The Paris 2024 Olympic Games will feature no fewer than 32 sports, each with various disciplines. Among them is modern pentathlon, consisting of five different sports: fencing, freestyle swimming, equestrian show jumping, pistol shooting, and cross-country running. This event is like a microcosm of the Olympic Games themselves: five very different sports requiring diverse skills, yet somehow working together to form a whole.

According to Victoria Hasler, Head of Fund Analysis at Hargreaves Lansdown, in many ways, modern pentathlon mimics fund management. “Any investment can be rewarding, but a portfolio of investments is usually much more beneficial. Just as cross-training in different sports leads to fewer injuries for athletes, a well-constructed portfolio of different investments can lead to lower volatility and better outcomes for investors.” In this sense, Hargreaves Lansdown has identified five fund ideas to include in a “modern pentathlon” portfolio:

Fencing: Troy Trojan Fund

“The use of what are essentially swords can make fencing seem like an aggressive sport. In reality, there is as much skill in defense as in attack. The managers of the Troy Trojan Fund, Sebastian Lyon and Charlotte Yonge, work with a similar philosophy, seeking to protect investors’ wealth as much as grow it. Instead of aiming for exorbitant returns, the fund seeks to steadily grow investors’ money over the long term while limiting losses when markets fall,” says Hasler.

Freestyle Swimming: BNY Mellon Multi-Asset Balanced Fund

In a freestyle swimming race, competitors are free to swim any stroke they choose (though it is extremely rare to see swimmers use anything but the fastest stroke: the crawl). According to Hasler, multi-asset fund managers have similar freedom, able to choose the markets and instruments most suitable to conditions.

This is the case with the BNY Mellon Multi-Asset Balanced Fund, which focuses on companies with good long-term prospects worldwide, along with some bonds and cash to act as diversifiers. The underlying universe of possible investments for this fund is large and includes emerging markets, smaller companies, high-yield bonds, and derivatives. For those who like a free approach but don’t want to make asset allocation decisions themselves, a fund like this could be a good option.

Equestrian Show Jumping: Invesco Tactical Bond Fund

Equestrian show jumping requires real skill. Not only must the rider be one with the horse, but together they must navigate various obstacles while appearing calm and completely in control. For Hasler, bond markets are similar, and bond managers must also possess the skills to navigate the obstacles of the global economy and geopolitics. The managers of the Invesco Tactical Bond Fund do just this.

“The fund is co-managed by Stuart Edwards and Julien Eberhardt, who can invest in all types of bonds, with very few restrictions imposed on them. The fund’s performance depends on their ability to interpret the broader economic landscape. They seek to protect the portfolio when they foresee tough times ahead; and seek strong returns as more opportunities arise. Depending on the managers’ views, at different times, this can be a relatively high-risk bond fund or be managed conservatively. Calm, serene, and always in control: the dream of a show jumper,” she explains.

Pistol Shooting: Rathbone Global Opportunities Fund

Shooting a pistol is a deliberate and specialized skill, but one that must be used with caution and control. This is similar to the skill of James Thomson, the manager of the Rathbone Global Opportunities Fund. The fund invests in global stock markets (including the UK) and gives exposure to a wide range of stocks. Thomson is undoubtedly a skilled investor and one of the few global fund managers who has demonstrated that he can pick great companies and outperform the broader global market over the long term.

“His success is due to a simple, skillful but disciplined approach, and a willingness to see the world a bit differently. Global equity markets can be a minefield, but Thomson navigates them with ease. He shows all the characteristics that a great pistol shooter should have: skill, caution, and control,” adds Hasler.

Cross-Country Running: iShares Emerging Markets Equity Index Fund

Cross-country running requires endurance and adaptability. These are characteristics we also see in emerging markets funds. From large Asian countries like China and India to Brazil and Mexico in South America, these countries offer much potential as part of a portfolio for investors looking for long-term growth opportunities. But it may take time for them to fully develop, so the risks are higher, and higher levels of volatility should be expected.

“The iShares Emerging Markets Equity Index Fund aims to track the performance of the broader emerging markets equity market and is one of the lowest-cost options for investing in these markets. The fund invests in a wide range of companies based in emerging countries, including China, India, Brazil, South Africa, and Taiwan. It’s a convenient way to invest in emerging markets. However, there is potential for volatility along the way, so investors may need endurance,” concludes the analyst.

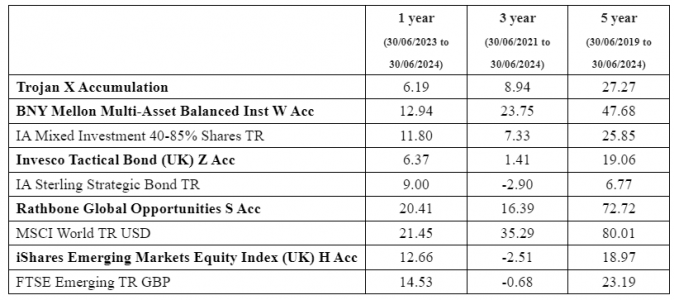

Fund Performance vs. Benchmark Index