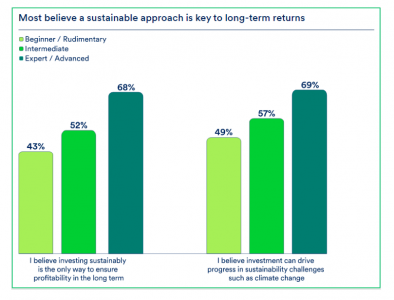

“Expert” investors are more likely to believe that investing sustainably is key to driving long-term returns compared with people who rate themselves as less knowledgeable, Schroders Global Investor Study 2022 has found.

The sustainability-focused findings of Schroders’ flagship study, which has surveyed more than 23,000 people who invest from 33 locations globally, found that more than two-thirds (68%) of people who class themselves as having “expert/advanced” investment knowledge believe sustainable investment is the only way to ensure profitability in the long term.

This compares with 52% of ‘”intermediate” investors and 43% of those who believe they have ‘”beginner/rudimentary” investment knowledge. Similarly, 69% of “expert” investors share the view that investing sustainably can support positive change when it comes to challenges such as climate change.

Hannah Simons, Head of Sustainability Strategy at Schroders, commented: “The interaction between sustainability and returns has seen some polarising results this year. While beginner investors appear more sceptical, the majority of people believe sustainability is crucial to delivering long-term returns. This is encouraging to see and further emphasises the crucial role asset managers have to play in terms of helping investors better understand how investing sustainably can not only help overcome challenges such as climate change, but also support their long-term returns. Indeed, we see an intrinsic link between long-term sustainable investment returns and solving some of the world’s social and environmental challenges.”

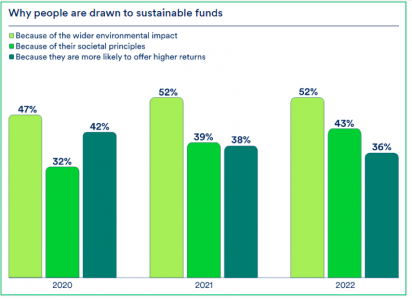

Specifically, the study found that environmental impact was the main reason people are attracted to sustainable investing. However, investing according to social issues has grown in importance compared with previous years. Interestingly, financial gains only ranked third in investors’ list of priorities, having declined over the past two years, falling from 42% in 2020 to 36% this year.

However, a focus on delivering financial returns unsurprisingly still remains a priority for many investors. More than half (56%) seek a fund that focuses primarily on delivering financial returns while integrating sustainability factors. That is particularly the case for people in Asia (61%) and the Americas (60%), while people in Europe were more likely to choose a fund with sustainability characteristics (51%).

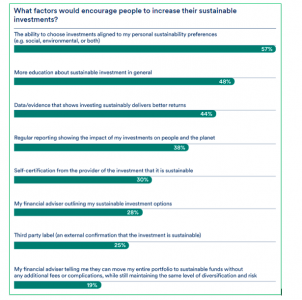

The study also found that people would increasingly invest in sustainable funds if they were able to invest in line with their preferences. More than half of investors across all self-defined expertise levels said that the ability to choose investments that align with their personal sustainability preferences would encourage them to increase their allocation to sustainable investments.

In terms of investors’ specific sustainability goals, quality education was seen as the most important globally, with a fifth of those surveyed (21%) ranking this option first.

Education and evidence of better performance and impact also key factors to encourage sustainable investment

Countries with higher poverty levels appeared to prioritise addressing poverty over other factors. In India, eliminating poverty was the top priority (having been selected by 21% of investors). In contrast, investors in Switzerland selected educational improvements as the priority.

As well as the ability to choose investments aligned to their personal sustainability preferences, just under half (48%) said that more education around sustainable investing would encourage them to allocate more sustainably. The lack of clear definitions of sustainable investments was cited as one of the most significant barriers to investing sustainably by all knowledge levels.

Completing the top three, some 44% of people stated that more data and evidence showing that investing sustainably delivers better returns would encourage them to increase their investments.

Andy Howard, Global Head of Sustainable Investment at Schroders, said: “This year’s survey results show that environmental challenges remain one of the key reasons individuals are looking to invest sustainably. However, the ‘S’ in ‘ESG’ can’t be forgotten, with human capital, education and equality all top of people’s investment priorities. Financial education is a key element in driving more capital towards sustainable investing. It is clear from our research that what people seek is essentially guidance and clarity. The more people are able to understand the products they invest in and their impact on society and the environment, the more capital we should see flowing into sustainable investing.”