With a current attractive business situation, political, fiscal and monetary support and a healthy inflation, the Japanese debt market offers investment opportunities according to BNP Paribas Investment Partners.

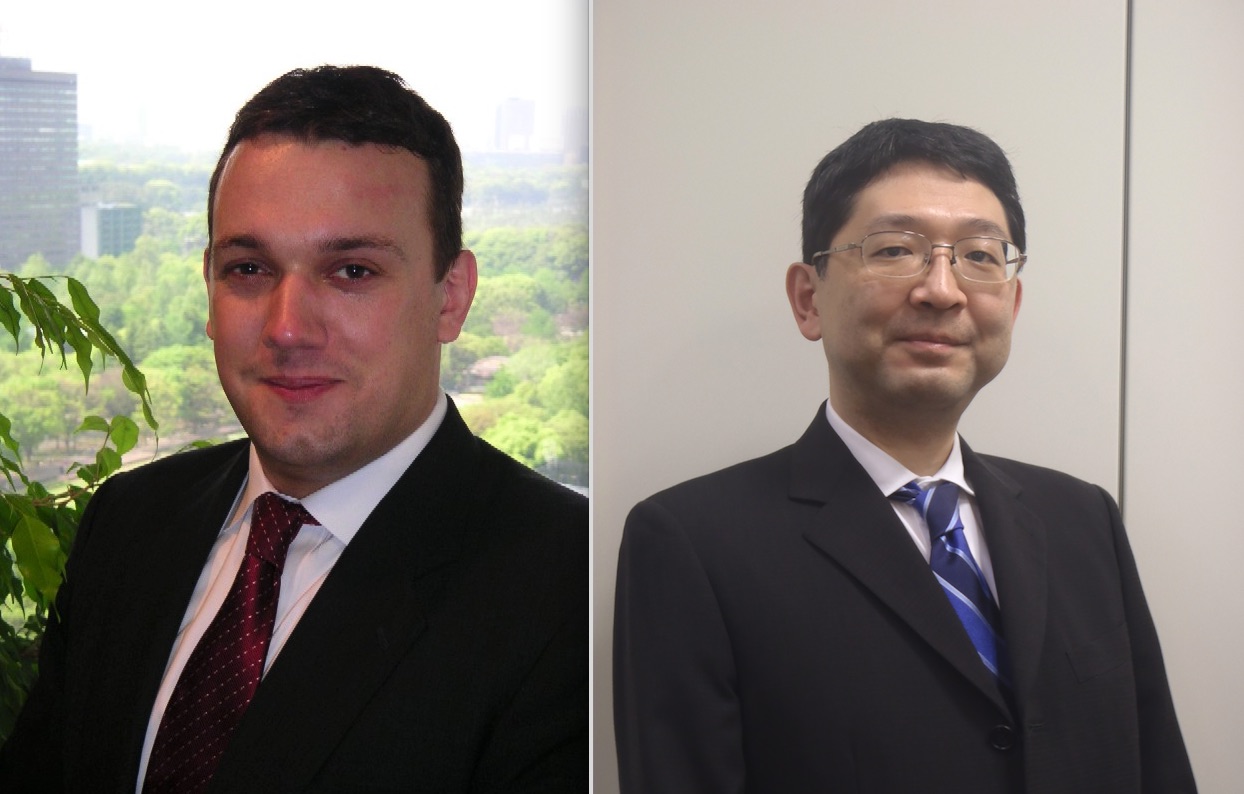

Tony Glover, Tokyo-based head of the investment management department at the company believes that “it really depends on the assumptions that the investor has. An investment in Japanese fixed income (for a European investor) is a bet on the JPY. Investors in our Parvest Bond JPY fund generally do so if they think the JPY will strengthen, as it tends to do in times of market stress (i.e. a ‘risk-off’ play). A strengthening JPY generally puts downward pressure on the equity markets (as earnings forecasts are usually revised down) – so if the investors’ assumption is a strong JPY, then fixed income might be the better investment. But as I said to clients in Madrid last month, we think that the equity markets currently look attractive due to 1) earnings growth, 2) inexpensive valuations, 3) expected corporate governance improvements, 4) increased activity by domestic investors.”

Naruki Nakamura, head of Fixed Income with BNP Paribas Investment Partners Japan, and Fund Manager of the Parvest Bond JPY believes that if you look at flow indicators published by MoF (Japanese Ministry of Finance), foreigners have been heavy buyer of short and intermediate JGBs for months at deep negative yen base yield. “Why they buy? I assume the buyers are USD based investors who are buying with currency swap hedging. Toward the end of November last year (Nov 29), the spread went as far as -0.85%. 2 Year JGB was traded around -0.17%. If the USD based investor buy 2 year JGB with currency swap hedges, USD based yield can be as high as 1.95%, which is much higher than 2 Year Treasury yield of around 1.1% then (Very rough estimation without considering transaction cost). Investors with ample USD and who do not care about illiquidity, such as Sovereign wealth fund or Foreign reserve, might think it attractive. Any way, if you are an institutional investor with currency swap capability, have ample cash and unwilling to invest in deep negative yield short Bunds (or better have 0% return rather than sizable negative rate return), willing to sacrifice liquidity, willing to take Japanese sovereign risk, JGB market might be the candidate to put money in. As of now, basis swap has recovered to some extent and 2-year JGB’s yield is at deeper negative level, however, short Bunds yields are much lower due to ECB/risk off, so relative attractiveness may be bigger.”

Apart from FX hedging base, he agrees on that some European investors use JGB to take JPY FX risk. “In the past, JPY strengthened in the risk-off environment. Although Japanese fiscal situation continues to deteriorates, we think the Japanese crisis is at least 5 years away. So, if an Euro based investor wants to diversify the investment, buying unhedged JGB might make sense, especially if the investor is worried about Europe-oriented risk-off.”

“As of BOJ policy, as you might know, they changed their policy frame work in September 2016. They used to think unlimited quantitative ease could solve the problem, but they no longer think so. Currently they are reluctant to either increase QE nor go deeper into negative yield policy rate. They only want to fix the entire JPY yield curve at current level. Which means, we do not expect JPY to decline excessively from Japanese monetary policy factor for now . (So, for example, if US tightens more than market expectation, JPY may fall versus USD.) If there is another global financial crisis, we expect JPY to initially strengthen sharply. Then, if the JPY’s appreciation is excessive, BOJ may again change their policy to add aggressive monetary ease, which likely to curve the appreciation.” He concludes.