This week marks the beginning of the Q2 earnings reporting season in the U.S.

Approximately 42% of S&P 500 companies (213 in total) will report their performance by the end of the month. As usual, banks will be the first to report and are expected to detract the most from overall financial sector earnings growth (-10%), whereas excluding banks, the aggregate earnings per share (EPS) for insurance companies, capital markets, and other financial services firms would increase by ~15% (compared to the 4.3% estimated by consensus for the industry).

At first glance, the performance of banks (BAC, C, WFC, JPM) will likely be similar to the previous quarter. The yield curve remains inverted, long-term bond yields have increased by 0.17% during the period (compared to a 0.3% rise in the first three months of the year), loan growth continues to moderate, and while net interest income will also maintain a moderate growth rate, management teams might provide positive comments regarding a bottoming out of the margin. More clarity on the news reported by Reuters about comments on Basel III “Endgame” capital rules by the Fed would boost the share prices of major banks.

Broadening the perspective, according to S&P data, the consensus among analysts expects S&P 500 EPS to grow by 5.74% for the April-June quarter compared to the same quarter last year. Strategists and managers are betting on a positive EPS surprise below the average of recent quarters, placing this growth in the 7% – 8% range. The twenty companies that have pre-announced have reported ~+4% above consensus, justifying this bet.

The numbers are heavily skewed towards the contribution of the technology and communication services sectors. Earnings for Microsoft, Amazon, Apple, Meta, Nvidia, and Alphabet are expected to grow by 32%, while non-tech industries will only grow by ~2%. This starting point increases uncertainty regarding the outcome of the quarterly performance announcements because, on one hand, the EPS growth of these tech companies is slowing down (from 68% in Q4 2023 to 56% in Q1 this year). On the other hand, margins are unlikely to improve much further.

The consensus projects operating margins of 12.5% for the S&P (an increase of 5.3% from last year, still below the 2021 peak of 13.54%), with a 30.87% contribution from technology and communication services.

Therefore, it is important to pay attention to the comments from the management teams of hyperscalers regarding their plans to deploy around $200 billion in capital investments, with a significant portion associated with generative AI developments announced last quarter.

Everything has its limits, and while generative AI remains a priority for tech companies from an investment perspective, monetary commitments of this magnitude could negatively impact return on invested capital (ROIC) if not adequately monetized, and this is not simple or quick to achieve.

Nvidia’s cadence in launching new products helps build an AI offering more efficiently in the medium term, although in the short term, the price to pay starts to concern investors.

Blackwell, Nvidia’s new GPU chip, which will be marketed around 2025 and installed in the AI server GB200 NVL72, provides up to 30 times more performance than a rack configured using the same number (74) of Hopper GPUs (H100, the model preceding Blackwell) for large language model inference, while reducing energy consumption per computing unit (FLOP). The new system is also four times faster in training AI models than the previous version. However, these impressive improvements are not cheap. The price of two 16 GPU H100 systems is $400,000, and according to some analysts, the GB200 NVL72 could cost $3.8 million.

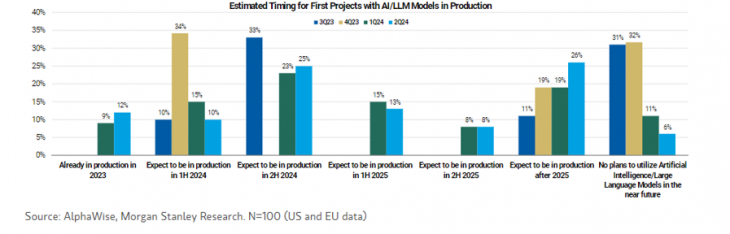

Nvidia is undoubtedly the clear winner in the AI leadership race, as demonstrated by its numbers. Analysts estimate more than $200 billion in revenues for the data center business by 2025, which generated $48 billion in 2023, translating to a compound annual growth rate of 63%. However, according to a Morgan Stanley survey of Chief Information Officers, AI investment momentum is slowing, and passing on such significant price increases to customers, despite efficiency improvements, may become more challenging.

Experts in the field expect continued spending on increasingly costly and complex large language models (LLM) development, which could cost between $10 billion and $100 billion by 2027, according to the CEO of Anthropic in this interview. And investors have no reason to doubt.

If Microsoft, Alphabet, Meta, or Amazon suggest slowing their investments or taking a more patient approach, these same investors might start to waver.

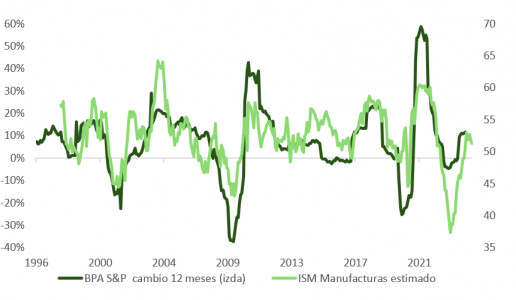

As explained earlier, the good performance and maintenance of guidance by tech companies are necessary for analysts to maintain their aggressive earnings growth targets, averaging 12.85% per quarter for the next five quarters. This is possible but increasingly challenging if, as mentioned last week, the recovery in industrial activity begins to cool.

Arguments in favor of a first rate cut in the U.S. in September are mounting after Thursday’s CPI and Jerome Powell’s comments: the Fed chair stated in his testimony this week that inflation “is not the only risk we face.” However, while the compression in public debt yields benefits the valuation of growth companies like software or semis, managers seem too focused on the return of disinflation but not enough on the slowing growth – which is becoming increasingly evident – and the volatility that the presidential campaign will bring starting in September.

Biden’s intervention at the NATO meeting was much more solid than his debate with Trump, and his intention is to run for re-election, although there are increasing domestic (both political and non-political) and international pressures for him to step down.

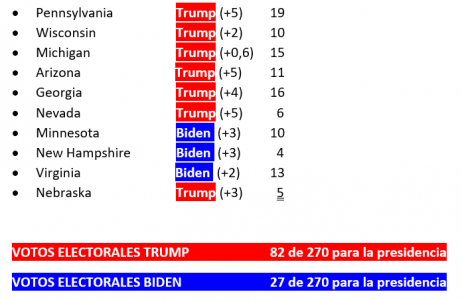

The aggregate polling provided by RealClearPolitics gives Donald Trump a 47.2% voting intention compared to 44.2% for Joe Biden. Although isolated polls like ABC News (46-46) or Reuters/Ipsos (40-40) show a more uncertain situation, Trump still has the electoral college count on his side, even if he loses the popular vote. Of the 10 states that could tip the balance – with results within 5 points – he would emerge victorious in 7 of them.

Jensen Huang, CEO of Nvidia, said at his developer conference in California that, despite the rising cost of their GPUs, “the more you buy, the more you save.”

The math is correct, but investor sentiment’s volatility and a less dynamic economic activity could suddenly shift investors’ focus from the slogan to the numbers.