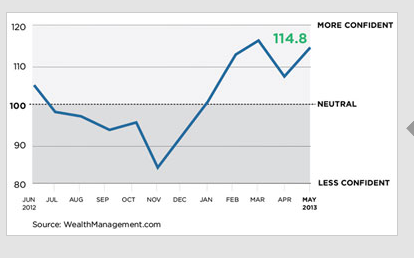

The WealthManagement.com Advisor Confidence Index (ACI), a benchmark of financial advisors’ views on the U.S. economy and the stock market, reversed course and rose 5.6 percent during the month of May to 114.8.

The upward tick in confidence comes a month after the index fell almost 6.8 percent to its lowest point since the start of the year. Advisors then said they believed that stock prices were rising too far too fast, and that the underlying economic recovery was still too fragile to support record-high valuations.

The most recent uptick in optimism suggests advisors may be capitulating to the bull market and perceive that the economic foundation of the recovery is getting stronger. Many still suggest that the markets are being supported more by government stimulus than a strong economy.

“For 2013, it has been buy the dip as the market has grinded higher,” says Kenny Landgraf of Kenjol Capital Management. “This probably the most hated bull-market rally. The bears and their cash positions earning zero are getting pulled off the sidelines. Central banks will continue to provide liquidity for the market and prevent companies from running out of cash. Interest rate yields are terrible. As bond investments mature, the bond investors are slowly forced to take more risk to replace the same yield as their maturing debt. We expect a sideways market and then we will hit new highs in the fall again.”

WealthManagement.com‘s ACI records the views of a panel of some 150 financial advisors who agreed to participate on a monthly basis, recording their level of confidence across four categories: confidence in the current state of the economy, confidence in the economy in both six months and twelve months, and confidence in the near-term future of the stock market.

Still, several advisors suggested the improved picture was in fact due to the underlying economy getting stronger. Housing and unemployment numbers seem to be getting better and that is fueling more aggressive market positions.