Cryptocurrency exchange-traded products (ETPs) have recently garnered significant attention and popularity as investors seek exposure to the growing world of digital assets. These innovative investment vehicles provide a more efficient way for retail and institutional investors to gain exposure to cryptocurrencies without the complexities of directly owning and managing digital wallets, highlights an analysis by the fund manager FlexFunds.

What is Cryptocurrency ETP?

Cryptocurrency ETPs are investment products that track the performance of one or more digital currencies. There are several types of cryptocurrencies ETPs available in the market:

- Exchange-Traded Funds (ETFs)

- Exchange-Traded Notes (ETNs)

- Exchange-Traded Certificates (ETCs)

Each type has its unique structure and characteristics, offering different levels of exposure to the underlying digital assets.

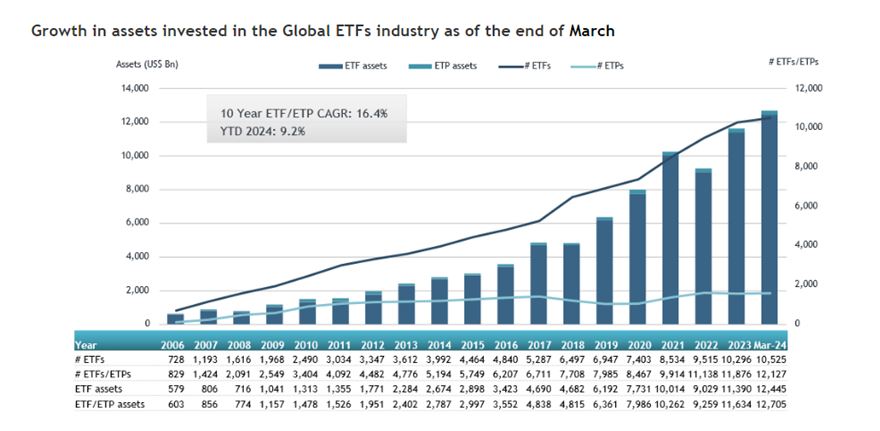

According to the specialized consultancy firm, ETFGI, assets invested in the global ETF industry reached a record $12.71 trillion at the end of the first quarter of 2024, up 9.2% from the end of 2023, when the figure was $11.63 trillion, as shown in the following graph:

Furthermore, when examining exchange-traded products (ETPs) with digital assets as underlying collateral, Fineqia International revealed that assets under management (AUM) at the end of March 2024 reached $94.4 billion, reflecting a cumulative increase of 91% in 2024 compared to the beginning of the year when AUM was $49.5 billion.

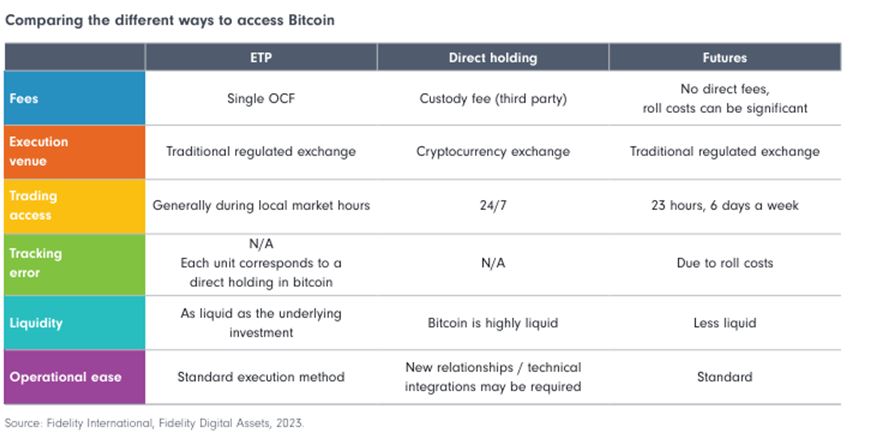

From this, it can be inferred that cryptocurrency ETPs show an upward trend as an alternative form of participation in the digital assets market. Asset managers or investors interested in exploring the cryptocurrency market have three main ways to gain market exposure, summarized in the following table:

Cryptocurrency ETPs allow portfolio managers and investors to access the volatility and growth potential of cryptocurrencies without having to subscribe directly to one or more specific currency. One possible way to structure such digital asset ETPs is by the means of asset securitization programs like those offered by FlexFunds. As a leading company in designing investment vehicles, FlexFunds allows for the securitization of any underlying exchange-traded fund in less than half the time and cost of any other alternative in the market, facilitating distribution to global private banking channels and access to international investors.

Here are the advantages and risks that asset managers should consider when opting for a cryptocurrency ETP:

Main Advantages:

- Diversification: Cryptocurrency ETPs allow portfolio diversification by gaining exposure to a wide range of digital assets, reducing the concentration risk associated with investing in a single cryptocurrency.

- Accessibility: ETPs provide a nimble and effective investment vehicle that can be easily listed on secondary markets.

- Liquidity: Unlike direct ownership of digital currencies, ETPs offer liquidity through their listing on regulated exchanges, allowing for buying or selling holdings at market prices during trading hours.

- Exposure to different investment strategies: ETPs can replicate the performance of specific cryptocurrencies, while others may focus on specific sectors or themes within the cryptocurrency market. This allows asset managers to tailor their portfolios based on their preferences and market outlook.

- Regulatory oversight: Cryptocurrency ETPs are subject to regulatory oversight, which raises compliance standards, offering investors a higher level of protection and transparency compared to other existing alternatives for participating in this type of asset.

Risks and Considerations:

- Volatility: The cryptocurrency market is known for its high volatility, and ETPs tracking digital assets are not immune to this, as they reflect the value of the underlying assets.

- Regulatory uncertainty: The regulatory landscape surrounding cryptocurrencies is evolving, and changes in regulations can affect the viability and availability of cryptocurrency ETPs.

- Tracking error: ETPs aim to replicate the performance of their underlying digital assets, but tracking errors can occur due to various factors such as fees, market conditions, and rebalancing.

- Lack of investor protection: Unlike traditional financial markets, cryptocurrency ETPs may not offer the same level of investor protection.

- Technological risks: Cryptocurrencies depend on blockchain technology, which is still relatively new and evolving.

- Tax implications: The tax treatment of cryptocurrency ETPs can vary depending on the jurisdiction.

The emergence of cryptocurrencies and the subsequent development of exchange-traded products (ETPs) for digital assets have opened a new realm of possibilities for asset managers, investors, companies, and the global financial landscape as a whole. An increasing number of investors are eager to delve into these types of digital assets, especially during bullish periods. This implies that asset and portfolio managers must find ways to offer their clients a means of participating in this market with minimal exposure to inherent risks and volatilities.

An example of utilizing a vehicle that securitizes digital asset ETFs is the recent issuance by FlexFunds for Compass Group, one of the leading independent investment advisors in Latin America. FlexFunds structured its first investment vehicle backed by cryptocurrency ETFs, securitizing assets with a nominal value of $10 million, making it easier and less risky for Compass Group clients to participate in such assets.

If you wish to explore the advantages of digital asset securitization, feel free to contact the experts at FlexFunds at info@flexfunds.com

Disclaimer:

The purpose of content of the above article, blog, or post is only informational, and it is not intended to provide any sort of investment advice, as an offer of solicitation to buy, sell, or hold, or as recommendation, endorsement of any security, investment, fund and / or company. The content and information provided in the above article, blog, or post does not constitute financial, trading, or investment advice of any type. Neither FlexFunds ETP nor FlexFunds Ltd. is a U.S. registered broker-dealer, or an investment adviser registered with the U.S. Securities and Exchange Commission. Our entities do not raise capital for clients or the Issuers. We do not solicit any specific products, nor offer investment advice or make investment recommendations, nor do we offer tax, legal, financial advice or otherwise. Perform your own due diligence and consult a financial advisor prior to making any investment decision.