The COVID-19 pandemic has ravaged economies worldwide. Weak infrastructure and healthcare systems, dependence on commodities and tourism for income, and high debt loads have left emerging markets suffering disproportionately.

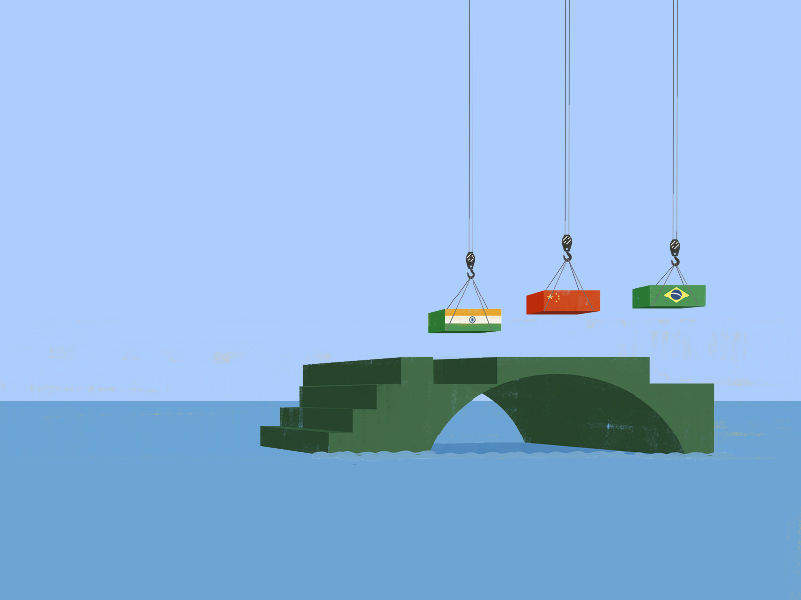

But looking beyond the short-term, prospects for these countries are hopeful. Vast fiscal and monetary stimulus have poured into the global financial system as governments everywhere look to mitigate the pandemic’s impact on their economies. A considerable proportion has been earmarked for infrastructure. Crucially, governments will be in a position to restructure their economies in ways that not only boost their productivity but are also environmentally friendly – to build back better. Indeed, in many cases the greener course of action is also the most economically sensible for emerging markets, according to a report by Oxford University’s Smith School sponsored by Pictet Asset Management.

Even before Covid-19, the green investment potential of emerging economies was huge. It’s estimated that the Paris Agreement has paved the way for some USD 23 trillion in climate smart opportunities in emerging markets by 2030, according to the World Bank.

So far, their performance has been mixed. Yet, there is political momentum, driven by a groundswell of popular support, for green recovery from COVID-19, in a way there wasn’t following past pushes like the 1997 Kyoto agreement. Government efforts are reinforced by and reflect a groundswell of environmental activism by both individuals, companies and communities.

Not that it necessarily needs new money. For instance, public subsidies for coal, oil and gas production and consumption amounted to roughly USD 500 billion worldwide in 2019, compared to USD100 billion for renewables.

In many cases, this support is provided by governments of less developed economies in an effort to develop oil and gas fields or to keep their populaces happy with cheap energy. But just reversing those subsidies would make huge strides towards climate change mitigation. And would save tens of billions of dollars from becoming stranded assets.

Between USD 5 trillion and USD 17 trillion of assets are already at risk if governments decide to pursue a high ambition strategy of limiting warming to 1.6˚C. That’s the value of infrastructure and other assets that would have to be mothballed to achieve the lowest rate of warming in Oxford’s scenarios. Further investment into fossil assets only pushes the value of stranded assets higher.

The green economy already makes up some 6 per cent of the global stock market, according to FTSE Russell. For it to expand further, investments will need to flow beyond the power sector, which currently receives most low-carbon funding, to agriculture, transport and forestry among others.

The significant structural changes economies need to undergo to mitigate climate change will absorb large amounts of funding over a long period, but financing is also needed for the many smaller, cost-effective measures that can be taken to adapt to the rise in global temperatures. For instance, early warning systems for storms and heat waves are estimated to save in assets and lives ten times what they cost. In all, adaptation currently represents just 0.1 per cent of private climate finance flows.

There’s an inevitability about the shift towards greener investment. The economics are moving in that direction. The finance will follow. Governments and private investors are likely to heed the early signals and allocate capital accordingly.

Read more about the Oxford-Smith paper at this link.

Except otherwise indicated, all data on this page are sourced from the Climate Change and Emerging Markets after COVID-19 report, October 2020.

Information, opinions and estimates contained in this document reflect a judgment at the original date of publication and are subject to risks and uncertainties that could cause actual results to differ materially from those presented herein.

Important notes

This material is for distribution to professional investors only. However it is not intended for distribution to any person or entity who is a citizen or resident of any locality, state, country or other jurisdiction where such distribution, publication, or use would be contrary to law or regulation. Information used in the preparation of this document is based upon sources believed to be reliable, but no representation or warranty is given as to the accuracy or completeness of those sources. Any opinion, estimate or forecast may be changed at any time without prior warning. Investors should read the prospectus or offering memorandum before investing in any Pictet managed funds. Tax treatment depends on the individual circumstances of each investor and may be subject to change in the future. Past performance is not a guide to future performance. The value of investments and the income from them can fall as well as rise and is not guaranteed. You may not get back the amount originally invested.

This document has been issued in Switzerland by Pictet Asset Management SA and in the rest of the world by Pictet Asset Management Limited, which is authorised and regulated by the Financial Conduct Authority, and may not be reproduced or distributed, either in part or in full, without their prior authorisation.

For US investors, Shares sold in the United States or to US Persons will only be sold in private placements to accredited investors pursuant to exemptions from SEC registration under the Section 4(2) and Regulation D private placement exemptions under the 1933 Act and qualified clients as defined under the 1940 Act. The Shares of the Pictet funds have not been registered under the 1933 Act and may not, except in transactions which do not violate United States securities laws, be directly or indirectly offered or sold in the United States or to any US Person. The Management Fund Companies of the Pictet Group will not be registered under the 1940 Act.

Pictet Asset Management Inc. (Pictet AM Inc) is responsible for effecting solicitation in North America to promote the portfolio management services of Pictet Asset Management Limited (Pictet AM Ltd) and Pictet Asset Management SA (Pictet AM SA).

In Canada Pictet AM Inc is registered as Portfolio Managerr authorized to conduct marketing activities on behalf of Pictet AM Ltd and Pictet AM SA. In the USA, Pictet AM Inc. is registered as an SEC Investment Adviser and its activities are conducted in full compliance with the SEC rules applicable to the marketing of affiliate entities as prescribed in the Adviser Act of 1940 ref. 17CFR275.206(4)-3.