ETFGI, an independent research and consulting firm focused on global ETF industry trends, revealed that assets invested in actively managed ETFs worldwide reached a new record of $974.29 billion at the end of July. That month, these vehicles registered net inflows of $35.92 billion, bringing year-to-date flows to $189.96 billion, according to the firm.

ETFGI’s July report highlights the following key points:

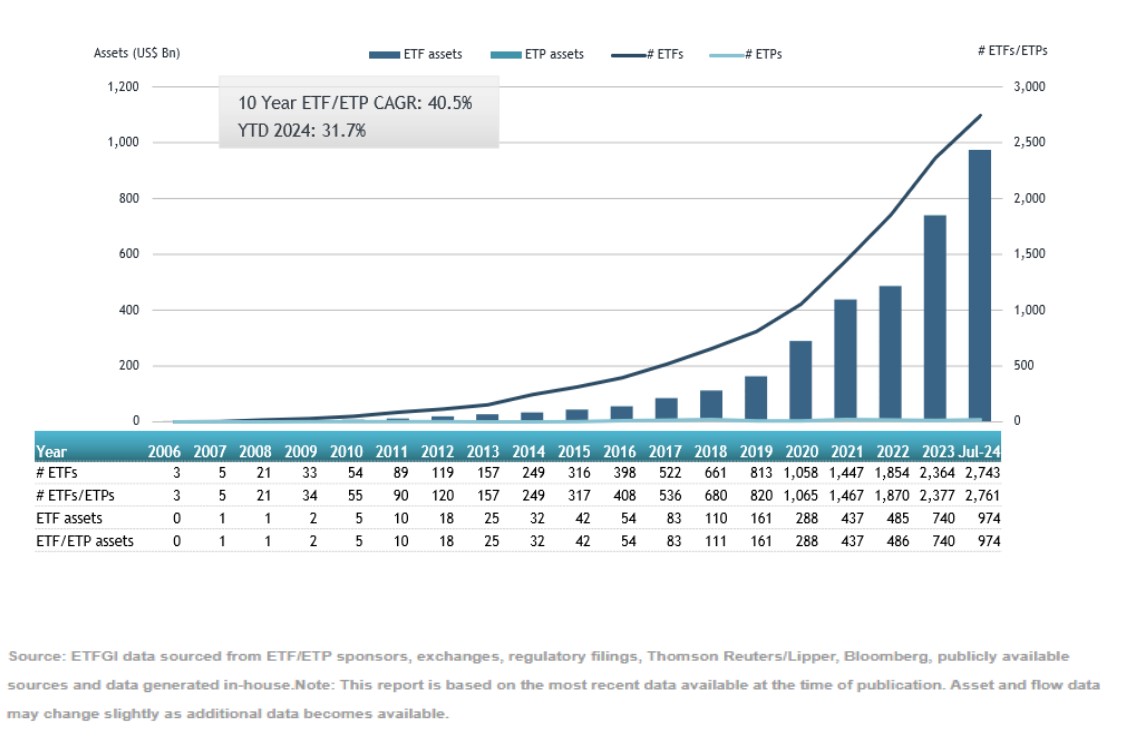

1. The assets invested in actively managed ETFs worldwide reached a new record of $974.29 billion at the end of July, surpassing the previous all-time high of $923.22 billion set at the end of June 2024.

2. The value of assets has increased by 31.7% year-to-date, rising from $739.87 billion at the end of 2023 to $974.29 billion in July.

3. July saw net investment inflows of $35.92 billion.

4. Year-to-date net inflows have reached $189.96 billion, the highest ever recorded, followed by year-to-date inflows of $86.12 billion in 2023 and contributions of $85.25 billion in 2021.

5. With July’s inflows, the industry has now seen 52 consecutive months of net investment inflows.

“The S&P 500 rose by 1.22% in July and 16.70% throughout 2024. Developed markets, excluding the U.S., gained 3.37% in July and 8.12% in 2024. Ireland (+6.48%) and Belgium (+6.42%) saw the biggest declines among developed markets in July, while Greece (+6.93%) and the UAE (+6.18%) posted the highest gains among emerging markets,” said Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Growth of Assets in Actively Managed ETFs (As of July)

At the end of July, 2,761 actively managed ETFs were listed worldwide, with 3,421 share classes and $974.29 billion in assets, from 461 providers across 37 exchanges in 29 countries.

Actively managed equity-focused ETFs received net investment inflows of $19.37 billion during July, bringing the year-to-date net inflows to $108.52 billion, significantly exceeding the $58.01 billion in flows during the same period in 2023.

Actively managed fixed-income ETFs worldwide attracted $14.57 billion in investment in July, bringing the year-to-date net inflows to $69.12 billion, far surpassing the $27.44 billion in subscriptions during the January-July 2023 period.

These substantial inflows can be attributed to the top 20 actively managed ETFs by new net assets, which collectively gathered $13.42 billion in July. The Magellan Global Fund/Open Class brought in $1.64 billion, marking the largest individual net inflow.