The 99% of European companies have revenues below €10 million. Among large companies (those with revenues over €100 million), 96% are not publicly traded. According to Aramide Ogunlana, Head of Private Credit Investments at M&G, there is “a clear imbalance in funding sources,” providing additional data: only 4% of companies turn to private markets for financing, compared to 52% that issue bonds and 44% that are publicly traded. Ogunlana delivered a workshop during the recent European Media Day organized by M&G Investments in London.

Private markets have become a cornerstone of M&G Investments’ growth strategy in recent years. The firm is developing new vehicles to make these investments accessible to a broader range of investors. M&G has been investing in private credit since 1997, and its investment portfolio includes both liquid and illiquid corporate debt assets, amounting to €15 billion in private corporate credit and €35 billion in private debt as a broader asset class, including various strategies such as structured credit and real estate debt.

Ogunlana emphasizes the crucial importance of having a long investment history in these markets, as they are heavily relationship-driven: “Maintaining contact is very important, especially when aiming for the most illiquid parts of the market and acting as a sole lender. It’s also important to build relationships in the market to reach the companies you want to enter.” She also highlights the importance of having sufficient analytical capacity in-house to develop proprietary ratings. At M&G, the rating assignment process is conducted independently from the managers’ activities to ensure a neutral perspective. The firm focuses on segments rated B and BB and typically deals with over 200 liquid private companies and between 40 and 60 illiquid private companies.

Why Now?

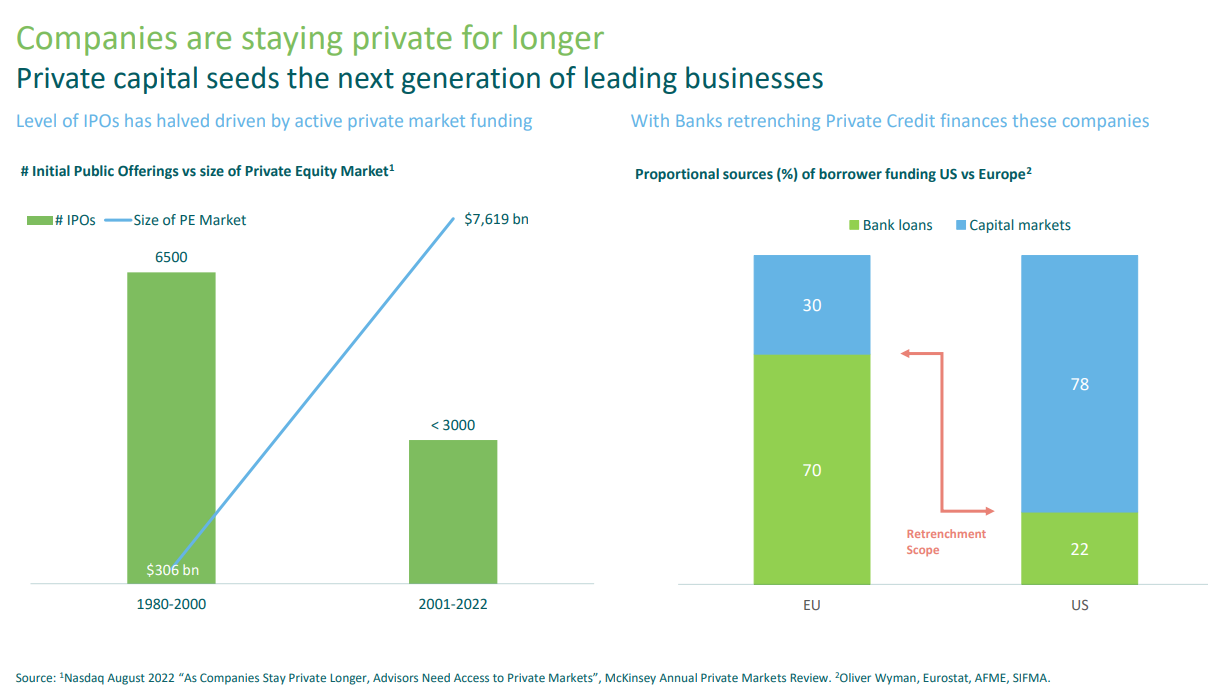

According to Ogunlana, now is a particularly exciting time to delve into investment opportunities in the private debt market, noting the downward trend in the number of IPOs—the current levels are half of those recorded in the previous 20 years—along with the increase in delistings by companies wanting to return to private status to work more closely and flexibly with their funding sources (see chart).

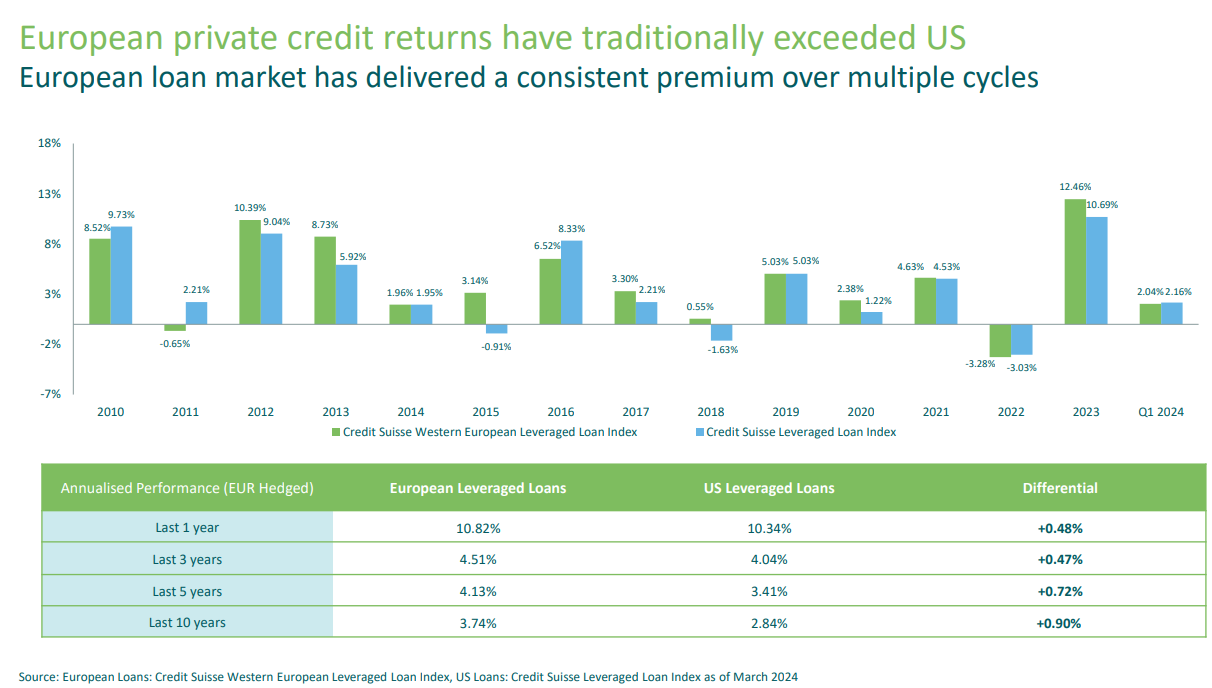

The investment head notes that the potential is high, given that currently, 70% of European companies still finance themselves via traditional bank loans, compared to 22% of US companies. “This opportunity stands out particularly in Europe, although the global trend still points to high bank intermediation,” the expert notes. She adds that, historically, the European private credit market has outperformed the US in terms of returns (see chart).

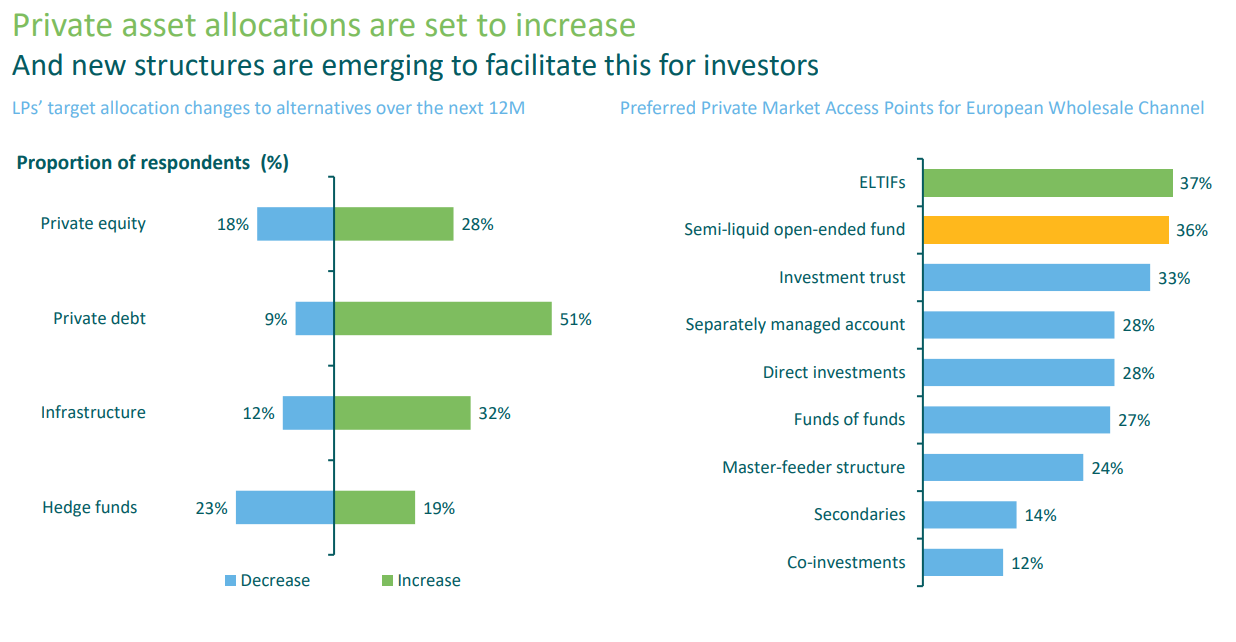

As a result, the firm notes that new capital structures have emerged in recent years, and they also anticipate an increase in capital allocations to these market segments. Specifically, based on a survey conducted by Preqin in November 2023, they expect a 51% increase in private debt allocations (up from the current 9%), followed by a 32% increase in infrastructure and a 28% increase in private equity. The only category expected to see a reduction in allocations is hedge funds, which would drop from the current 23% to 19% (see chart).

According to similar data from a Cerulli study, the preferred vehicle for accessing these assets in the wholesale channel is ELTIFs and semi-liquid open-ended funds (37% and 36%, respectively), while co-investment is the least demanded option, with 12% of responses.

Misconceptions

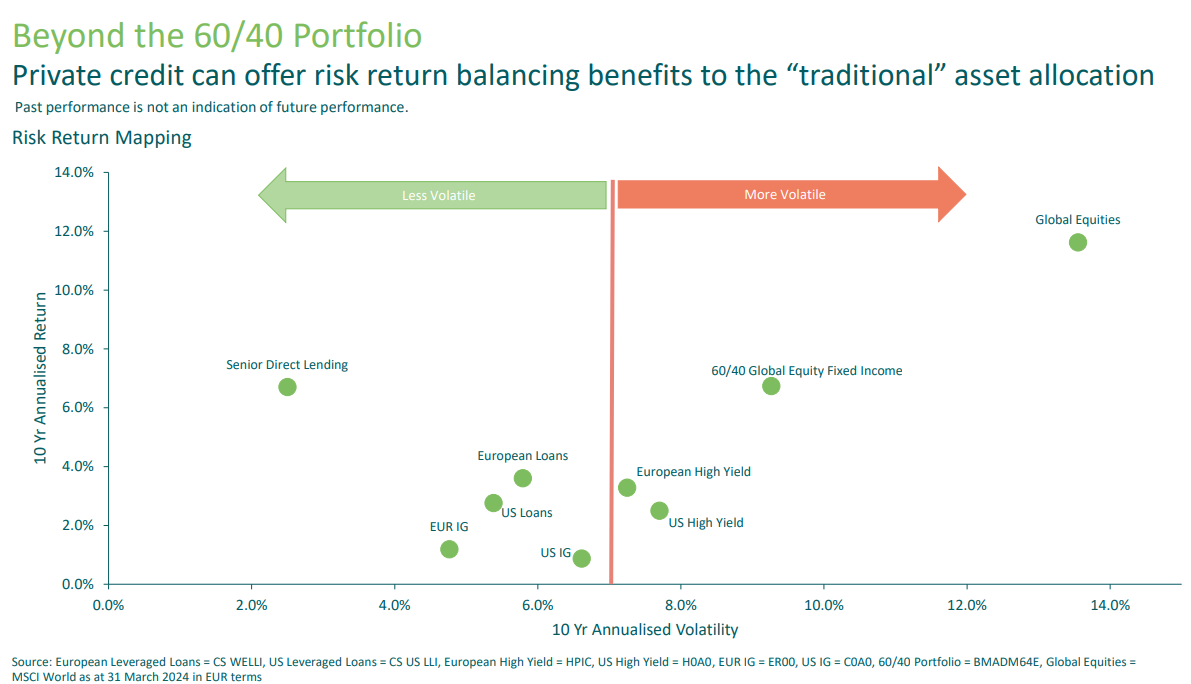

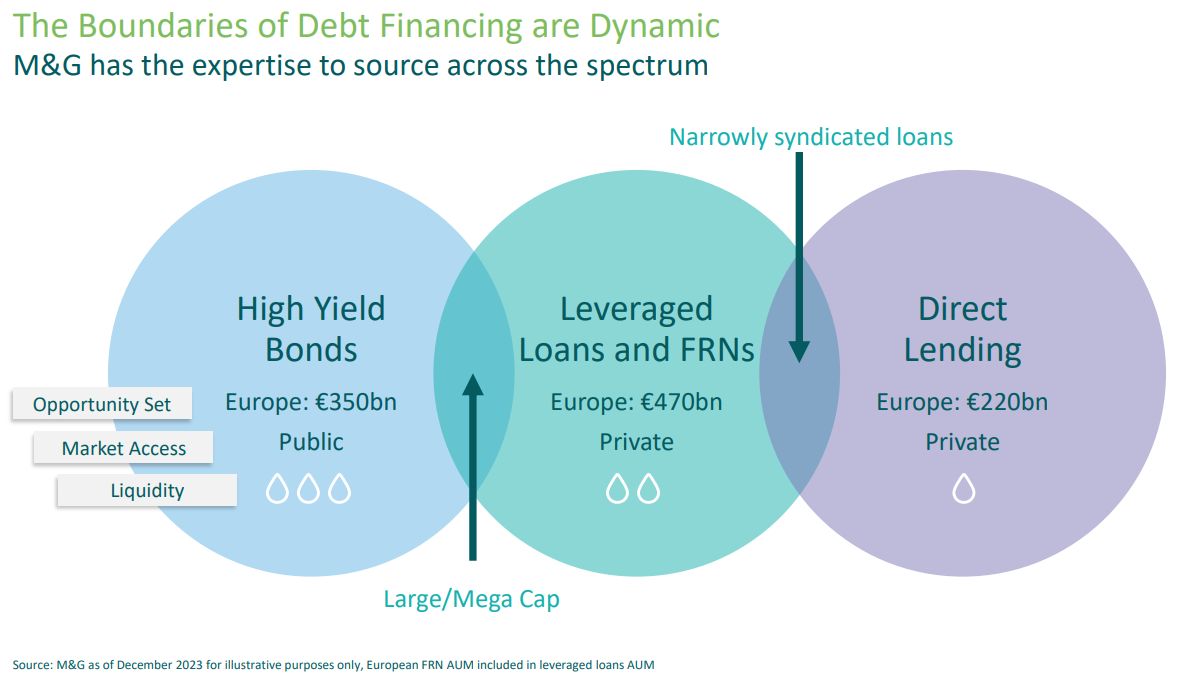

Ogunlana also addressed a second set of perceptions that do not align with the reality of the size, liquidity, and returns currently offered by European markets. For example, she explained that, contrary to the perception that the high yield market is larger and more liquid than other private market segments, the reality in Europe is different (see chart).

Ogunlana demonstrates that the leveraged loan and floating rate note (FRN) market is worth €470 billion, compared to €350 billion for European high yield. “Seniority is very important for investing in these markets; we focus on finding the highest quality assets, at the top of the capital structure, and are very selective in our credit analysis because interest rates are still very high, so we need to calculate the principal recovery well,” she clarifies. She indicates that the recovery rate for syndicated loans is 73%, compared to 67% for senior secured debt.

The most illiquid part of the market is direct lending, with a size of €220 billion. This market is frequented by smaller companies (with EBITDA between €5 million and €75 million) and often each company has only one or very few financiers. It’s a market where “there is no room for error; we need a lot of investment analysis, and therefore our stance is very conservative,” the expert points out.

As a result of all these observations, the expert advocates for a review of the 60/40 model portfolio, noting that private credit offers diversification and decorrelation benefits compared to public markets. For example, Ogunlana states that direct lending behaves “almost like cash,” especially compared to high yield. Additionally, these assets offer a premium for complexity and illiquidity compared to other assets. For all these reasons, it would make sense for private markets to be considered not only as a distinct asset class when designing portfolios but also as part of the mix in more conventional fixed income and equity allocations (see chart).