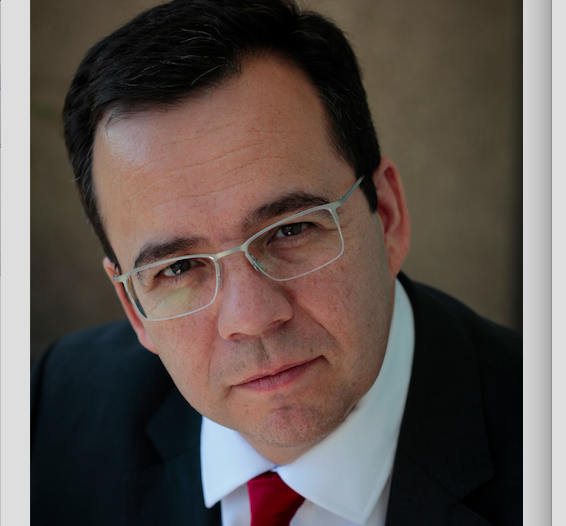

Luis Felipe Céspedes, Minister for Economy, Development, and Tourism of the Republic of Chile, shared his overview on the current situation of “the most competitive economy in Latin America,” its optimistic forecasts and investment opportunities in the country –which was placed 35th in the Global Competitiveness Index– for the more than 200 participants in the World Strategic Forum. We had a chance to interview him after his speech at the event held in Miami last week.

Céspedes attributes the success of this Southerneconomy on the strength of four key elements: its institutions and the communication between them, the macroeconomic framework, the financial system and the commitment to the country’s openness and global integration. “We need to generate savings which will later be invested,” he said, referring to the financial system, adding that the vocation of integration with the economy of the rest of the world is not only governmental but a commitment of the country.

The reality is that Chilean investors represent a tiny part of the capital which the wealth management industry manages in Miami, since, say the experts, Chile presents conditions of security, stability, and opportunities for investment which are rare in the region. The Minister agrees and explains that the process of internationalization of companies, the strong growth of the economy, and its openness made it very attractive to invest in Chile. To this we must add that the government recently carried out a tax reform plan that included a capital repatriation plan, with a preferential tax rate of 8% so that fortunes held offshore would be returned to the country.

Chilean investors who wish to seize the opportunities offered by foreign instruments can do so without major difficulties, contrary to what happens in other economies in the region. According to a report by ALFI, the Association of the Luxembourg Funds Industry, of the 100 most international fund managers in the world, 57 have their products registered in Chile. And according to a study by Global Pension Assets Study, published by Willis Towers Watson, Chile is the market where the volume of pension fund assets under management grew the most globally, according to CAGR figures over the last 10 years (in local currency), up to 18%.

Cespedes insists that “the growth of the Chilean economy is due to its own engines” even though it “benefits when neighboring countries do well”. With a GDP of $ 22,972 (ppp), and a net public debt with a surplus of 3% of GDP, the minister explained that the state budget is consistent with the long-term forecasts, so that, for example, “this year we have adjusted our budgets to the lower copper prices and its long-term forecasts”. Unemployment is at around 6%, inflation fluctuates between 3 and 4%, and growth forecast for this year stands at 2%.

Challenges

The great challenge is to increase productivity; that is difficult partly because the Chilean labor force is very small -half of that in the OECD countries- and its economy is concentrated in several, but limited sectors. In this respect, the government has set several objectives: to generate diversification, attract investors, establish policies to improve competitiveness and provide opportunities for innovation.

Mining

One of the country’s great talents and major industries is mining. Chile is the largest copper producer in the world and accounts for 30% of world reserves of a mineral which represents 60% of its exports, 20% of revenues in the state coffers through taxes, generates 11% of all employment and accounts for 13% of the country’s GDP. The question is can copper play a new role in the development of the Chilean economy?

“We have to attract investments”

It’s complicated, but doable. At least, that’s what is deduced from the optimistic speech of this finance professional, and from the policy stating that “we have to attract investments” in order to improve technology and innovation, the connection between demand and providers, care for the environment, and develop the production process to adapt it to global needs, promoting exports of other, already manufactured, copper-related products.

Opportunities

Following the fall of oil prices and the sharp rise in energy prices, the government took action: “Since 2013, the government has reduced the price of energy by 40% and investment in the energy sector is now greater than that allocated to copper. We have attracted new investors to the energy sector,” the satisfied Minister for the Economy pointed out.

According to the minister, opportunities currently lie in mining development, sustainable tourism, healthy food, construction, creative economy, the fishing and fish farming sector, technology, and health services.

“The five largest companies in the world did not exist 20 years ago, however, the 10 largest Chilean corporations are all more than 20 years old,” he says, convinced that the key is to attract innovative minds.

Profile

Luis Felipe Céspedes Cifuentes is Minister of Economy, Development and Tourism of the Republic of Chile. He previously held various positions in the Central Bank of Chile, the last as Director of Research; he was chief economist adviser to the finance ministry, a professor at several universities, both in Chile and in the United States, and author of numerous publications on monetary, fiscal, and currency exchange policies.