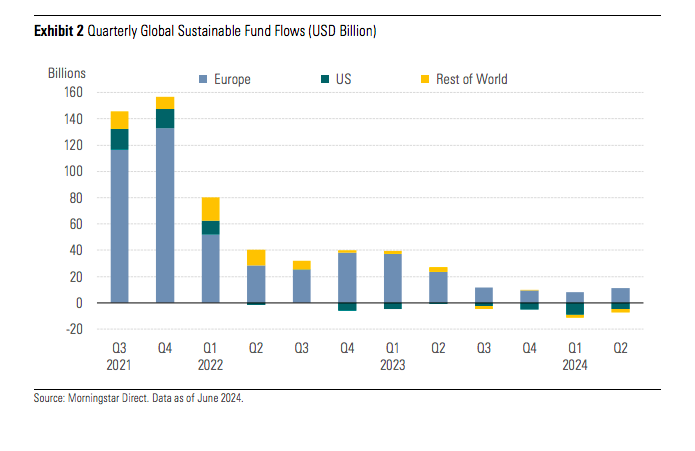

In the second quarter of 2024, the global universe of sustainable funds—which includes open-end funds and ETFs—received $4.3 billion in inflows, compared to the $2.9 billion in outflows experienced in the first quarter of the year. Does this mean that investors are returning to sustainable funds?

“The outlook for global ESG fund flows is starting to improve. We began the year with outflows, but this has since changed, with money returning to the sector. European ESG funds have gathered more than $20 billion so far this year. Across the pond, investor appetite for ESG funds remains moderate, with continued outflows, but these were smaller than those seen in the previous two quarters,” explains Hortense Bioy, Head of Sustainability Research at Morningstar Sustainalytics.

The report indicates that calculated as net flows in relation to total assets at the beginning of a period, the organic growth rate of the global sustainable fund universe was 0.14% in the second quarter, a slight improvement from the 0.01% rate in the previous quarter. “However, the aggregate growth of sustainable funds lagged behind the broader fund universe, which with $200 billion in inflows, recorded an organic growth rate of 0.4%,” the report notes.

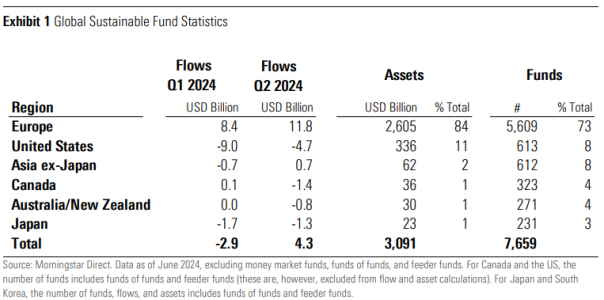

To put this in context, the Morningstar Global Markets Index achieved a 2.6% gain in the second quarter, while fixed-income markets, represented by the Morningstar Global Core Bond Index, fell 1.2%. “Europe represents 84% of global sustainable fund assets, and the United States maintained its status as the second-largest market. With total assets of $336 billion, it held 11% of global sustainable fund assets, reflecting the distribution observed three months ago,” the report states.

Specifically, European sustainable funds raised $11.8 billion, compared to the $8.4 billion recorded in the previous quarter. The report also noted a reduction in outflows in Japan, while sustainable funds in Asia continued to attract new net money.

Lastly, it highlights that product development continued on a downward trajectory, with only 77 new sustainable fund launches in the second quarter of 2024, “confirming the normalization of sustainable product development activity after three years of high growth during which asset managers rushed to build their sustainable fund ranges to meet the growing demand from investors,” the report indicates.