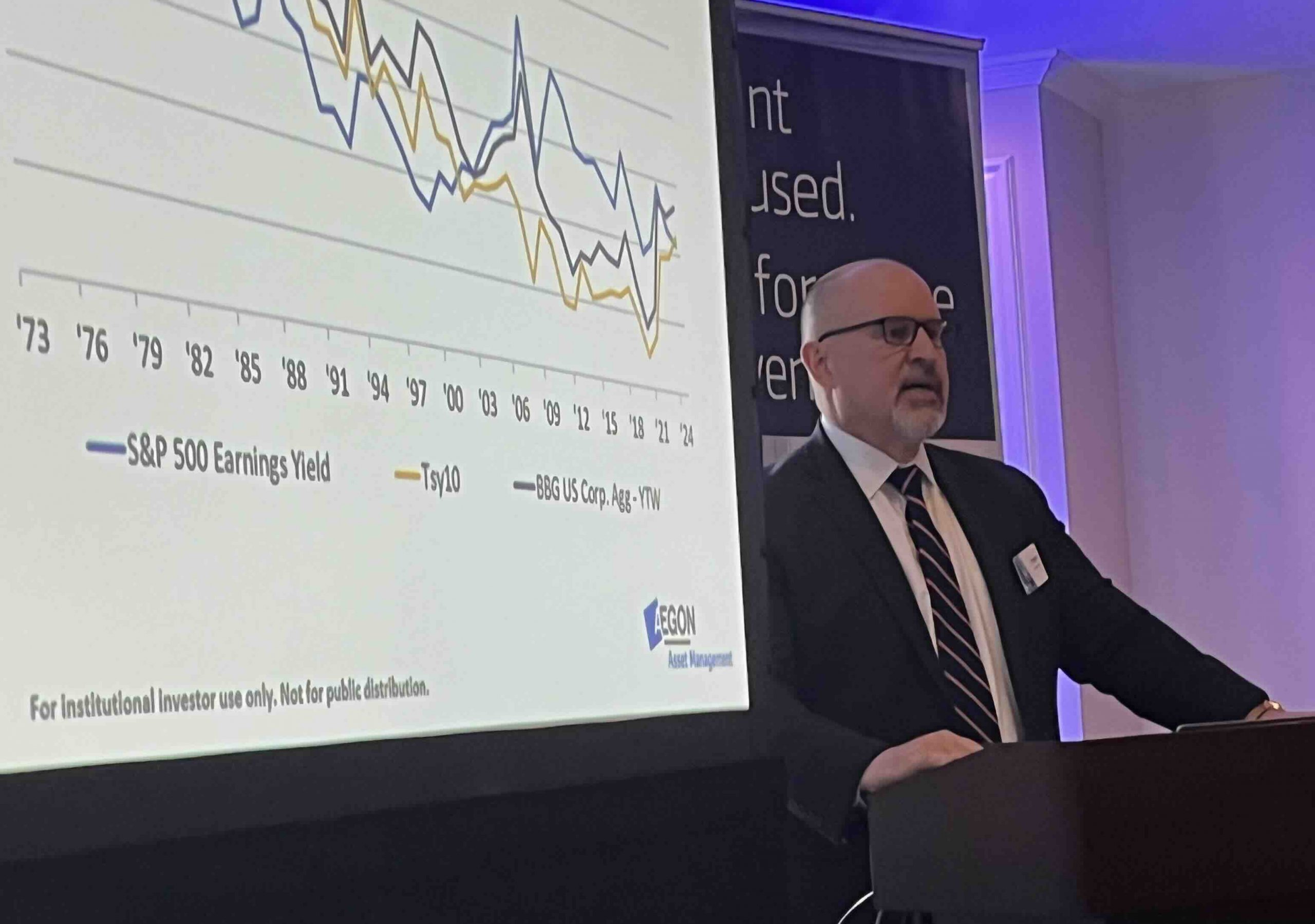

A new research from Managing Partners Group (MPG), the international fund management group, shows professional investors believe fixed income is becoming more attractive than equities over the next 12 months.

The 94% questioned in the global study with institutional investors and wealth managers holding assets of $114 billion under management say fixed income is more attractive with 17% saying it is becoming significantly more attractive.

The research by MPG found growing worries about a global recession and increased volatility in the equity markets plus increased correlation between bonds and risk assets is driving the shift in views.

US investment grade and European investment grade fixed income assets are likely to be the biggest beneficiaries of institutional investors and wealth managers increasing their exposure to fixed income but all asset classes will benefit as the table below shows.

Professional investors still believe there is a possibility of a bond rally if major economies slip into recession. Around 20% believe a bond rally is very likely in the next 12 months rising to 42% saying a bond rally is very likely over the next 24 months.

Around 79% think a bond rally is quite likely in the next 12 months while 57% believe it is quite likely over the next 24 months.

They have little or no correlation to equites or bonds and currently deliver an inflation busting yield of 12%. Also, MPG says alternative asset classes in general are set to benefit from increased diversification as investors look for reasonable returns while equities are set for a tough year ahead.