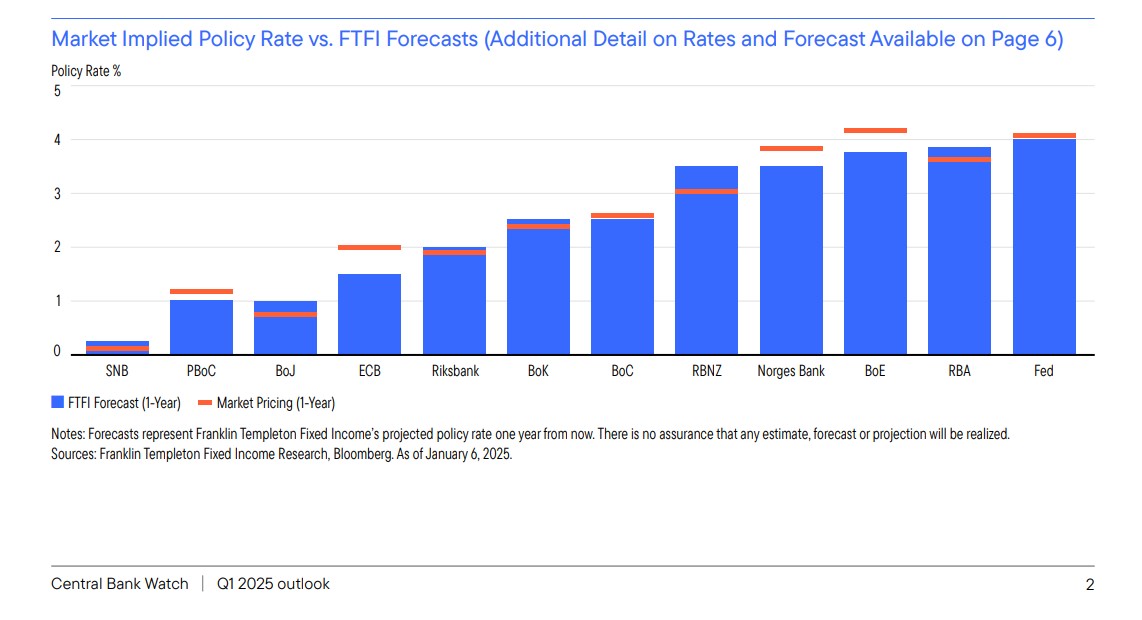

This is reflected in the Central Bank Watch report, prepared by Franklin Templeton, which reviews the activity of G10 central banks, plus two additional countries (China and South Korea), along with their forecasts.