In recent years, private capital has taken center stage in institutional portfolios due to its risk-adjusted return potential and diversification benefits. However, its defining characteristic—illiquidity—can pose a challenge for both investors and portfolio managers. In this context, securitization emerges as an innovative and effective solution to transform illiquid assets into listed, liquid, and easily accessible securities.

This article of FlexFunds explains in a clear and practical way how securitization works in the context of private capital, what benefits it offers, and how it can be implemented.

Asset securitization is simply the process of transforming any type of financial asset into a tradable security. Through this financial technique, exchange-traded products (ETPs) are created to act as investment vehicles, with the aim of providing the underlying assets with greater liquidity, flexibility, and reach.

Traditionally, this process has been associated with the banking or mortgage sectors. However, an increasing number of private equity fund managers are exploring this approach to bring more flexibility to their portfolios, monetize assets without selling them directly, and attract a broader investor base.

Private equity funds are investment instruments designed to support the growth of non-listed companies. These vehicles are established through financial intermediaries who raise capital from investors and direct it toward various companies or projects with significant growth potential.

These funds typically have long investment horizons (8 to 10 years or more) and are closed-end structures, meaning that investors cannot enter or exit the fund during its lifespan. This can limit access for certain investors who require greater liquidity or face regulatory constraints.

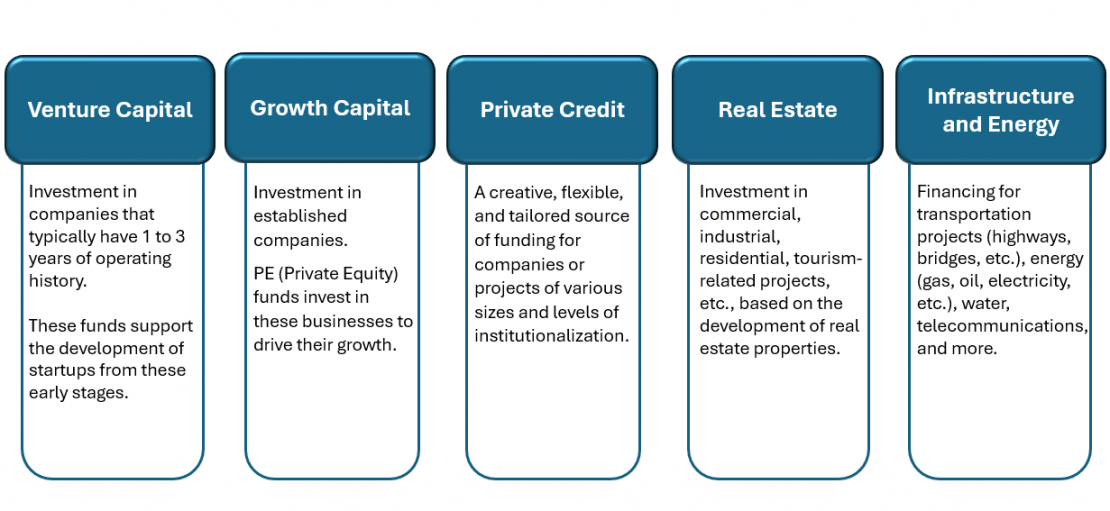

Some of the most common types of private capital investments include:

Through securitization, it’s possible to pool interests in a private equity fund and issue securities that represent rights to the future cash flows of those assets. These securities can be structured in different risk and return tranches, making them adaptable to various investor profiles.

That said, implementing a securitization structure requires expertise in financial structuring, international regulation, and access to distribution platforms. This is where FlexFunds, a company specialized in creating efficient investment vehicles, can play a key role.

FlexFunds offers investment vehicles that enable private capital managers to:

1.- Increase liquidity: Securitization turns illiquid assets into listed products with ISIN codes, tradable through platforms such as Euroclear and Clearstream, and custodial in existing brokerage accounts.

2.- Diversify risk: By distributing the risks associated with the underlying assets among multiple investors, securitization helps reduce exposure for any individual investor—especially relevant in times of market volatility.

3.- Access international capital: Securitization facilitates access to international capital markets, allowing managers to attract investment from a global investor base.

4.- Protect the assets within the structure: Since the issuance is executed through a Special Purpose Vehicle (SPV), the underlying assets are isolated from any credit risk that may affect the manager and, therefore, the investor.

Like any financial tool, securitization comes with challenges that must be managed, including:

- Accurate valuation of private assets

- Transparency and disclosure to investors

- Compliance with regulations across multiple jurisdictions

Securitization applied to private capital is a growing trend. It offers a viable solution to address the sector’s inherent illiquidity, expand the investor universe, and increase capital market distribution.

If you’re looking to expand the distribution of your private equity fund, securitization may be the tool that helps you reach a wider investor base. FlexFunds’ solutions can repackage this type of instrument in less than half the time and cost of any other alternative on the market.

For more information, please contact our experts at contact@flexfunds.com