In the current climate of economic uncertainty, market volatility, and increasing geopolitical risks, portfolio diversification has become a priority for asset managers. Traditional strategies based on equity and bond investments have proven insufficient to mitigate the inherent risks of financial markets. Alternative assets emerge as a critical tool here, providing managers with new diversification opportunities to enhance portfolio resilience and profitability, FlexFunds highlights.

Alternative assets encompass investments in real estate, private equity, infrastructure, private debt, commodities, art, and collectibles, among others, characterized by their low correlation with traditional assets. This makes them an attractive option for managers and investors seeking to reduce portfolio volatility and mitigate the adverse effects of economic cycles.

In a high-inflation, high-interest-rate scenario, managers need to explore opportunities outside traditional markets. Alternative assets offer stability and potential returns, helping safeguard investment value during uncertain times. David Elms, head of diversified alternatives at Janus Henderson Investors, highlights that, during periods of economic transition, alternative investments can generate long-term returns independent of equity or fixed-income markets, particularly in bearish conditions.

Today, portfolio managers are increasingly turning to asset securitization to optimize their diversification strategies. This tool enables converting illiquid assets into tradable securities, facilitating distribution among investors. For managers, this approach opens up access to assets that would otherwise be unattainable due to their illiquid nature.

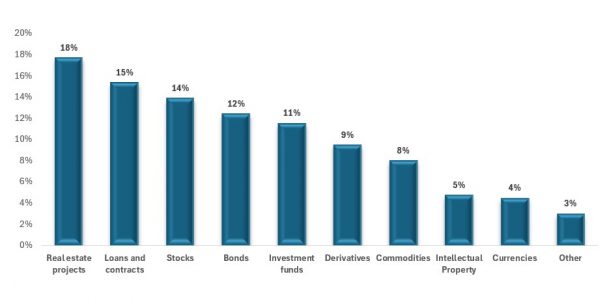

Securitization not only improves the liquidity of underlying assets but also provides an additional source of diversification. According to the II Annual Report of the Asset Securitization Sector by FlexFunds and Funds Society, portfolio managers are more familiar with securitizing traditional, tangible assets such as real estate projects, loans and contracts, and stocks.

One of the main advantages of alternative assets is their ability to generate absolute returns—i.e., positive returns regardless of market conditions. Portfolio managers incorporating these assets into their strategies aim to minimize economic cycle dependency by diversifying their investments into areas less correlated with equity or fixed-income markets.

In line with this, and based on a survey conducted by FlexFunds and Funds Society to over 100 investment and portfolio management experts, the most sought-after assets for securitization include real estate projects, loans and contracts, stocks, bonds, and mutual funds, as shown in Figure 1.

Source: II Annual Report of the Asset Securitization Sector 2024-2025

Figure 1: Assets of greatest interest for securitization

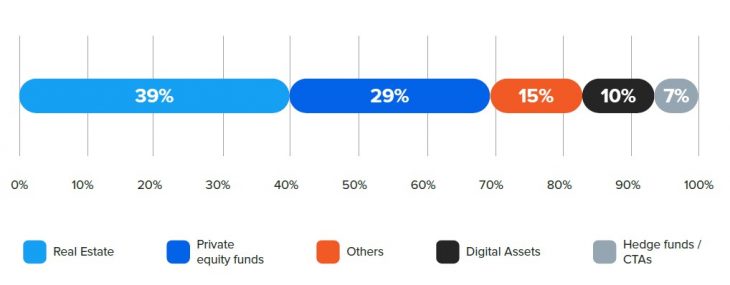

In addition to diversification and risk mitigation, alternative assets provide access to sectors undergoing growth and economic transformation. According to the same report, the most common types of alternatives that managers include in their portfolios are detailed in Figure 2.

Source: II Annual Report of the Asset Securitization Sector 2024-2025

Figure 2: Alternative product in the portfolio

However, investing in alternative assets also entails challenges that must be managed carefully. The lower liquidity of these assets, as well as their opacity and lack of regulation in some cases, can increase risks. To mitigate these, rigorous due diligence and an experienced management team are crucial to understanding each alternative investment’s unique characteristics.

From a manager’s perspective, integrating alternative assets into investment strategies represents both an opportunity and a responsibility. The challenge lies in identifying suitable assets that align with investors’ objectives and risk profiles. The selection of these assets should be accompanied by constant portfolio review and adjustment, considering market fluctuations and emerging opportunities.

In this context, FlexFunds, as a leader in designing and issuing investment vehicles (ETPs), facilitates access to international markets, especially in a financial environment where diversification through alternative assets is key. With its securitization program, FlexFunds offers managers the ability to:

- Issue ETPs at half the time and cost of other alternatives available in the market.

- Securitize multiple asset classes, including alternatives.

- Facilitate distribution of alternative assets across banking platforms worldwide via Euroclear.

- Streamline capital raising from international investors.

- Simplify the onboarding and subscription process for investors, compared to traditional alternative asset subscriptions.

For further information, please contact one of FlexFunds’ experts at contact@flexfunds.com

Disclaimer:

The purpose of content of the above article, blog, or post is only informational, and it is not intended to provide any sort of investment advice, as an offer of solicitation to buy, sell, or hold, or as recommendation, endorsement of any security, investment, fund and / or company. The content and information provided in the above article, blog, or post does not constitute financial, trading, or investment advice of any type. Neither FlexFunds ETP nor FlexFunds Ltd. is a U.S. registered broker-dealer, or an investment adviser registered with the U.S. Securities and Exchange Commission. Our entities do not raise capital for clients or the Issuers. We do not solicit any specific products, nor offer investment advice or make investment recommendations, nor do we offer tax, legal, financial advice or otherwise. Perform your own due diligence and consult a financial advisor prior to making any investment decision.