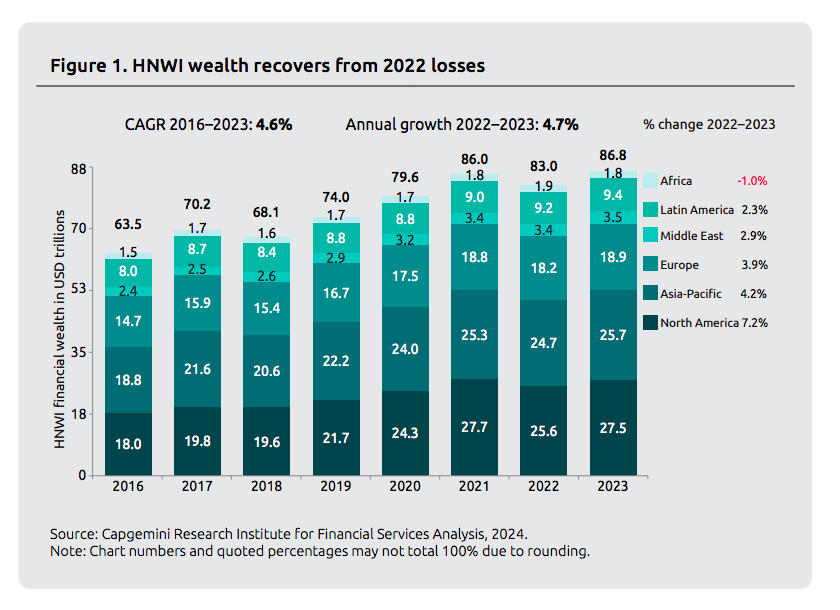

The number of high net worth individuals (HNWIs) and their wealth reached unprecedented levels in 2023, driven by a recovery in global economic outlooks, according to the latest edition of the Capgemini Research Institute’s World Wealth Report 2024.

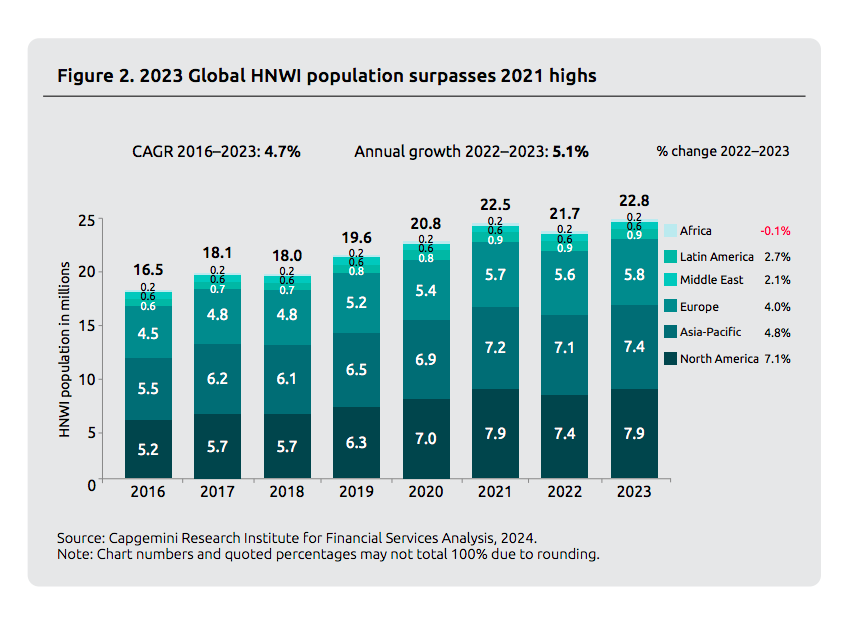

The document reveals that the global wealth of HNWIs grew by 4.7% in 2023, reaching $86.8 trillion, and the HNWI population grew by 5.1% to 22.8 million worldwide, despite market instability. “This upward trend offsets the previous year’s decline and puts HNWI trends back on a growth trajectory,” the report explains.

By region, North America recorded the largest recovery in HNWIs worldwide, with a year-on-year growth of 7.2% in wealth and 7.1% in population. According to the report, strong economic resilience, cooling inflationary pressures, and the formidable recovery of the U.S. equity market drove the growth.

This trend continues in most markets for both wealth and population, but to a lesser extent. The report shows that the HNWI segment in Asia-Pacific (4.2% and 4.8%) and Europe (3.9% and 4.0%) experienced more modest growth in wealth and population. Additionally, Latin America and the Middle East recorded moderate HNWI growth, with wealth increases of 2.3% and 2.9%, and population increases of 2.7% and 2.1%, respectively. Finally, Africa was the only region where HNWI wealth (1.0%) and population (0.1%) declined due to falling commodity prices and foreign investment.

The Case of Spain

The report details that in Spain, the number of high net worth individuals (HNWIs) rose from 237,400 in 2022 to 250,600 in 2023, an increase of 5.6%, above the global average of 5.1%, positioning the country at 15th in the ranking of the top 25 countries by HNWI population. Spain also aligns with the global trend of increasing wealth value, with wealth rising by 5.7%, corresponding to $39.2 billion (from $687.2 billion in 2022 to $726.4 billion in 2023).

Finally, the report notes that the main factors driving this widespread increase have been the rise in stock market capitalization, the decline in general inflation, and the surge in housing prices. Thus, all Western European countries have seen their wealth increase, with Italy and France leading (growth of 8.5% and 6.5%, respectively), partly benefiting from a record year for tourism, strong luxury sector data, and a rebound in exports. Countries such as Switzerland (5.6%), Denmark (4.5%), the United Kingdom (2.9%), and Germany (2.2%) are below Spain.

Regarding Spain’s macroeconomic context, the report details that real GDP grew by 2.5% in 2023 after experiencing 5.7% growth in 2022. The positive GDP is mainly explained by the faster-than-expected fading of the energy crisis, as well as the good performance of the Spanish external sector, closely linked to both tourism and non-tourism services. Additionally, in terms of savings, the report explains that national savings as a percentage of GDP slightly increased to 22.4% in 2023, up from 21% in 2022. Nominal private consumption reached $879.4 billion, representing a 9% increase in 2023; and nominal public consumption reached $315.9 billion, constituting a 9% increase in 2023.

Asset Allocation

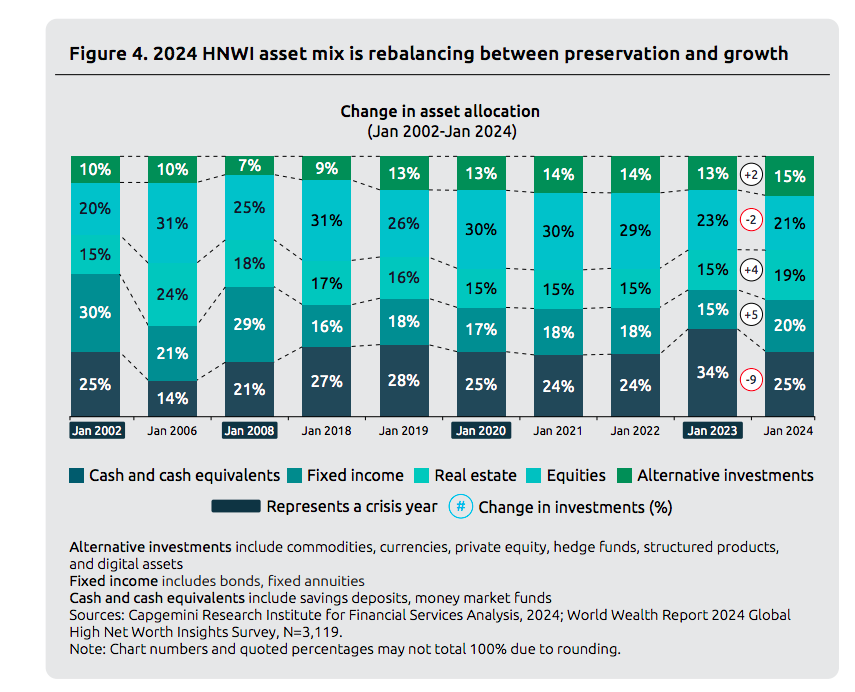

As HNWI growth prospers, asset allocations are beginning to shift from wealth preservation to growth. Early data from 2024 suggests a normalization of trends regarding cash and equivalents (deposits, money market funds, etc.) to 25% of the total portfolio, a marked contrast to the 34% observed in January 2023. The report indicates that two out of three HNWIs plan to invest more in private equity during 2024 to take advantage of potential future growth opportunities.

Within the entire HNWI segment, ultra-high-net-worth individuals (UHNWIs), who represent about 1% of the total segment but concentrate 34% of the segment’s wealth, prove to be the most lucrative for wealth management entities. It is estimated that over the next two decades, older generations will transfer more than $80 trillion, driving interest in both financial (investment management and tax planning) and non-financial (philanthropy, concierge services, passion investments, and networking opportunities) value-added services, which represent a lucrative opportunity for wealth management companies.

Additionally, the report reveals that 78% of UHNWIs consider value-added services (both financial and non-financial) essential when choosing a wealth management or private banking firm, and more than 77% rely on their wealth management firm to help with their generational wealth transfer needs. As HNWIs seek guidance for wealth management, 65% express concern about the lack of personalized advice tailored to their changing financial situation.

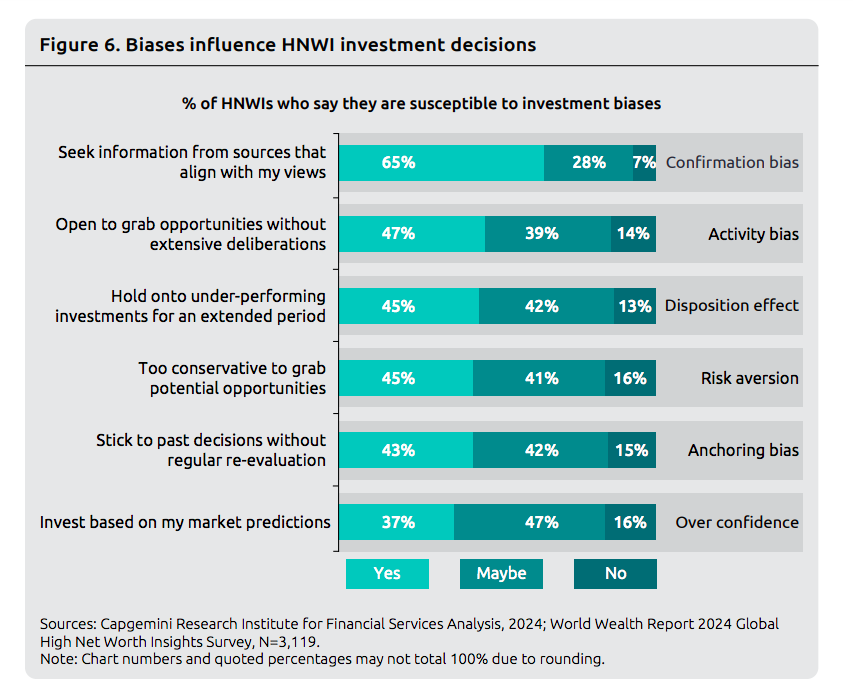

“Clients are demanding more from their wealth managers as challenges have never been greater. There are active measures firms can take to attract and retain clients and offer a personalized and omnichannel experience as wealth transfer occurs and HNWI growth continues. While the traditional way of profiling clients is ubiquitous, the application of behavior-driven finance tools powered by AI, using psychographic data, should be considered. They can offer a competitive edge by understanding individuals’ decision-making to offer greater client intimacy. Creating real-time communication channels will be crucial in managing biases that may trigger sudden and volatile market movements,” explains Nilesh Vaidya, global head of the retail banking and wealth management sector at Capgemini.

Investment Decisions

More than 65% of HNWIs confess that biases influence their investment decisions, especially during significant life events such as marriage, divorce, and retirement. As a result, 79% of HNWIs want guidance from relationship managers (RMs) to help manage these unknown biases. By integrating behavior-driven client finance with artificial intelligence, wealth management firms can assess how clients react to market fluctuations and make data-driven decisions less susceptible to emotional or cognitive biases. The report highlights that AI-based systems can analyze data and detect patterns that may be difficult for humans to recognize, enabling managers to take proactive measures to advise clients.

According to the report, UHNWIs have increased the number of relationships they maintain with a wealth management firm from three in 2020 to seven in 2023. This trend indicates that the sector is struggling to provide the range and quality of services demanded by this segment. Conversely, single-family offices, which serve only one family, have grown by 200% over the past decade. To better serve HNWI and UHNWI segments, wealth management firms must find a balance between competition and collaboration with family offices. One in two UHNWIs (52%) wants to create a family office and seeks advice from their primary wealth management entity to do so.