The idea that the more risk taken, the higher the expected return is well understood by the public and is at the core of an investment professional’s knowledge. However, in a context of high volatility and choppy markets, many investors struggle to truly incorporate this concept when it comes to making real investment decisions.

The current environment for dollar denominated LatAm corporate debt, as well as for other risky assets that might form part of a diversified portfolio, poses a dilemma: on the one hand, valuations and spreads look particularly attractive amid a volatile market, but on the other, managers are taking extremely cautious stances and holding cash on the sidelines, reflecting risk aversion.

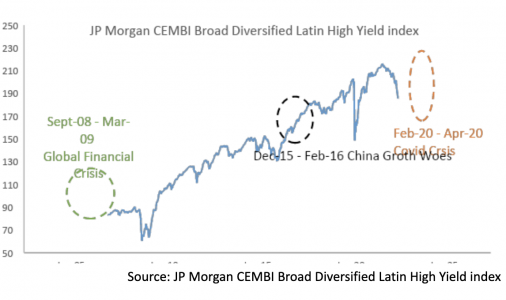

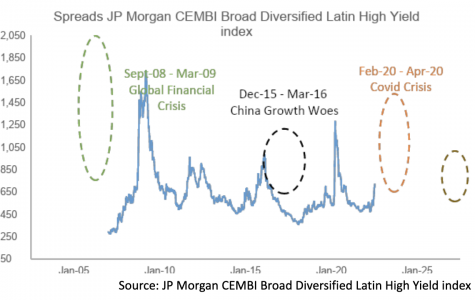

Taking a closer look at the last 15 years of history, we find three periods of abrupt sell offs of the JPMorgan CEMBI Broad Diversified Latin HY index. All three episodes share two main features: spreads widening above 300 basis points in less than 3 months and returns tumbling more than 15% in that same period. These are the 2008 global financial crisis between September that year and March of 2009, then the concerns over Chinese growth between December 2015 until February 2016, and finally the covid crisis between February and April of 2020.

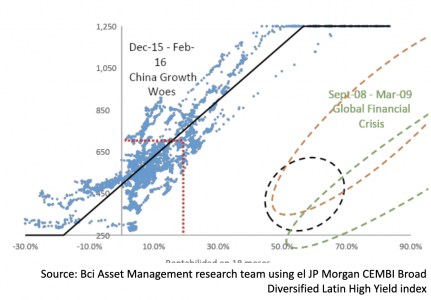

Looking deeper, if we analyze the returns obtained after 18 months elapsed from investing in the index for each day of the last 15 years, we find a direct positive relation between the entry spread level and the final return after 18 months, as shown in the following chart.

This exercise provides evidence that in this asset class, the entry level of spread or valuation at the moment of investing has historically held a direct relation with the returns obtained after 18 months. This implies that, the lower the spread at entry, the lower the final return or inversely, the higher the spread level at the time of investing, the higher the achieved return. The relationship is especially apparent in the case of investments during the three crisis episodes identified and highlighted in the chart above. The red dotted line shows the current spread level of LatAm high yield corporate debt and the potential expected return after 18 months using this historic relation between the spread entry level and the terminal return in this period.

What can we expect for markets in the coming months? What will be the peak levels for LatAm corporate bonds spreads? We do not know; the answer to these questions depends on the evolution of global markets and investors’ risk aversion, as well as whether central banks efforts to control the persistent inflation and investors’ expectations are successful or not, among other developments impossible to predict. Furthermore, the answer will depend on whether or not the global economy avoids a deep recession brought on by monetary policy overshooting the necessary amount of tightening.

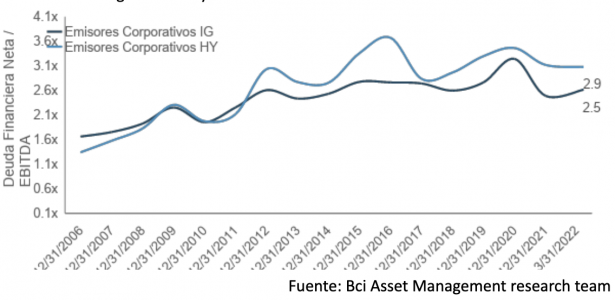

Today we see spread levels over 700 basis points and yields around 10% for the CEMBI Latin HY Index. Latin America is a region that maintains its historical dependency on commodities and continues to be subject to political uncertainty – the regional backdrop is the same as for the last 15 years. However, corporate issuers today have the lowest debt levels they have had in almost 10 years, suggesting resiliency in the face of a wavering business cycle.

It is important to recognize our own incapacity to accurately time an investment exactly at the market bottom while simultaneously acknowledging the significant impact that timing can have. For example, those who chose to invest in LatAm corporate high yield debt in the first month after the fall of Lehman Brothers in September, 2008 (at a spread around 700 basis points) saw returns after 18 months close to 20%. However, those who waited 6 months more until spreads reached 1,500 basis points were richly rewarded with returns after 18 months of approximately 60%. Despite these differences, it’s clear that in both cases, the decision to invest was correct. Final returns were double-digit, compensating the risk undertaken in the throes of the greatest economic and financial crisis of modern history.

In summary, we are neither likely to perfectly time the market, nor are we likely to predict the duration of the downturn in Latin American debt markets. However, given this universe of issuers with healthy financial situations, we feel comfortable extrapolating that current spread levels allow for double-digit returns over the next year and a half, based on the historical precedent of the last three similar market downturns.