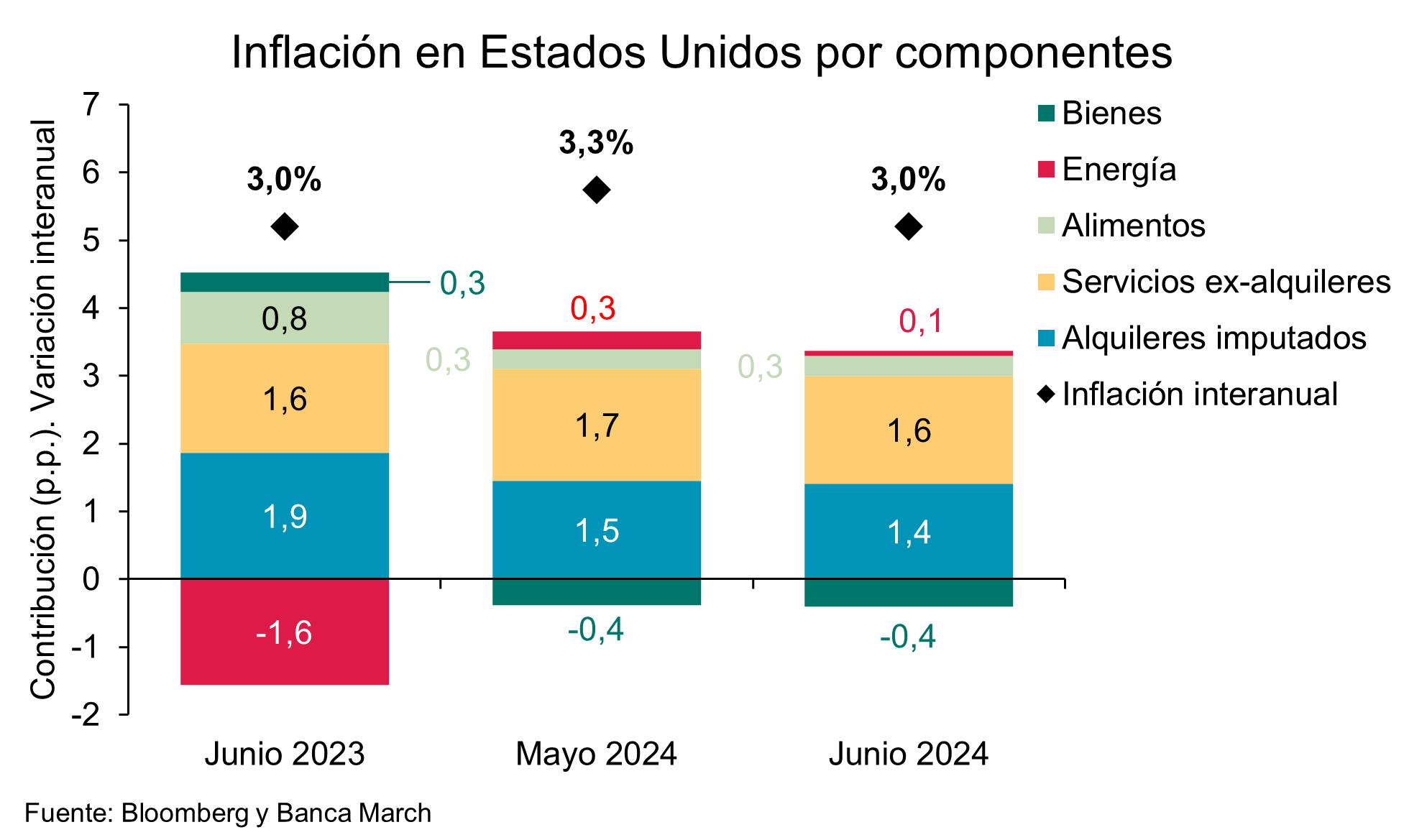

Markets and investors are confident that the US Federal Reserve (Fed) will announce a first rate cut in September. The argument supporting this conviction is the positive inflation data for June in the US: the year-over-year headline indicator showed an increase of 3%, lower than the expected 3.1% and down from 3.3% the previous month; and the core CPI surprised with a cut of one-tenth from the previous figure, reaching its lowest level since April 2021.

“On a monthly basis, the headline rate turned negative for the first time in nearly four years, with a -0.1% versus the expected 0.1% and the flat variation of the previous month. Overall, this confirms the trajectory towards the 2% target, although fluctuations may occur in the coming months,” explain analysts at Banca March.

By components, Banca March notes that both services and goods contributed less to inflation. “For services excluding energy, the variation was only 5%, the lowest rate since April 2022, contributing 3% compared to 3.11% the previous month. This was mainly due to a significant slowdown in attributed rents: 5.4% in June, the lowest growth since May 2022, compared to 5.6% previously, contributing 1.4%. As for goods prices, they declined at a rate of 1.84%, the biggest drop in 20 years, thus subtracting 0.40% from inflation. Finally, there was also a sharp slowdown in energy, growing by 0.99% compared to 3.67%, contributing only 0.08% versus 0.26%,” they detail in their daily analysis.

According to Banca March, it is undeniable that this is a good data point, reflected in market behavior. “It boosted bond prices on both sides of the Atlantic, leaving 10-year rates in the United States at their lowest levels since late March, and in Germany, the 2.5% level was breached again. Additionally, interest rate futures raise the chances of cuts in September to 90%, making it practically certain,” they add.

September: Rate Cut

In light of this macroeconomic data, combined with the outlook on the labor market and the US economy presented by Fed Chairman Jerome Powell this week during his testimony before the Senate Banking Committee, the first rate cut in the US is set for September. According to Ronald Temple, Chief Market Strategist at Lazard, at this point, a rate cut in September should be a “done deal.” “In the second quarter, the overall inflation rate in the US was 1.1%, with core inflation at 2.1%, making it increasingly evident that the upward surprises in the first quarter were anomalies. Given the growing evidence of slowing economic growth, it is time for the Federal Reserve to refocus on the dual mandate and ease monetary policy,” Temple argues.

For John Kerschner, Head of US Securitized Products and Portfolio Manager at Janus Henderson, both the headline and core CPI were weaker than expected, giving the Federal Reserve the unequivocal signal that it will start lowering rates by the end of the year. “With less than three weeks until the next Fed meeting, the market is currently pricing in that it will skip that meeting and make its first cut in September. The probability of a cut at that meeting is now close to 100%, according to the market. More importantly, the market now expects three cuts by the end of January 2025. Chairman Powell recently said that inflation risks are now more ‘balanced.’ Yesterday’s figure reinforces that view and may now tilt the balance toward concern over a sharper slowdown in the US economy,” Kerschner states.

There is a clear consensus that weaker US inflation data strengthens the case for a rate cut at the September Federal Open Market Committee meeting. “Along with softer economic data, including a cooling labor market, this has increased confidence that inflation will tend to decline in the coming months. We lower our US inflation forecast to 3% in 2024 and 2.2% in 2025. We still expect the Federal Reserve to cut rates in September and December 2024,” acknowledges David Kohl, Chief Economist at Julius Baer.

According to Kohl, the decline in inflation in June follows a moderation in May and reinforces the view that the Fed will cut the federal funds rate target at its September meeting. “Weaker economic data, including a cooling labor market, also increases our confidence that inflation will decelerate further in the coming months and that the Federal Reserve will cut the target rate again at its December meeting. We lower our annual inflation forecasts for 2024 from 3.2% to 3.0% and for 2025 from 2.3% to 2.2%,” he concludes.

However, there are also dissenting voices in the industry. According to experts at Vanguard, despite the turn taken by the unexpected strength of the US economy, the events of the first half of 2024 have reinforced their view that the environment of higher interest rates is here to stay. “The current economic cycle is not normal. The global economy is still settling after unprecedented economic shocks that include a pandemic, a war in Ukraine, and rising geopolitical tensions. Structural changes, such as an aging population and rising fiscal debt, also make it difficult to decipher the economic cycle from the trend. This creates a challenging environment for central banks, markets, and investors,” says Jumana Saleheen, Chief Economist for Europe at Vanguard.