In the dynamic world of finance, asset securitization has emerged as a valuable bridge to multiple private banking platforms, enabling the conversion of underlying assets into what is known as “bankable assets”. “Bankable assets” can be effectively distributed through various private banking platforms. This process has become even more powerful by incorporating exchange-traded products (ETPs) as key tools for transforming underlying assets into bankable assets, the FlexFunds team explains in an analysis:

Securitization: a path to liquidity

Securitization is a financial process that goes beyond merely converting liquid or illiquid assets into securities. It also uses ETPs as instruments for this transformation. This process can become quite complex, but thanks to FlexFunds’ solutions, it can be carried out in an agile, straightforward, and cost-effective manner.

FlexFunds’ securitization program is crucial in facilitating access to multiple private banking platforms by designing and launching investment vehicles, similar to traditional funds, that enable strategy management and global distribution to international investors.

Securitization for multiple asset classes

One of the most notable advantages of securitization is its flexibility. It is not limited to a specific class of asset, which means both liquid and illiquid assets can be securitized. Most importantly, private banking treats these operations as debt, streamlining the process of registering a FlexFunds ETP compared to the complex and lengthy verification procedures associated with traditional funds.

Advantages of the asset securitization process

Asset securitization offers multiple advantages that make it attractive to both financial advisors and investors:

- Improved liquidity and access to alternative sources of financing: Securitization converts illiquid assets into tradable securities, providing financial institutions with additional liquidity and access to alternative sources of financing.

- Customization of securitized assets: It allows institutions to structure securitized securities according to investors’ preferences and needs.

- Diversification of investments: Securitized securities can be backed by various types of assets, enabling investors to diversify their portfolios and reduce exposure to specific risks.

How are assets converted into Bankable Assets?

The process of converting assets into bankable assets through an ETP is relatively straightforward for FlexFunds’ clients. In five simple steps, they can bring their ETP to market, facilitating access to investors in the global capital markets:

- Design the investment strategy for your ETP.

- Sign the Engagement Letter.

- Conduct Due Diligence.

- Create the ETP.

- Issue the ETP.

Once this process is completed, advisors can market the product, which combines a series of assets into a single investment vehicle, simplifying the investment process for their clients.

The Role of ETPs in Modern Finance

ETPs are exchange-traded products that track the performance of underlying assets, such as indices or other financial instruments. They trade on exchanges similarly to stocks, which means their prices can fluctuate throughout the day. However, these prices fluctuate based on changes in the underlying assets.

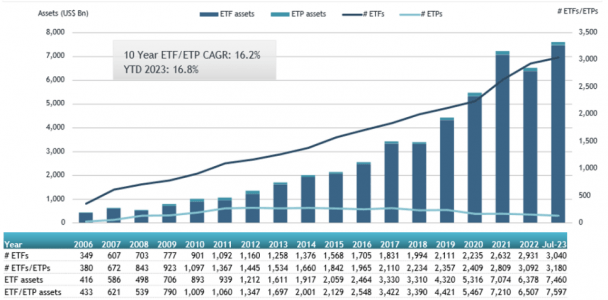

Since the launch of the first ETF in 1993, these funds and other ETPs have grown significantly in size and popularity. According to ETFGI data, as of the end of July 2023, ETFs in the United States reached a record of $7.6 trillion in assets under management (AUM). Their low-cost structure has contributed greatly to their popularity, attracting assets away from actively managed funds, which typically have higher costs.

By the end of July, the U.S. ETF industry had 3,180 products totaling $7.6 trillion in assets, from 289 providers listed on three exchanges.

Trends Toward 2027

According to a report by Oliver Wyman, Exchange-Traded Funds (ETFs) are projected to account for 24% of total fund assets by 2027, up from the current 17%. As of December 2022, total ETF assets under management in the U.S. and Europe reached $6.7 trillion, experiencing steady growth with a compound annual growth rate (CAGR) of approximately 15% since 2010. This growth is nearly three times faster than that observed in traditional mutual funds.

Despite various trends, such as increased demand from retail investors, tax and cost advantages, favorable regulation, growing demand for thematic ETFs, and direct indexing, positively influencing the growth prospects of ETFs, their launches face various challenges. These challenges include the high costs associated with establishing infrastructure and significant risk of failure. These obstacles have given rise to white-label ETF providers, a relatively novel business model that allows fund providers to bring their strategies to market quickly and efficiently.

Additionally, there is anticipated strong focus on technologies like artificial intelligence and autonomous learning to gain competitive advantages and provide greater value to customers. These trends also open up opportunities for wealth managers to expand their business models, especially concerning non-bankable assets, which represent a significant and growing portion of individuals’ total wealth today.

Asset securitization through ETPs offers innovative financial solutions that enhance liquidity, expand financing options, and enable portfolio customization. These strategies align with future trends in the financial sector, which are moving towards personalized solutions and adopting advanced technologies. FlexFunds stands out as a leader in this transformative industry, providing advisors with unique opportunities in modern finance.

If you wish to explore the benefits of asset securitization in greater depth, do not hesitate to contact our experts at info@flexfunds.com