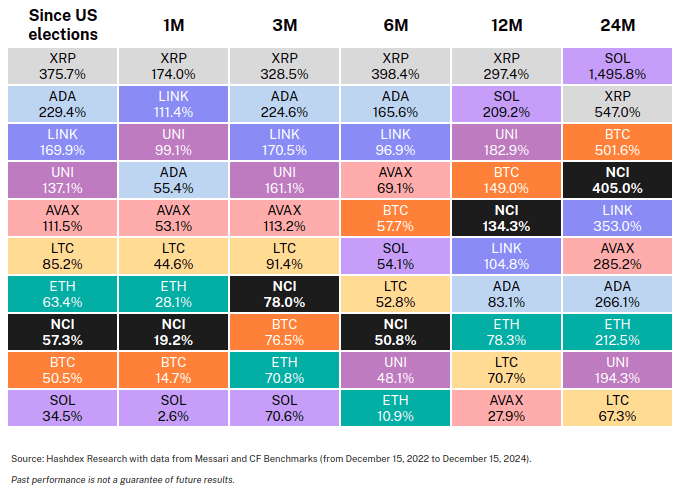

2024 was a year of transition for the cryptocurrency universe. According to Hashdex, this market went through a recovery cycle following a turbulent 2022 marked by bad actors and fraudulent activities. Reflecting on the past year, they believe crypto assets experienced a recovery phase and the beginning of a bull market. A key turning point was the U.S. election results and Donald Trump’s victory. Evidence of this is the Nasdaq Crypto Index, which has risen more than 57% since November 5, 2024, driven by widespread optimism about the future direction of U.S. digital asset policies.

“We believe the current investment case for bitcoin and other crypto assets remains strong. The steady demand from institutional investors, advancements in infrastructure, and a regulatory environment set to improve significantly in 2025 are positioning this asset class for what could be its strongest year on record,” said Samir Kerbage, CIO of Hashdex. In his opinion, crypto assets tend to follow a cycle of four years that includes a bullish phase lasting approximately 12 months, followed by a bear market lasting one year, and then a recovery period spanning two years. In the last two bull markets, altcoins (that is, everything except bitcoin) have significantly outperformed the largest crypto asset, according to Hashdex.

“I believe we have entered a bull market, reinforced by the macroeconomic environment and the U.S. election results. But another indicator of a bull market is the superior performance of the Nasdaq Crypto Index compared to bitcoin. Over the past three months, the index has outperformed bitcoin (78% vs. 76.5%) and, since the elections, the Nasdaq Crypto Index has outpaced bitcoin by 6.8%,” added Kerbage.

2024 was a year of transition for the cryptocurrency universe. According to Hashdex, this market went through a recovery cycle following a turbulent 2022 marked by bad actors and fraudulent activities. Reflecting on the past year, they believe crypto assets experienced a recovery phase and the beginning of a bull market. A key turning point was the U.S. election results and Donald Trump’s victory. Evidence of this is the Nasdaq Crypto Index, which has risen more than 57% since November 5, 2024, driven by widespread optimism about the future direction of U.S. digital asset policies.

“We believe the current investment case for bitcoin and other crypto assets remains strong. The steady demand from institutional investors, advancements in infrastructure, and a regulatory environment set to improve significantly in 2025 are positioning this asset class for what could be its strongest year on record,” said Samir Kerbage, CIO of Hashdex.

A key area, according to the entity, is smart contract projects—platforms that will enable users to conduct transactions involving not only information but also value and ownership. Hashdex estimates that these platforms and applications will outperform bitcoin over the next 12 to 18 months, as they compete for users and lay the foundation for decentralized applications.

“Thanks to the infrastructure developments we have seen in this area in recent years, new applications are emerging in fields such as artificial intelligence, video games, and many others as tokenization continues to expand. We also believe that new regulatory advances in 2025 will be more beneficial to these applications than to bitcoin specifically, given that bitcoin already has regulatory clarity and a well-developed capital market structure, with the growth of ETFs, options, and futures,” Kerbage explained.

In the U.S. and Europe, this legislative and regulatory clarity benefiting altcoins may include market structure legislation, as proposals like FIT21 aim to eliminate ambiguities regarding crypto assets’ status as commodities or securities, while creating registration pathways that could drive adoption in the U.S.

According to the latest report from Sygnum, a global banking group specializing in digital assets, relatively small institutional investor inflows into bitcoin ETFs could have a disproportionate impact on the market due to limited liquid supply. Their analysis of recent ETF flows suggests that every $1 billion inflow (approximately 0.1% of Bitcoin’s market cap) corresponds to price movements of 3-6%, with larger inflows showing greater price sensitivity.

The report predicts that this multiplier effect could be amplified if major institutional investors—including sovereign wealth funds, endowments, and pension funds—begin making allocations. Some U.S. state pension funds have already invested in crypto assets, and several states have introduced bills encouraging pension funds to consider cryptocurrency allocations. With the size of assets managed by these investors, even conservative estimates represent a larger wave of inflows than experienced in 2024 with the launch of spot cryptocurrency ETFs in the U.S.

“Many traditional institutional investors, those with the largest volumes of assets under management, are just beginning their foray into cryptocurrencies. Our analysis shows how even relatively modest allocations from this segment could fundamentally alter the crypto asset ecosystem. With greater regulatory clarity in the U.S. and the potential for Bitcoin to be recognized as a reserve asset for central banks, 2025 could mark a significant acceleration in institutional participation in crypto assets,” said Martin Burgherr, Chief Clients Officer of Sygnum Bank.

Stablecoin legislation, particularly the implementation of MiCA, will also play an important role by driving stablecoin adoption in the U.S. and Europe, expanding their use beyond emerging markets.

The repeal of SAB121, allowing U.S. banks to hold cryptocurrencies for their clients, is expected to enable banks and brokerages to expand their cryptocurrency trading and custody offerings, benefiting altcoins in particular. Additionally, new ETF launches under the new SEC chair are raising hopes for more approvals, including ETFs for indices and individual assets like Solana and XRP. Although uncertainty persists, the availability of new assets with ETFs as access points is highly positive.

Altcoin Use Cases

According to Kerbage, in addition to bitcoin evolving as an emerging digital store of value and smart contract platforms becoming a new way to exchange information, value, and ownership, three other altcoin use cases are expected to benefit over the next year:

- DeFi: Projects aimed at creating an internet-based financial system, operating on smart contract platforms, will establish a new global capital markets infrastructure for payments. Stablecoins and tokenized money market funds are the first major use cases.

- Web3: A new iteration of the internet that will enable users to own their data and make the web decentralized and more useful for innovations like AI agents and other advancements.

- Digital Culture: An emerging digitally native generation will drive greater demand for owning digital assets and collectibles, with video games as the first natural application.

“If we compare cryptocurrencies to the internet, this industry is like the internet in the 1990s, and bitcoin could be compared to email—the only application most people have heard of. However, if we fast-forward 20 years, although email remains very useful, it has not been the internet application that has created the most value for society. We believe this perspective could apply to how bitcoin is currently perceived in relation to cryptocurrencies,” Kerbage concluded.