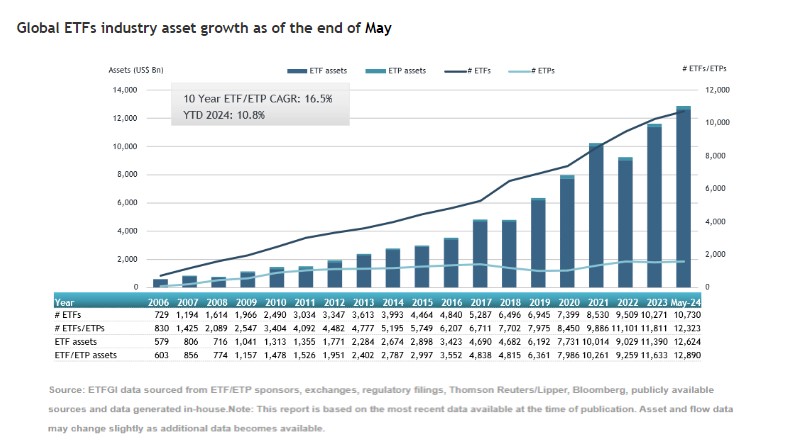

New record for the ETF industry. The assets of these vehicles worldwide reached 12.89 trillion dollars at the end of May, according to data compiled by ETFGI, an independent research and consulting firm specializing in ETFs. A snapshot of the global ETF industry in May 2023 shows there are 12,313 products, with 24,729 listings, from 752 providers listed on 80 exchanges in 63 countries.

“The S&P 500 index increased by 4.96% in May and has risen by 11.30% so far in 2024. The index of developed markets excluding the U.S. increased by 3.62% in May and by 6.09% so far in 2024. Norway and Portugal saw the largest increases among developed markets in May. The emerging markets index increased by 1.17% during May and has risen by 4.97% so far in 2024. Egypt and the Czech Republic saw the largest increases among emerging markets in May,” notes Deborah Fuhr, managing partner, founder, and owner of ETFGI.

In terms of flows, during May, there were 126.32 billion dollars in inflows, bringing the total inflows to 594.19 billion dollars during the first five months of the year. Equity ETFs reported inflows of 64.73 billion dollars, and fixed-income ETFs reported inflows of 32.93 billion dollars during May. Commodity ETFs also stood out, reporting inflows of 768.14 million dollars.

Active ETFs, which have gained great popularity in both the U.S. and European markets, captured 27.53 billion dollars in May, accumulating 125.11 billion so far this year, a new record compared to 2023.

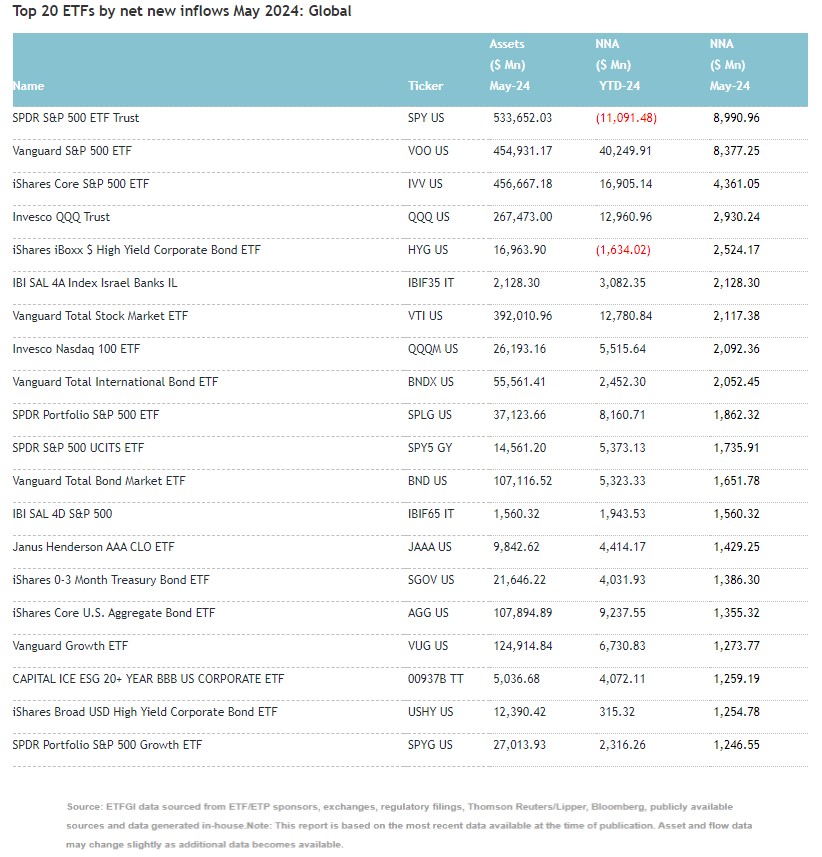

“The substantial inflows can be attributed to the top 20 ETFs by new net assets, which collectively gathered 51.59 billion dollars during May. Leading this ranking is the SPDR S&P 500 ETF Trust (SPY US), which gathered 8.99 billion dollars, the largest individual net inflow,” notes ETFGI. Vanguard S&P 500 ETF, iShares Core S&P 500 ETF, Invesco QQQ Trust, and iShares iBoxx $ High Yield Corporate Bond ETF complete the top five positions in this ranking.