The latest monthly fund manager survey conducted by BofA shows an extremely optimistic sentiment, reflected in a record allocation to U.S. equities, low cash exposure, and the highest level of global risk appetite in three years. According to the entity, this optimism is driven by U.S. growth associated with “Trump 2.0” and a flexible Federal Reserve regarding rate cuts.

Fund managers have improved their expectations for global growth and corporate earnings in the December edition of BofA’s survey. Specifically, six out of ten respondents believe there will be no global recession in the next 18 months. Additionally, 60% point to the likelihood of a soft landing, 33% still believe there will be no landing, and only 6% are considering a hard landing, the lowest in six months.

Part of this sentiment is clearly reflected in the cash allocation. “The level fell from 4.3% to 3.9% of assets under management (AUM), matching the lowest level since June 2021. Specifically, cash allocation decreased to a 14% net underweight from a 4% net overweight, the lowest level recorded, at least since April 2001. The 18-percentage-point drop in December represents the largest monthly decrease in cash allocation in the past 5 years. Previous low levels of cash allocation coincided with significant highs in risk assets (January-March 2002, February 2011),” the entity explains in its report.

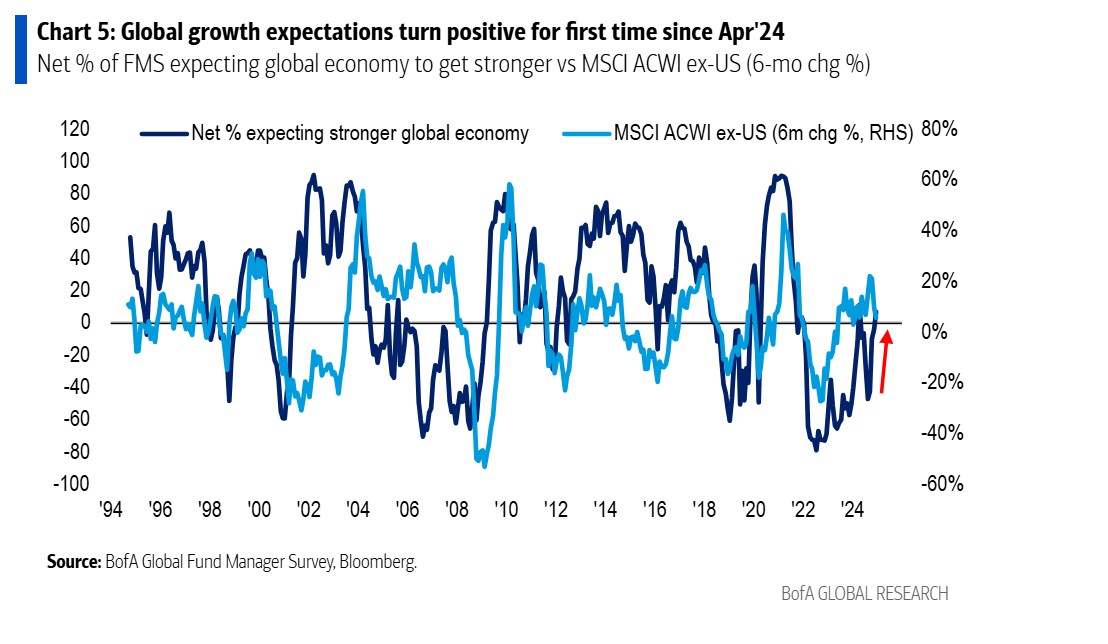

It is also noteworthy that, in December, expectations for global growth improved to a 7% net of respondents expecting a stronger economy (compared to the 4% net that expected a weaker economy in November), being considered positive for the first time since April 2024. “December’s increase in global macroeconomic sentiment was led by greater optimism about U.S. growth, with the highest percentage of FMS investors expecting a stronger U.S. economy (6% net) since at least November 2021,” they point out from BofA. Additionally, they explain that the “Trump 2.0” political agenda (tax cuts, deregulation) drove earnings expectations, with 49% expecting an improvement in global earnings, a 22% increase from the previous month, reaching a three-year high. These expectations are also relevant in terms of what managers expect from monetary policy. In this regard, 80% expect further interest rate cuts in the next 12 months.

This optimism is not incompatible with managers identifying certain risks. In fact, 39% cite the trade war as the biggest downside risk for 2025, while 40% identify growth in China as the biggest upside risk. When asked which development would be seen as the most optimistic in 2025, the FMS respondents in December pointed to: the acceleration of growth in China (40%); productivity gains driven by AI (13%); a peace agreement between Russia and Ukraine (13%); and tax cuts in the U.S. (12%).

Asset Allocation

The survey reveals an interesting asset allocation fueled by this optimism. According to the survey, the weight of U.S. equities increased by 24% compared to the previous month, reaching a net 36% overweight—the highest level ever recorded.

The December jump was the largest observed since September 2023. “Investors are positioning their portfolios for an ‘inflationary boom in the U.S.’ next year, in anticipation of the pro-growth policies announced by the upcoming Trump administration,” notes BofA.

In relative terms, fund managers have the highest overweight in U.S. equities compared to emerging market equities since June 2012. Similarly, they hold the highest overweight in U.S. equities relative to Eurozone equities since June 2012—during the Eurozone debt crisis. Notably, the relative overweight of U.S. equities versus Eurozone equities is the fourth highest in the last 24 years.

Among the monthly changes made by fund managers, allocations highlight an increased weight in the U.S., the financial sector, and equities in general, while reducing allocations to emerging markets, the Eurozone, and cash.