The average age of CEOs of the companies on the Fortune 500 list is 58 years, with only three of them exceeding the age of 80: Warren Buffet, 93, and Robert Greenberg of Skechers, and Albert Nahmad of Watsco, both 83 years old.

Cognitive abilities decline to varying degrees as we age and affect our performance differently depending on the type of professional responsibilities we face. Additionally, from age 80 onward, the probability of death begins to increase exponentially, and the current president of the U.S., if victorious in November, would end his second term at 86 years old.

Therefore, it is surprising that the Democratic Party waited until last week’s debate to seriously consider Joe Biden’s suitability as a presidential candidate, something that could have been addressed almost a year ago when an AP poll, widely covered by the media, showed that Americans believed Biden was too old to consider a second term as president.

Certainly, Donald Trump is also nearly an octogenarian (78). But at these ages, 3-4 years can make a difference, as evidenced by Biden’s decline since his inauguration in 2020, something reflected by 77% of respondents in a CNN poll, who overwhelmingly declared Trump the winner of the debate.

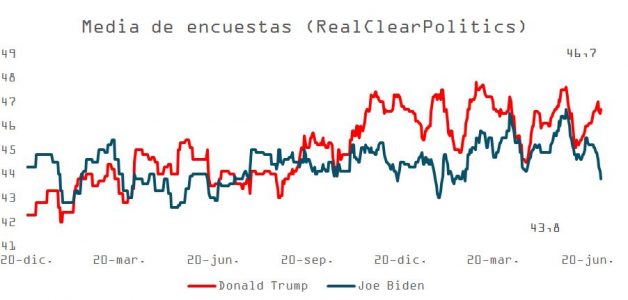

The ripple effect of the first Biden-Trump debate has yet to fully manifest in the polls, but an Ipsos analysis reveals that voters’ confidence in Biden’s ability to lead the country has further declined. The conclusion is echoed in a New York Times poll, which now gives Trump a 6-point lead (up from 3 points before the debate), and a Wall Street Journal poll showing the same gap, indicating that 76% of Democratic participants do not see Biden fit for another 4 years.

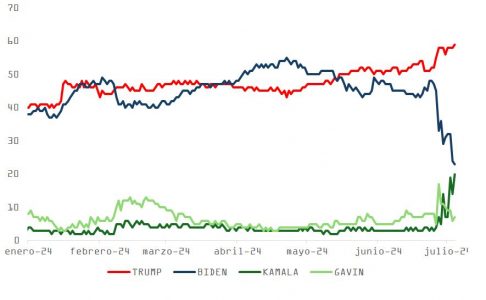

A Wall Street Journal article on Friday also began to reveal growing doubts among Democrats about Biden’s suitability as the party’s presidential candidate, who could be replaced by Kamala Harris (the most likely option) or Gavin Newsom, to prevent Trump from leveraging the debate result as an electoral weapon.

Initially, as the betting markets show (see graph below: PredictIt with a 59% probability of Trump winning after the debate, almost assuming Kamala Harris will replace Joe Biden on the ticket), this would be a damage-control move, as it would consolidate the votes of indecisive Democrats regarding Biden’s situation. But it would still be a patch. Either alternative would start with a disadvantage due to late entry into the campaign: the Democratic convention, the last opportunity to replace Biden, will be held in Chicago from August 19-22, with the election on November 7. On the other hand, Kamala Harris’ popularity, although higher than the current president’s, remains mediocre.

The markets’ reaction, in general terms, also indicates an increase in the Republican candidate’s electoral chances. After the recent rises, public debt prices adjusted downward for the long term (bear steepening) due to the perceived fiscal profligacy associated with the Republicans’ agenda; some Latin American currencies corrected in response to the threat of renewed trade sanctions and/or tariffs, and the stock market continued to rise.

Although the U.S. Treasury bond may suffer in the short term from a consolidation of Donald Trump’s leadership, Japan’s example (which in just over 20 years has seen its debt-to-GDP ratio rise from 100% to 225%) reduces the likelihood of the worst-case scenario. The U.S., like Japan, keeps a significant portion of its public debt at home (approximately 74.9% is held by domestic investors such as families, businesses, and federal agencies like Social Security and Medicare), with just over 23% held by foreign institutions, including central banks and financial corporations in international business centers like the UK, Switzerland, Luxembourg, or the Cayman Islands.

As long as the dollar remains the reference currency for international trade and investment, and despite the trend towards central bank diversification, it seems unlikely that the U.S. will face significant refinancing problems in the medium term.

It is also important to consider that, ceteris paribus, as highlighted by the latest report from the Congressional Budget Office (CBO), the trajectory of the U.S. budget deficit, estimated to remain close to 7% of GDP in 2034 with a debt-to-GDP ratio of 122%, should be a concern for both Democrats and Republicans alike, regardless of their base’s preferences, which do not lean towards austerity. The CBO estimates that Social Security will exhaust its resources by 2033, forcing whoever is in the White House then to cut benefits by approximately 20%-30% or significantly raise taxes.

Therefore, it is reasonable to think that if the Republican party wins the November elections, it will seek discretionary spending adjustments to at least partially offset a potential extension of the Tax Cuts and Jobs Act (TCJA, 2017), which expires in 2025. The risk to public debt valuation through an increase in the term premium remains distant, though it is certainly something to monitor.

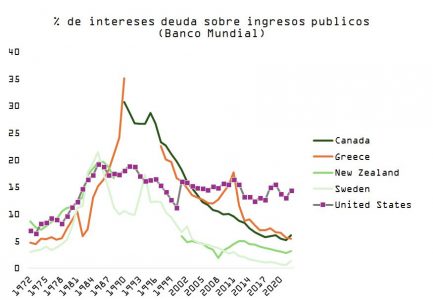

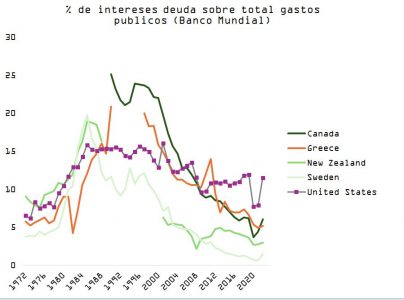

Forecasts suggest that the cost of U.S. federal debt interest as a percentage of revenue will increase in the coming years. Based on the rise in debt levels and the 2022-2023 rate hike campaign, interest payments are expected to consume around 20.3% of revenue by 2025, surpassing the previous peak of 18.4% set in 1991.

In 2023, the U.S. government spent $658 billion on net interest payments, or 2.4% of GDP. Projections indicate this figure will continue to grow, potentially reaching 3.9% of GDP by 2034. This significant increase will pressure the federal budget, complicating the financing of other essential programs and services that are citizens’ rights (Medicaid, Medicare, Social Security, unemployment benefits).

The growing cost of public debt service is expected to exceed spending on key federal programs like Medicaid and defense in the next decade. By 2033, interest payments could account for 14% of total federal outlays, doubling the percentage spent in 2022.

Although the deterioration is undeniable, according to the World Bank database, the differences remain notable when comparing the U.S. situation to the debt crises that preceded those in New Zealand in the 1980s, Canada in the early 1990s, Greece, or Sweden.

Besides keeping inflation under control and preserving full employment, the Fed has a “third mandate” to ensure financial stability. In a context like the one depicted in the CBO report, this involves avoiding excessive tension on the cost of money.

In this regard, Jerome Powell’s statements in Sintra (where he explained that inflation seems to be “back on a disinflationary path”) and the minutes of the last Fed meeting (which expressed concern about growth and employment prospects) highlight the possibility of positive surprises regarding monetary policy direction. The core PCE is already below the target set for December 2024 (2.6% vs. 2.8%), and unemployment aligns with the forecast by U.S. central bankers (4%).

The updated JOLTs survey, which came out slightly better but adjusted May’s data downward, shows that unemployment claims have entered a clear upward trend, suggesting difficulties in reemployment after job loss. The weakness in the June ISM Services, surprisingly entering contraction territory (48.8 vs. consensus expectations of 52.7, with the new orders sub-index plummeting to 47.3 from 54.1 in May) or – as we explained last week – the stagnation in the nascent recovery in industrial activity pointed to by the ISM Manufacturing (48.5 vs. 49.1 expected, showing weakness in subcomponents of employment, export orders, and production) are symptoms of a slowing economy.

Fed members expressed concern in this regard, suggesting that the payroll series may be presenting an overly optimistic view of the labor market situation. They also noted that moderate/low-income households are facing increasing strain in coping with rising living costs, no longer benefiting from the savings accumulated during the pandemic.

The economy, as the data and Fed comments show, is slowing down. Investors remain in “bad news is good news” mode, and as we explained last week, the consensus is for a soft landing. Technically, the S&P is overbought, sentiment is optimistic, and the stock market is not cheap.

Soon we will hear management teams report their second-quarter performance, and expectations are high with 9% EPS growth, the largest since 2021.

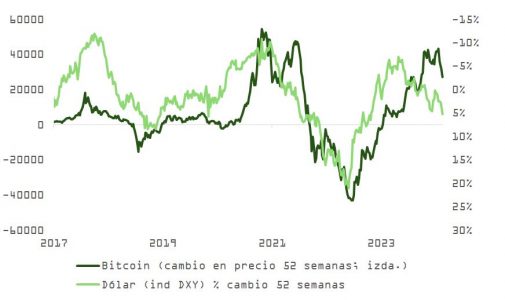

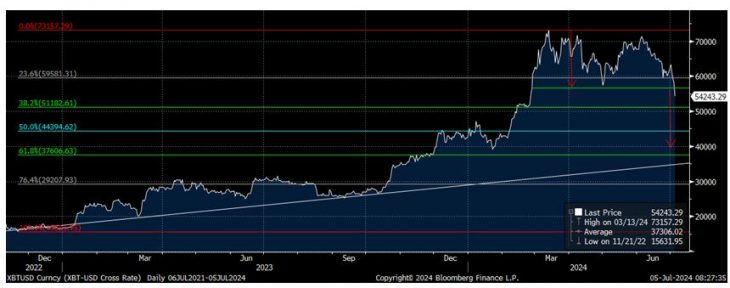

Sentiment is now the main support for this market, which is why it is worth monitoring what “hot money” does. In this regard, bitcoin’s price is reacting to the dollar’s strength (and what it implies), breaking relevant support levels that could result in a much steeper decline. What relevance does this have for the stock market? Bitcoin, as shown in the graph, is a “steroid bet” on the movement in the equity market risk premium, and this week’s declines do not bode well for stockholders.