Special Purpose Vehicles (SPVs) have become essential tools in portfolio management due to their ability to optimize resources, reduce risk, and provide operational flexibility. An SPV is a legal entity established for a specific purpose, often structured as a limited liability company, according to an analysis by the specialized fund manager FlexFunds. This structure enables an effective separation of assets and liabilities from the parent company. By containing the risks of a specific project within an independent entity, companies protect their core operations and reduce exposure to potential losses or liabilities arising from high-risk activities.

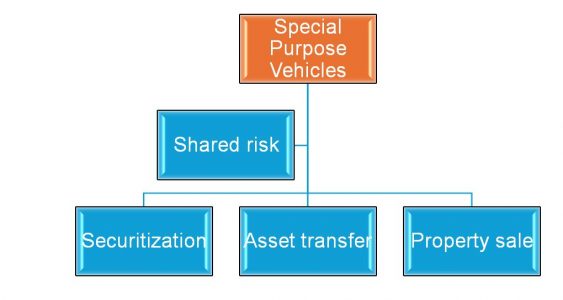

Portfolio managers use SPVs for various purposes, including risk-sharing and isolation, asset securitization, asset transfer facilitation, and optimization of property sales, which can be illustrated graphically as follows:

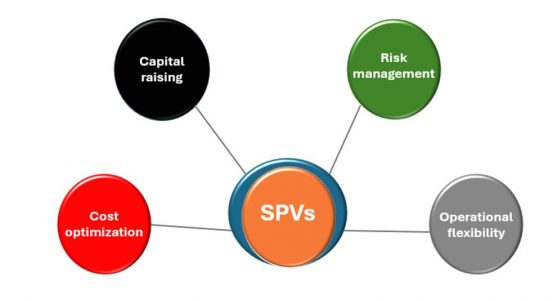

Key benefits of SPVs for portfolio managers

The use of SPVs offers multiple benefits, starting with risk management. These entities allow companies to handle high-risk projects without jeopardizing the financial stability of the parent entity, as any financial or legal challenges are contained within the SPV. Portfolio managers also find SPVs to be highly useful tools for adapting to market regulations and norms, achieving operational flexibility that facilitates expansion into new areas or the development of projects with minimal risk to the core business. In regulated sectors, SPVs are particularly advantageous, as they help companies comply with market regulations without endangering their primary structure.

Another key benefit of SPVs is cost optimization. Since these entities are limited to a specific project, they enable the reduction of general and operational expenses. Construction projects or product developments can be managed through SPVs, minimizing the financial impact on the parent company’s structure and maximizing cost efficiency. Additionally, SPVs provide an accessible avenue for raising capital without affecting the parent company’s credit rating, as they maintain their own credit profile. This represents a strategic advantage for portfolio managers, allowing them to finance individual assets or projects without increasing the financial risk or debt of the main organization.

Despite their advantages, SPVs come with challenges, particularly regarding transparency and risk oversight. SPV structures can be complex, making it difficult to assess associated risks fully. Portfolio managers must monitor SPV assets and liabilities constantly to identify hidden risks and mitigate potential financial issues. Regulatory compliance is another critical aspect. SPVs must operate transparently and not be used to evade taxes or liabilities. Any irregularities could expose both the SPV and the parent company to significant penalties.

The demand for SPVs has surged in the last decade, driven by their effectiveness in facilitating cross-border capital flows and enabling private investors to access emerging markets. According to the “SPV Global Outlook 2024” report by CSC, the increased use of SPVs stems from their ability to protect parent company assets and liabilities, offer ease of creation and administration, and the possibility to isolate individual assets to optimize performance. This approach has made SPVs a popular choice among fund managers and investors seeking tax-efficient and adaptable structures.

Special Purpose Vehicles (SPVs) operate in an increasingly complex regulatory environment, presenting both challenges and opportunities for asset managers. As Thijs van Ingen, global leader of corporate and legal services at CSC, states, “regulation is driving complexity,” and the regulatory frameworks can vary depending on the jurisdiction in which each SPV operates. For managers, this entails significant responsibility regarding compliance and governance of these entities, which may be subject to multiple layers of regulation, ranging from funds to corporations and specific investments.

Future outlook for SPVs

- Increased use in emerging markets: As investors explore growth opportunities in emerging markets, SPVs are likely to play a more prominent role in managing investments in these regions. For instance, private equity firms might use an SPV to invest in a portfolio of medium-sized companies in developing markets, providing capital access while safeguarding investor interests.

- Sustainable investments: With the rising importance of environmental, social, and governance (ESG) factors, SPVs are expected to take on a more significant role in financing sustainable projects. Companies investing in renewable energy or social impact initiatives can channel funds through SPVs to maximize returns in high-growth sustainable sectors.

- Increased regulatory scrutiny: As SPVs become integral to the financial system, regulators are focusing on these structures. SPVs may face new transparency and leverage requirements aimed at mitigating risks and preventing tax evasion. This scrutiny could lead to more comprehensive reporting obligations and additional controls, raising administrative costs.

Special Purpose Vehicles (SPVs) are a valuable strategic tool for portfolio managers seeking to protect their assets and mitigate risks without compromising the financial structure of the parent company. Their ability to isolate risks, provide operational flexibility, and facilitate capital raising makes them an attractive option for managing assets and high-risk projects.

At FlexFunds, we specialize in designing and creating investment vehicles, offering solutions that enable managers to issue exchange-traded products (ETPs) through Irish-incorporated SPVs. Our solutions are tailored to client needs, halving the time and cost compared to other market alternatives. Supported by renowned international providers such as Bank of New York, Interactive Brokers, Bloomberg, and CSC Global, FlexFunds delivers personalized, efficient solutions that enhance the distribution of investment strategies in global capital markets.

For more information, please contact our specialists at contact@flexfunds.com.

Disclaimer:

The purpose of content of the above article, blog, or post is only informational, and it is not intended to provide any sort of investment advice, as an offer of solicitation to buy, sell, or hold, or as recommendation, endorsement of any security, investment, fund and / or company. The content and information provided in the above article, blog, or post does not constitute financial, trading, or investment advice of any type. Neither FlexFunds ETP nor FlexFunds Ltd. is a U.S. registered broker-dealer, or an investment adviser registered with the U.S. Securities and Exchange Commission. Our entities do not raise capital for clients or the Issuers. We do not solicit any specific products, nor offer investment advice or make investment recommendations, nor do we offer tax, legal, financial advice or otherwise. Perform your own due diligence and consult a financial advisor prior to making any investment decision.