According to Vanguard’s Investor Pulse survey, American investors continue to maintain a predominantly positive outlook for the new year, following a clearly optimistic 2024. In fact, they expect a market return of 6.4% in 2025 and 7.6% over 10 years, and they also indicate that the U.S. GDP will grow by 4%. These positive forecasts coexist with a certain sense of economic uncertainty, which translates into inflation expectations of 3.2% and a more moderate short-term GDP growth.

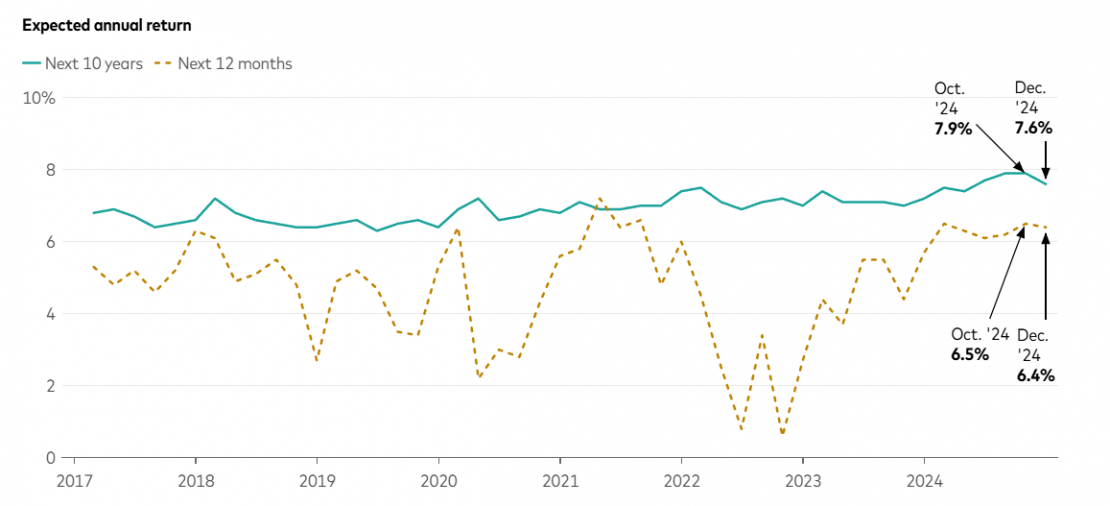

In the history of this survey, Vanguard notes that 2024 was the most optimistic year for investors. Throughout last year, investors’ return expectations for the next 12 months remained above 6%, reflecting a high and sustained level of optimism. Looking ahead to 2025, the survey shows that investors continue with this level of optimism and currently expect the market to deliver a 6.4% return. For the next 10 years, investors expect the average annual market return to be 7%.

“Investor optimism reached a new level of stability in 2024 and remained there throughout the year. However, it seems that investors have adjusted their short-term economic outlook in the last few months of 2024. This could reflect people’s concerns about growth resulting from the increasing complexity of the current economic environment,” notes Xiao Xu, an analyst at Vanguard Investment Strategy Group.

U.S. Economy

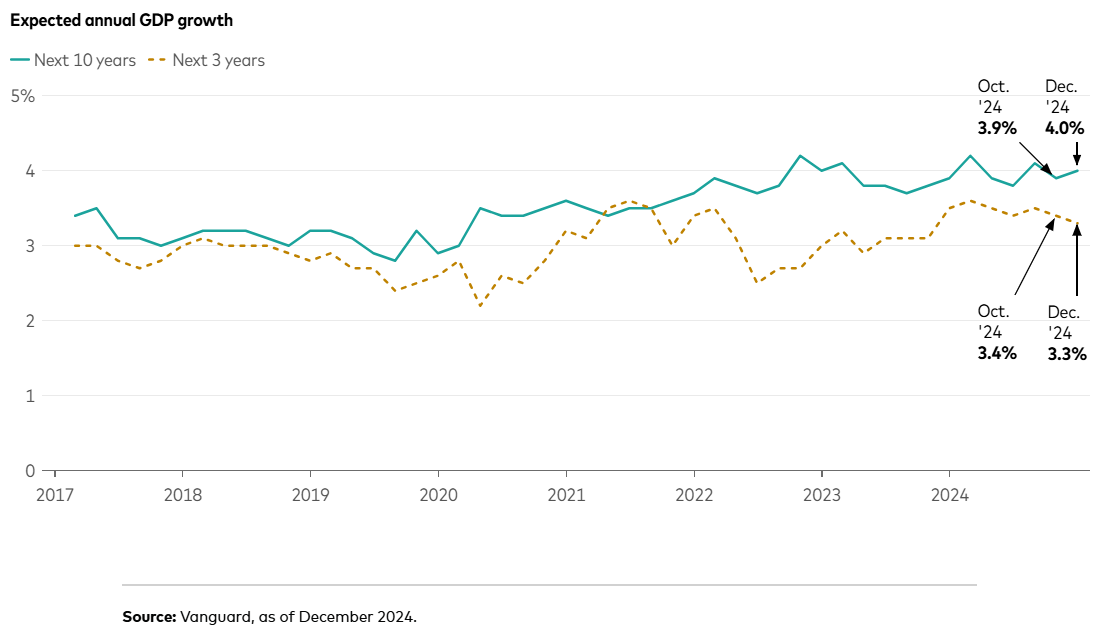

A striking conclusion is that investors’ expectations for average GDP growth in the U.S. over the next three years softened throughout 2024, despite the strong economic growth recorded during the year. According to the survey, although growth expectations remain in a fairly optimistic range, the rebound from the June 2022 low may have come to an end. Specifically, the GDP growth forecast for the next 10 years remains high at 4%.

Lastly, inflation expectations throughout 2024 hovered around 3%, a level above the Fed’s 2% policy target but consistent with overall inflation during the year, according to Vanguard. With a reported uptick in inflation in recent months, the median inflation expectation rose by 0.2% at the end of 2024, meaning investors expect inflation to be 3.2% in 2025.

“Investors remain cautiously optimistic about the stock market and the economy heading into 2025. They are bullish on growth but bearish on inflation,” says Andy Reed, head of Investor Behavior Analysis at Vanguard.

Do investors believe the Fed will be able to bring inflation down to its 2% target by the end of 2025? Since June 2024, we have asked survey participants to estimate the likelihood of different inflation scenarios in the U.S. over the next 12 months. In the second half of 2024, investors increasingly believed that inflation would remain above the 2% target, with their probability assessment rising from 65% in August to 70% in December.

In December 2024, investors estimated a 15% probability that inflation would exceed 6% within 12 months, significantly higher than the 9% probability they had projected back in August. Similar to professional forecasts, including Vanguard’s economic and market outlook, uncertainty surrounding potential trade policies may be a key factor on many investors’ minds.