Markets have been hit by profit taking, to a large extent caused by increased uncertainty about future monetary policy and not by global growth worries. Remarkable is that growth oriented, cyclical assets have outperformed defensive and income generating assets recently. Are we witnessing a new trend?

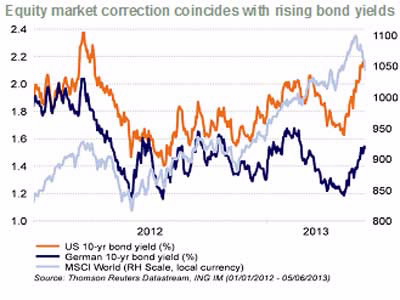

According to ING IM’s MarketExpress, quite remarkable are the different directions in which the different segments of the financial markets have been moving in the past few weeks. We saw a big sell-off in Japanese equities, which is not very surprising after the strong rally of the past months. Other equity markets in developed economies declined relatively moderately. Furthermore we have seen a sharp rise in ‘safe’ government bond yields, while credit spreads tightened.

Increased uncertainty

The question is off course how these movements can be explained. Indeed, uncertainty has increased on the back of rising doubts about the Japanese policy experiment, the future of emerging market growth models and the implications of future unwinding of quantitative easing policies in developed markets, particularly in the US. We do however not believe that the recent bout of profit taking is caused by a general reduction of risk appetite driven by worries over global economic growth. In that case, we should have seen lower equity markets, higher credit spreads and lower safe government bond yields across the board.

Shift in investor preference

We see signs of an important shifting undercurrent in investor preference whereby investors are gradually shifting from income generating assets towards growth oriented assets. This seems to have started late April and persisted during the recent market correction. Contrary to the first four months of the year, cyclical sectors largely outperformed defensive sectors in the equity markets in May. Next to defensive equity sectors, also other previously popular “yield” plays like real estate equities and fixed income assets came under significant pressure.

To view the complete story, click the attachment button above.