The political uncertainty following recent European elections and ahead of the U.S. elections in November this year is a key factor in evaluating the future of the euro-dollar exchange rate. Additionally, this situation is compounded by the evolution of inflation in both economies, which is decreasing at a slower pace than expected, and the decisions that the ECB and the Fed will make regarding the pace of interest rate cuts.

To provide an approximate forecast of how the euro-dollar relationship will evolve, we have gathered analysis from various experts. For example, Claudio Wewel, currency strategist at J. Safra Sarasin Sustainable AM, considers it unlikely that the euro will rebound, as manufacturing momentum is slowing, although the currency should rise once the Fed starts cutting rates.

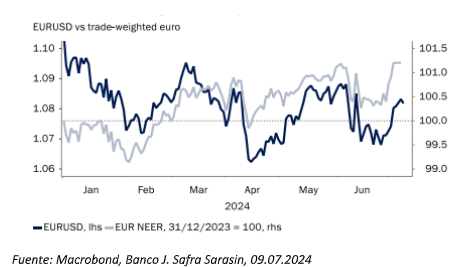

“Since the beginning of the year, the euro has had a mediocre performance. So far this year, it has fallen by around 3% against the U.S. dollar, while it has recorded a 1% rise in trade-weighted terms. Notably, the euro’s fluctuation band has been narrowing in recent years, and since January, the euro-dollar ratio has remained between 1.06 and 1.10,” Wewel points out.

According to his view, the duration of the current episode of “prolonged rise” will depend on the data. In this regard, he notes that the latest U.S. macroeconomic data have been weaker than expected, suggesting a moderation of the U.S.’s superior cyclical performance. However, he sees it as unlikely that the cyclical euro will benefit from the weakening economic activity in the U.S., given that the main economies of the eurozone have seen disappointing manufacturing PMIs in June.

“In this relative cyclical context, the ECB should be able to cut its policy more than the Federal Reserve this year. Along with the greater rigidity of U.S. inflation, the Fed’s less deep rate cut path than the market expected also reflects the increased odds of Donald Trump’s victory in the 2024 U.S. presidential election, which markets have started to consider as the base case. In our opinion, Trump’s policy mix would likely be more inflationary than a continuation of Biden’s policies, implying that in 2025 the Fed would implement fewer rate cuts in this case,” adds the expert from J. Safra Sarasin Sustainable AM.

From Ebury, they point out that market nervousness and uncertainty will benefit safe-haven currencies. The fintech predicts a slight appreciation of the euro-dollar pair in the coming months, which will largely result from “some convergence in economic outcomes across the Atlantic in 2024, as the U.S. economy slows after an impressive year, while the eurozone accelerates from a very low base.” Ebury analysts believe this circumstance “will push the pair back towards the 1.10 level by the end of the year, with further appreciation towards the 1.14 level in 2025.”

However, they warn that the outcome of the November presidential elections in the U.S. could pose a risk to this view. “A Donald Trump electoral victory, which markets currently assign about a 50% probability, could be bearish for EUR/USD if the former president doubles down on the protectionist policies that characterized his previous tenure in the White House,” they explain.

Parity: An Omen of Bad Luck?

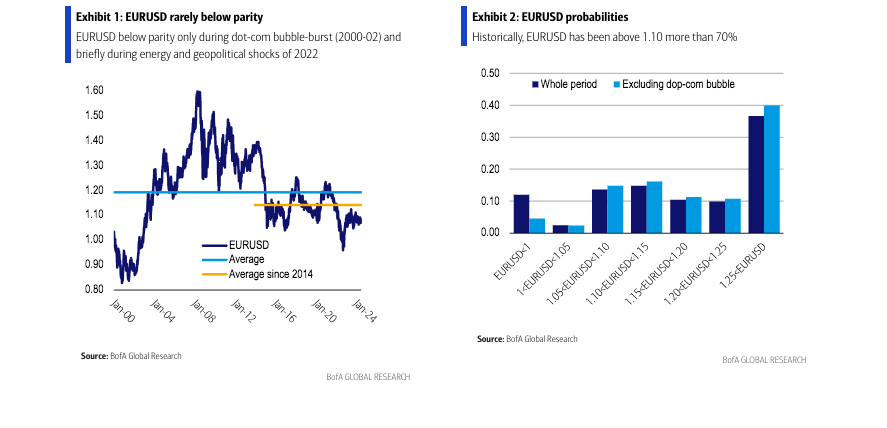

Finally, according to Bank of America, parity between the two currencies is “rare” and “has not lasted long,” and they believe that for it to happen again, “everything would have to go wrong and stay that way.” According to their analysts, the probability of the euro/dollar reaching parity or less using quarterly data is zero.

“The verdict is still out on whether the euro/dollar will stay at its post-2014 lows or recover to its previous highs. Much depends on the balance between unsustainable debt and U.S. exceptionalism, and to what extent Europe unites to tackle its severe challenges stemming from geopolitics and energy dependency. A potential trade war after the U.S. elections could further weaken the euro. However, for us, parity remains only an outcome in extreme risk scenarios, and even then, we wouldn’t expect it to last long,” explains the entity in one of its latest reports.

Drawing on historical perspective, BofA indicates that the euro/dollar fell below parity only in exceptional circumstances that did not last long. Specifically, it did so only during the periods of 2000-2002 and from August to October 2022. “The first period, which was the longest, occurred during the dot-com bubble in the United States and its burst. The second period was during a perfect storm of negative shocks for Europe, with the war in Ukraine triggering a severe deterioration in its terms of trade through an energy shock, and with divergent monetary policies as the Fed was raising rates while the ECB denied inflation, delaying its policy tightening. However, the euro/dollar was above parity in November 2022, as these shocks began to diminish and the ECB started catching up with the Fed,” they point out.

Their analysis shows that the euro/dollar weakened but stayed above parity during other severe shocks. For example, it was well above parity during the global financial crisis and the eurozone crisis. It weakened substantially but also remained above parity during the ECB’s negative policy rate period after 2014. “Similarly, it stayed well above parity and without a clear trend during Trump’s first term in the United States: the euro/dollar initially strengthened and then weakened. It also remained well above parity during the pandemic,” concludes BofA in its report.