Although the market and investors are focused on next week’s election in the U.S., these are not the only relevant elections we have witnessed this past week. Three days ago, the Japanese went to the polls, resulting in a new political landscape: the Liberal Democratic Party, a conservative party, lost the elections and with it its majority in the House of Representatives. According to experts, this electoral setback does not signify the fall of the coalition government, but it does introduce a degree of political uncertainty, leading to market volatility.

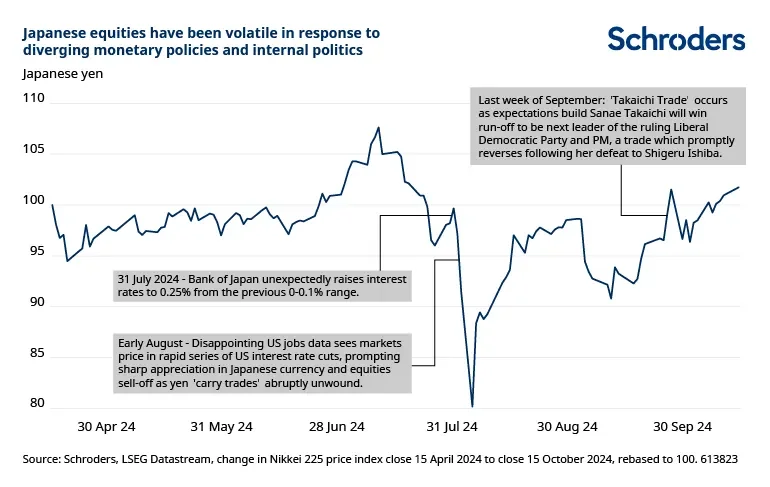

This situation, combined with the divergence in monetary policy between the United States and Japan, has driven the volatility of Japanese equities. “Japanese equities have been very volatile over the past three months. Initially, the divergence between U.S. and Japanese monetary policies led to a swift unwinding of yen carry trade positions (where investors borrow in yen and invest in higher-yielding foreign assets) and a sharp appreciation of the currency. Later, uncertainty around domestic politics became the main driver of equity market volatility, culminating in the call for early general elections last Sunday, October 27,” note experts at Schroders.

Starting with the election result on Sunday, Kaspar Köchli and David A. Meier, economists at Julius Baer, explain that the reprimand of the Liberal Democratic Party (LDP) has introduced an uncommon element of uncertainty into Japanese politics. “With expectations for more aggressive policies declining, the Japanese yen further weakened against the U.S. dollar, in line with our non-consensus view, while the Bank of Japan (BoJ) is likely to maintain its stance a little longer,” they state.

To understand why the election result equates to market volatility, Julius Baer economists explain that with Prime Minister Ishiba committed to staying in office, it is likely that a minority government will be formed, led by the current coalition and with some opposition parties (such as the Innovation Party and the Democratic Party for the People) cooperating on an ad-hoc basis.

“Although the election result is unlikely to bring about significant changes in fiscal and monetary policy, the reduction in the coalition’s administrative power could pressure for increased fiscal spending, as proposed by some opposition parties. These proposals include cash payments for low-income households, which Ishiba has already announced, and extended subsidies for electricity and gas, according to Komeito’s manifesto. A reduction in the consumption tax could also be considered until real wage growth is more stable,” they add.

However, RBC BlueBay expects that financial markets may remain somewhat unstable due to political uncertainty in Japan. From its perspective, this will have little impact on the economy or the Bank of Japan (BoJ). “The initial indications suggest that the upcoming round of spring wage increases, known as Shunto, could again exceed 5%, in a context of high corporate profitability and continued labor shortages,” notes the firm. From this point of view, RBC BlueBay continues to see the BoJ on track to raise interest rates in January or December. In fact, it believes the latter option may be gaining strength with the yen under some pressure in recent days.

Japan at a Political Crossroads

As Janus Henderson recalls, capital markets reacted unfavorably to policies implemented by the DPJ between 2009 and 2012. “Therefore, the prospect of opposition parties like the CDPJ coming to power has raised concerns about possible market risk aversion. Conversely, if the LDP remains in charge, the capital market could gradually focus on identifying undervalued assets and recognizing strong corporate performance,” explains Junichi Inoue, head of Japanese equities at Janus Henderson.

In Inoue’s opinion, as Japan faces political instability, the need for a strategic response, particularly one that addresses concerns of low-income groups, is becoming increasingly evident. “The country now stands at a crossroads, contemplating three possible paths forward: forming a coalition government with an opposition party, navigating the complexities of a minority government, or seeing the Constitutional Democratic Party of Japan (CDPJ) lead a coalition with other opposition entities. Given the significant policy discrepancies among these opposition parties, the likelihood of a unified opposition seems slim,” he points out.

According to his analysis, a decision on the new government framework is expected within a month, amid market instability. “Since August, market trends have been unpredictable, and this trend is expected to persist until a stable government is established,” warns the expert.

The BoJ and its Monetary Policy

When analyzing the Bank of Japan’s (BoJ) monetary policy, investment firms agree that the gradual increase in interest rates in a context of rising inflation will largely remain unchanged. “Although political uncertainty may influence the timing of rate hikes, the BoJ can afford to wait given the low risk of inflation surging. We expect the BoJ to keep rates on hold this week and for the governor to avoid giving strong signals about a hike in December, as we anticipate the next hike only in March,” acknowledge Julius Baer economists.

In Lazard Frères Gestion’s view, conditions are favorable for the Bank of Japan to continue normalizing its monetary policy, reinforcing its confidence that deflation has ended: “In Japan, GDP is growing at a moderate pace, but this is against a backdrop of a population declining by 0.5% per year. This means that per capita GDP continues to grow at a good pace. Business confidence among companies most exposed to the domestic economy is also buoyant. Wages are rising at the fastest pace in the past thirty years, which has not prevented corporate profits from rising significantly. Inflation has returned to positive territory,” they hold regarding their view of the country.

Köchli and Meier, from Julius Baer, focus on the fact that the further decline in expectations for aggressive policies further weakened the yen after it had already experienced a decline just a few weeks ago with Prime Minister Ishiba’s retreat from his comments on the preference for a BoJ adjustment. “This is happening against a backdrop of yen strengthening due to the recent unwinding of carry trade positions. We have been skeptical of this strength due to the persistent divergence in monetary policy and consider our non-consensus forecast confirmed, with policy being only one component, albeit the least important. We maintain our 12-month target for USD/JPY at 160,” they state.

In this regard, Gilles Moëc, chief economist, and Chris Iggo, CIO Core Investment Managers at AXA IM, point out that markets expect the BoJ to raise another 25 basis points or so over the next year. “U.S. interest rates will remain more than 300 basis points higher than those in Japan next summer, based on current market forward prices. In real terms, U.S. short-term rates will remain around 1%, while Japanese short-term rates will remain negative by approximately the same amount,” they conclude regarding the divergence between both monetary institutions.