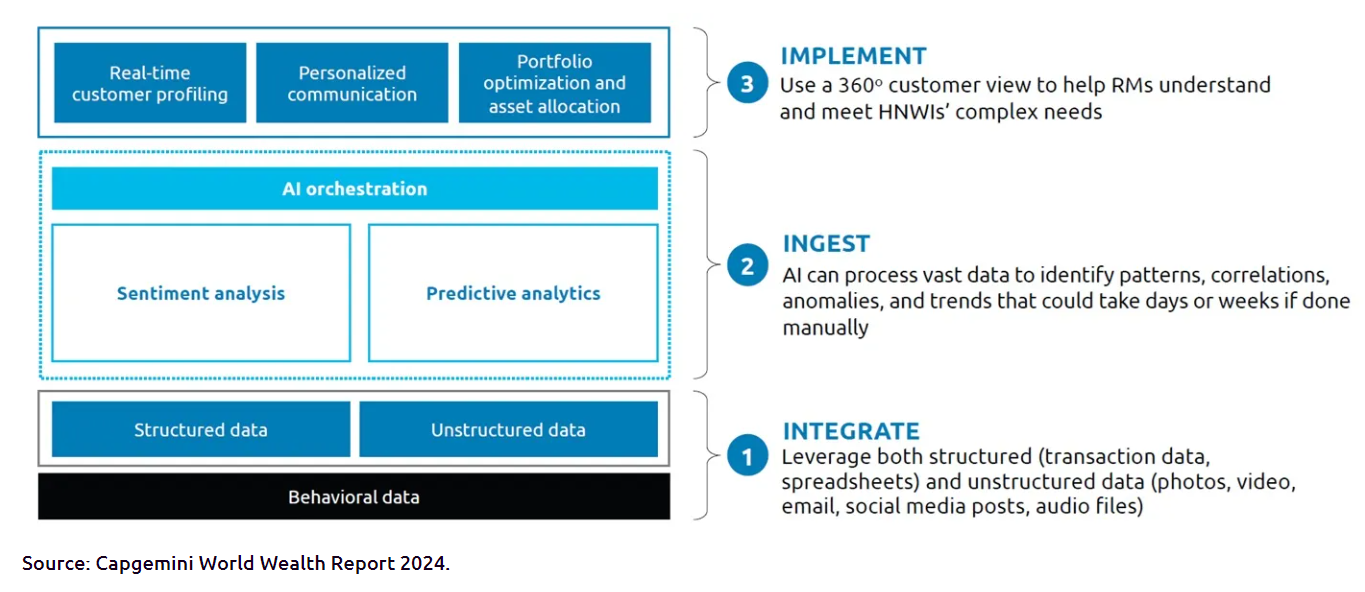

Building scalable AI-driven behavioral finance solutions requires a structured approach, according to a Capgemini study. This involves integrating diverse data sources by leveraging both artificial intelligence and generative AI capabilities. Additionally, the integrated data must be ingested using sentiment and predictive analysis based on AI, and the derived insights should be implemented to drive real-time customer profiling, portfolio optimization, and hyper-personalized experiences for high-net-worth individuals, as noted in the study.

This holistic approach not only enhances customer experiences but also empowers advisors by automating mundane tasks, optimizing their time, and minimizing errors. For example, the study cites firms like RBC Wealth Management U.S., which are already utilizing Salesforce’s “Personalized Financial Engagement” solution to integrate disparate data systems, create unified client profiles, and offer intelligent, automated customer journeys using generative AI.

However, executing a structured approach successfully is a significant challenge. To ensure that a company can efficiently integrate, ingest, and implement data to achieve necessary business value, Capgemini recommends six critical steps:

1. Make internal data accessible: For banks, the key question is not whether they have valuable data, but whether that data can be located and accessed by AI applications in real time. Isolated, hidden, and poorly labeled datasets need to be connected, cleaned, and standardized across business units and acquired entities.

2. Incorporate external data: While retailers commonly use third-party data to gain deep insights into customers, banks have lagged behind. To fully realize the promise of behavioral finance, banks must identify and integrate appropriate external sources with internal data repositories.

3. Set up robust AI infrastructure: Data must be delivered quickly to AI applications, as latency can severely limit AI’s ability to derive relevant insights. Banks need to design and deploy the appropriate computing, storage, networking, and cloud infrastructure to support AI foundations.

4. Adopt AI and generative AI solutions for finance: Understanding customer psychographics, creating hyper-personalized financial plans, and offering high-level client experiences requires adopting robust, purpose-built AI applications. Capgemini’s “Augmented Advisor Intelligence” solution, for instance, helps relationship managers make informed decisions and generate client-oriented communications.

5. Prepare to expose AI insights to clients: While AI for behavioral finance and customer communications is currently an internal function, high-net-worth individuals will eventually seek self-service capabilities alongside personal interactions with their relationship managers. To meet this future demand seamlessly, banks must design the architecture of technology and application bases with foresight.

6. Address regulatory concerns: As with any new technology, implementing AI solutions must comply with regulations to minimize risks of deviations or losses caused by AI applications. In addition to properly designing, deploying, and monitoring AI applications, banks should maintain human oversight between AI applications and customers, at least for now.

This comprehensive strategy is essential for financial institutions to maximize the benefits of AI-driven behavioral finance solutions while mitigating risks and preparing for future innovations.