At the end of July, the UK government announced plans to ban the sale of new gasoline and diesel vehicles from 2040, being the fifth country, with Holland, Norway, India and France, to end the sale of cars with traditional internal combustion engines. Noting the rapid changes taking place in the industry, many of the major car manufacturers have in turn announced their plans to focus on electric powertrain technologies in developing their product plans and launches. What’s more, in Volvo’s case, it has been announced that from 2019 the vehicles released into the market will be either electric or hybrid.

However, while much of the market narrative focuses on electric vehicles, the destruction of demand and the end of the oil era, the energy team at Investec Asset Management believes that global demand for crude oil continues to grow at a decent rate.

The International Energy Agency continues to alter historical data, distorting the picture, but the projected growth rate of demand is at 1% to 1.5% per year and shows no signs of slowing down. With this in mind, we expect the price of oil to remain at between 10% and 15% of current prices in the short and medium term. Even more important, for the energy companies that we have in our portfolios, we have behind us four consecutive quarters (from June 30th, 2016 to June 30th, 2017) in which the price of a barrel of Brent has averaged $50. This gives us a good understanding of the company’s profitability in the new oil order. In fact, we can find companies that are in the process of becoming more profitable at this price level than they were at the highest peak of the last cycle: given cost cuts, in asset classes, debt reduction and strategic focus on ‘value over volume’, which is perhaps not surprising. The main gas and oil companies have historically had no difficulties in generating liquidity; their errors have been committed from a poor allocation of capital and a search for growth.”

Fred Fromm, an analyst and Portfolio Manager at Franklin Natural Resources, a Franklin Equity Group fund, argues that while a small number of countries have announced plans to eliminate sales of internal combustion vehicles, given a time frame, which is often measured in decades, they do not see an impact in the oil markets. “These goals are long term and aspirational, with little foresight given the physical limits and practical implications of that shift. In the medium and short term, there simply is not enough infrastructure to facilitate a complete shift towards electric vehicles, while gasoline-powered vehicles have decades of infrastructure to withstand them, even with increased electric vehicle penetration, it will take years, if not decades, before the global base of vehicles, and therefore the demand for oil, is significantly affected,” says Fromm.

“The move to electric vehicles will require an upgrade of the existing electricity grid, the creation of new public recharging stations, the refurbishment of homes to equip them with charging capacity, and an increase in the production of batteries and associated minerals. While we see the increase in electric vehicle usage as a long-term trend, we do not think it is so short-term as to threaten global demand for crude oil. In any case, the Franklin Natural Resources fund is a diversified portfolio, with significant exposure to the energy sector, but which also invests in diversified metals and mining companies, so that it can invest in companies positioned to benefit from growth in demand for electric vehicles. In addition, the fund’s energy investment is spread among several sub-sectors and among oil and natural gas producers, the latter is likely to benefit, as it is a cleaner fuel in generating the electricity needed to recharge electric vehicles. While part of this potential increase in demand for electricity can be met from renewable sources of energy, such as wind and solar energy, these alone will not be sufficient and will depend on battery technology and large capacity storage solutions,” he adds.

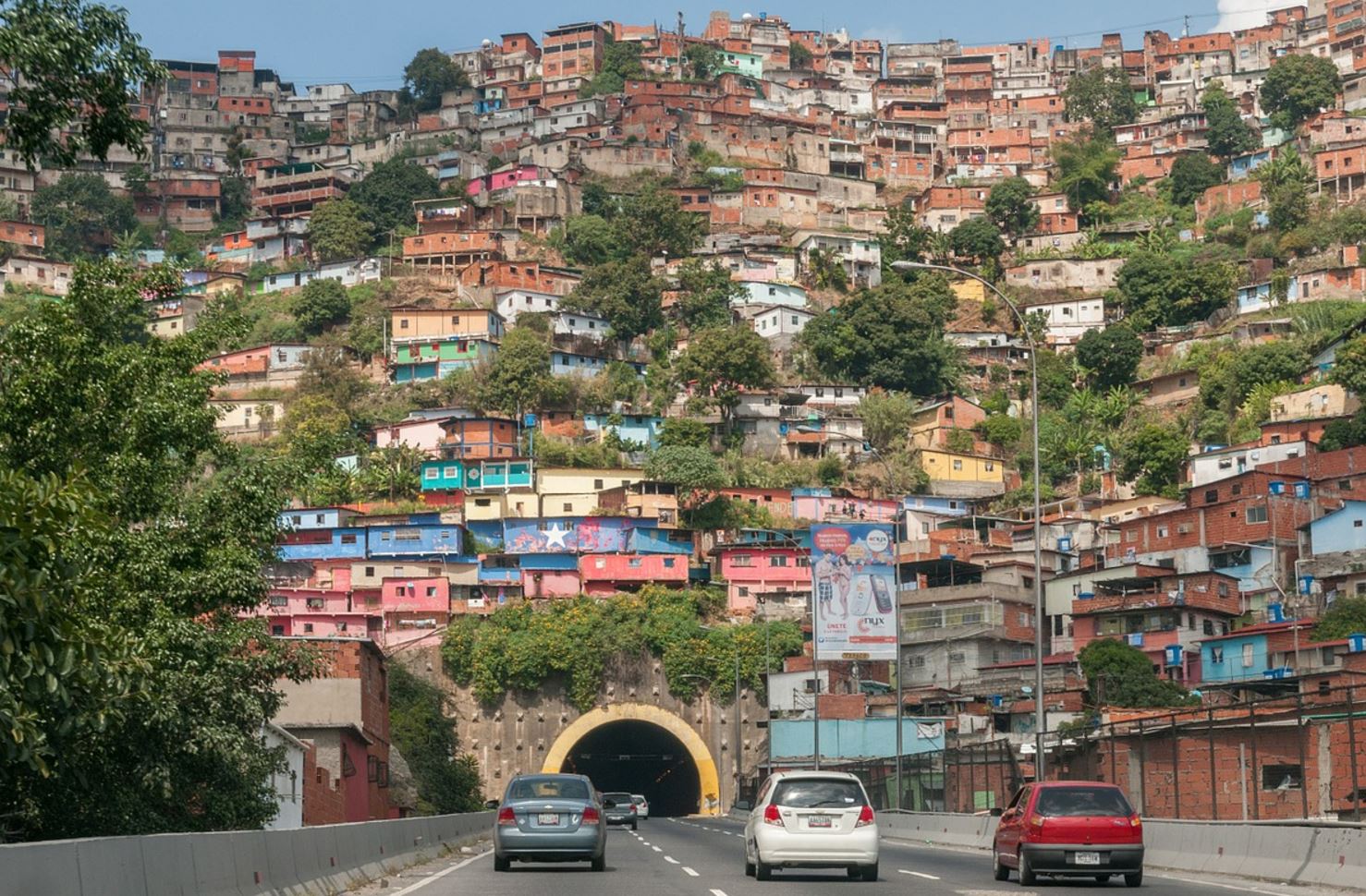

Likewise, Pieter Schop, Lead Manager of the NN (L) Energy fund, agrees that the impact of the electric vehicle on the demand for oil is exaggerated. “Demand for crude oil is expected to continue to grow at around 1.5 million barrels per day for the next few years, reaching peak demand within a decade or two. Demand for gas-powered passenger vehicles in the developed world will be affected, but growth in demand will come from China and other emerging countries. There are still 3 billion people without access to a car, and the first vehicle they are going to buy is probably not a Tesla. Secondly, the other half of the demand for transport comes from demand for aircraft, trucks and buses, where it is much more difficult to switch to electric motors. Industrial and residential demand is also expected to be more resilient.”

According to Eric McLaughling, senior investment specialist at BNP Paribas Asset Management Boston, while he is aware of the forecasts for the long-term demand for fossil fuels, short-term prospects for oil prices are positive. Lower investment by oil producers will weaken supply growth throughout the latter part of this decade. “Through the lens of our investment horizon, the gradual introduction of the electric vehicle does not alter our valuation thesis.”

When it rains, it pours

In an industry that has been affected by the volatility and uncertainty surrounding oil and energy prices, a negative sentiment persists despite the fact that Brent’s average price so far this year is US$ 52 per barrel, surpassing the US$ 45 per barrel average of 2016; the devastation caused by Hurricane Harvey in Texas and adjacent states is now the immediate focus of investors.

“There are numerous repercussions in refineries, as well as in the upstream and midstream sectors, however, we believe that the impact will be transitory, given past experiences, and the operational strength and resilience of these sectors and businesses,” the team at Investec Asset Management comments.

In that regard, Schop, Manager at NN IP claims that the direct effects of the storm are limited. “The affected refineries will suffer cuts for a limited period of time and afterwards will continue production. We have seen some weakening in the price of WTI, but the Brent has not been impacted. This has resulted in an expansion of the spread between the WTI and Brent barrel. For most European oil companies, Brent is more important. The indirect effect of the storm is that it can result in lower GDP growth in the United States as damage costs are expected to exceed $ 10 billion. In turn, lower GDP results in lower demand for oil.”

Finally, from Franklin, they point out that in terms of impact on global markets, changes in production on the Texas and Louisiana Gulf Coast have resulted in a shift in trade flows, where Latin American markets have sought to import products from Europe and Asia to replace those typically received from the United States, and recent exports have also suggested that refineries in Asia are looking to secure US crude because of the discount at which it trades against Brent. “Although changes in production are the primary impetus that has led to the expansion of the differential, this was expected to occur at some point given the growth in US production, the limited ability of US refineries to expand their processing capacity in the short and medium term, and the need to encourage a decrease in net imports (through lower imports and higher exports).”