In the equity market, historical highs can evoke mixed feelings. According to investment firms, historically, bull markets have lasted much longer than bear markets, reaching new highs in each cycle and creating opportunities.

For example, following the earnings presentation of U.S. banks, the good results reflect the positive state of the sector in the last quarter before expected rate cuts in September by the Fed and ECB. However, the equity markets saw sales gain momentum due to bans on exporting advanced technology to China for AI development. “Thus, stocks like Nvidia and ASML suffered losses close to double digits, dragging down major indices: the S&P 500 lost 2% over the last 5 days compared to -4% for the Nasdaq and -4.3% for the Euro Stoxx 50, while the Ibex 35 fell only 1.45% due to its lower tech weight,” notes Portocolom’s investment team.

Edmond de Rothschild AM’s latest analysis indicates that recent U.S. political events have reinforced the large rotation underway since inflation data was released a few weeks ago. “Investors are replacing large-cap companies with small caps, tech stocks with energy and real estate, and growth with value,” they note.

“With the momentum of energy stocks, the U.S. market continues to reach new highs, diverging from the sideways movement of the European stock market, which has not reached new highs since April. Issues in China are affecting Europe’s main sector, leaving it behind in stock market gains,” explain Activotrade.

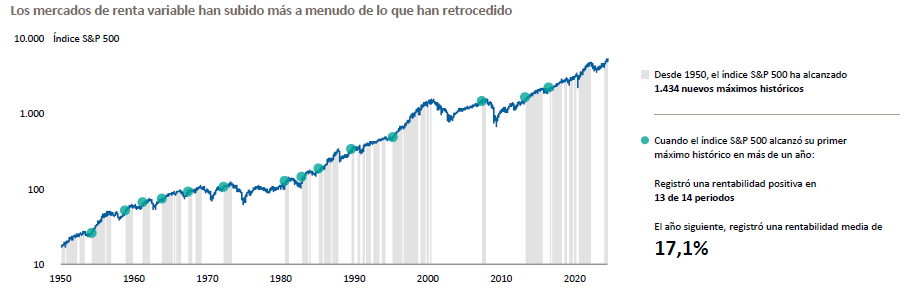

When the market hits a new high, investors might conclude that the market has peaked and they’ve missed the opportunity. According to Capital Group, nothing could be further from the truth. “Over long periods, markets have tended to rise and reach multiple highs in a cycle,” they note.

Everyone knows that market declines are inevitable and can happen at any time. But according to Capital Group, history has shown that periods when markets hit new highs have offered an attractive entry point for long-term investors. “Since 1950, whenever the S&P 500 index has reached its first all-time high in at least a year, the average equity return has been 17.1% in the following twelve months. Except at the start of the 2007 financial crisis, an investor would have gained in all these periods,” explain Capital Group.

“That’s why we focus on themes like globalization, productivity, and innovation, which drive growth significantly. We will face market declines, but these have not changed the long-term trajectory. Hence, I usually advocate for market appreciation,” adds Martin Jacobs, equity manager at Capital Group.

According to Yves Bonzon, CIO of Swiss private bank Julius Baer, the market’s performance has been good so far this year, and it seems the bears have capitulated for the sake of their careers. “Consequently, it wouldn’t take much to reset the greed (bullish sentiment) and fear (bearish sentiment) indicator back towards fear. The risk/reward ratio for the second half of the year is the least attractive we’ve seen in a long time. To be clear, we still believe the main trend is bullish. Therefore, we are trying to protect against an intermediate correction in a bullish trend,” states Bonzon.

For Julius Baer’s CIO, the narrative is now shifting towards a healthy rotation but not immediately. “Although still to be seen, we are not convinced of the likelihood of a swift and convenient shift towards a much broader U.S. equity bull market where the equally weighted S&P 500 suddenly outperforms its market-cap weighted counterpart. In other words, the economy may enjoy Goldilocks-like conditions, but markets are rarely so kind. We doubt the Goldilocks scenario for equities, with a broad market rise, began last Thursday,” he argues.

Another sign that a sustainable rotation has not yet begun is the disappointing performance of European and Chinese equities. “If such a rotation is underway, European and Chinese equities do not seem to be benefiting from it. We believe the odds of a correction are higher than those of a sustainable rotation. We cannot overlook the disturbances that likely would have flooded the U.S. if the assassination attempt on former President Trump had succeeded,” he asserts.

Second Half Outlook

According to DPAM, we are in an atypical cycle characterized by persistent economic growth amid restrictive monetary policy, causing concern for both bulls and bears. “The balance between disinflation, growth, interest rate hikes, and long-term secular themes continues. Bulls currently have the upper hand, as evidenced by the new market highs,” notes Johan Van Geeteruyen, CIO of Fundamental Equity at DPAM.

In this context, Van Geeteruyen believes that investors have yet to react and prefer large caps until economic stability improves, with monetary tightening also affecting small caps. “We believe the best strategy is to accumulate positions gradually, as several catalysts, such as ECB rate cuts, improved macroeconomic conditions, and low positioning, suggest an imminent shift. The recent improvement in flows, with the return of U.S. investors, could also be a strong catalyst,” he notes.

According to their forecasts, the market expects growth recovery in 2024 and 2025. They believe the composite PMI has risen above 50, thanks to the strength of the services PMI, and the manufacturing PMI has improved from 45 at the beginning of the year to over 47. This turning point historically indicates an imminent superior performance of small caps, which are sensitive to economic improvements but have been at recessionary valuation levels for over two years.

“We remain neutral on the U.S. due to valuation issues but lean towards overweighting Europe. We avoid underweighting the U.S. due to its dynamism and safe-haven status. Factors supporting our overweight position in Europe include improving macroeconomic indicators, increased business confidence, a resurgence in business activity, attractive capital distribution, and undervalued AI dissemination,” points out Van Geeteruyen.