As expected from an alternative asset manager, Apollo publishes a report that plays on the nerves of traditional investors and outlines what could happen if, due to volatility, there were a significant pullback of foreign capital in the S&P 500.

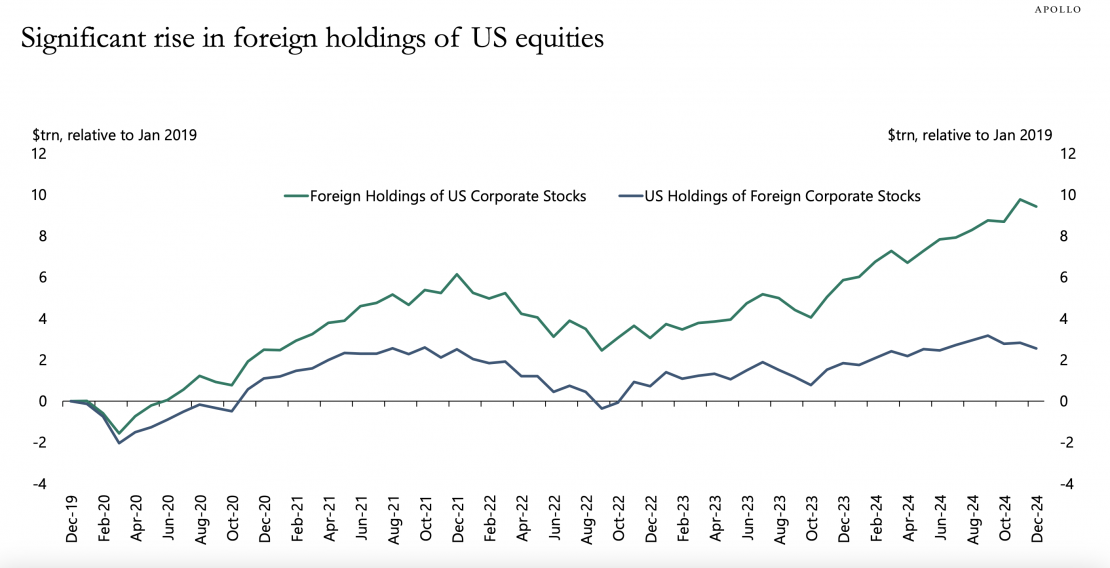

“There have been significant inflows of foreign capital into U.S. equity markets, and foreign investors now have a significant overweight in U.S. equities,” the firm said in a press release.

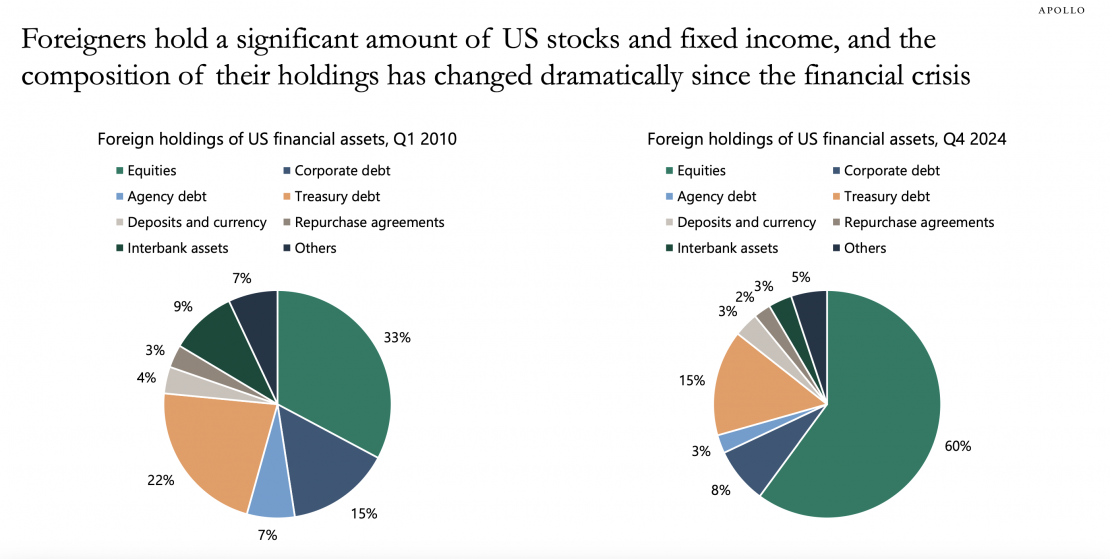

In 2024, 60% of holdings in U.S. equities belong to foreign investors, whereas this figure was 33% in 2010. This structural shift is particularly concentrated in this asset class.

Apollo believes that, when adding the depreciation of the dollar and the continued overvaluation of the Magnificent Seven, the risks of a decline in the S&P 500 as a result of foreign capital selling are significant.

By Fórmate a Fondo

By Fórmate a Fondo