Each month, Rahul Bhushan, Managing Director in Europe at ARK Invest, shares the standout data from the European thematic ETF market: key trends, changes in investor flows, and more. In his year-end 2024 edition, he chose to analyze November’s investment flows, uncovering several highly relevant insights.

The expert highlights three key areas of inflows:

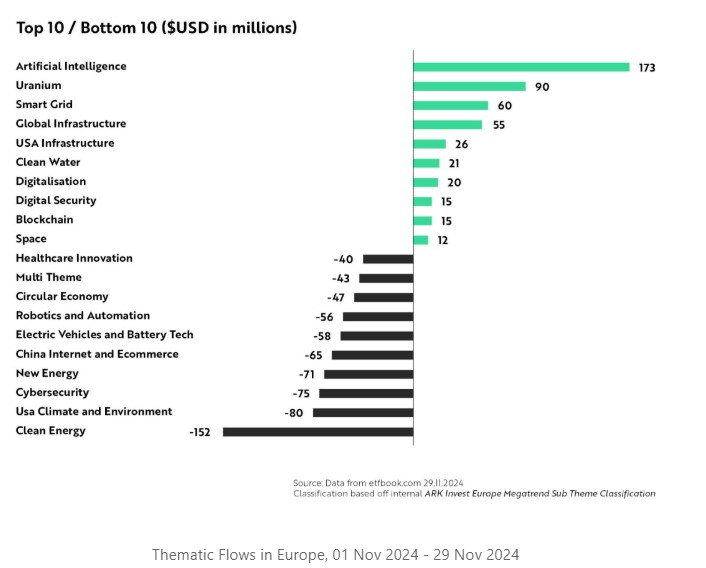

1.- Artificial intelligence ETFs recorded inflows of $172 million in November, “highlighting investor enthusiasm as the AI boom shifts from hardware-driven infrastructure development to software applications that unlock real productivity gains,” says Bhushan.

2.- Uranium ETFs attracted $90 million, reflecting the anticipated growth of alternative energy sources. “Donald Trump’s reelection as U.S. president signals a return to pragmatic energy policies that position nuclear energy as a cornerstone of resilience and efficiency,” Bhushan explains.

3.- Infrastructure ETFs led inflows with $81 million in November, underscoring strong investor interest in domestic infrastructure. “Infrastructure stocks tend to perform well in election years and are bolstered by Trump’s plans to rebuild and reindustrialize America, signaling sustained growth in this sector,” the expert adds.

Bhushan also noted trends in the thematic ETFs that underperformed during the month:

1.- Clean energy ETFs recorded the largest outflows, with $152 million in redemptions. Investor appetite appears to be shifting beyond the capital-intensive renewable energy generation supply chain. “Instead, attention is increasingly focused on more profitable areas of the value chain, such as energy efficiency solutions and software-based grid infrastructure, where companies are better positioned to deliver short-term returns,” he notes.

2.- Cybersecurity ETFs saw outflows of $75 million, as investors took profits after a strong performance period. However, as cyber threats grow more sophisticated and AI transforms security environments, Bhushan explains that the need for robust digital defenses continues to drive long-term opportunities in the sector.

3.- China ETFs experienced redemptions of $64 million, “highlighting persistent investor concerns about geopolitical tensions and a shift toward more predictable growth opportunities in Western markets.”

Longer-Term Observations

The available data, covering nearly the entire year with only one month remaining, is sufficient to draw conclusions about investor preferences in 2024.

Among the highlights of the year are:

1.- Artificial intelligence ETFs, which have led investment inflows with $1.78 billion. AI continues to capture investor attention as a transformative force, with significant advancements and applications across all sectors bolstering confidence in this theme.

2.- Smart grid ETFs, with investment flows totaling $405 million, “highlighting the demand for infrastructure supporting energy efficiency and modernization of the power supply,” according to Bhushan, who adds that as digital infrastructure expands, “smart grids will be critical for managing energy effectively.”

3.- Uranium ETFs, which have accumulated $250 million in subscriptions, reflecting growing interest in nuclear energy within the broader energy transition. “Investors see nuclear energy as a reliable and scalable energy source for decarbonizing the energy mix.”

Key trends among the most lagging ETFs included:

1.- Robotics and automation ETFs have experienced the largest outflows, with a total of $996 million. As investors focus more on AI, interest in broader areas like pure industrial automation may be waning amid a shift in thematic preferences.

2.- Clean energy ETFs have recorded outflows of $834 million. This narrower focus within the energy transition theme appears to have seen cautious positioning, according to the expert, “especially ahead of the U.S. elections and potential regulatory changes.”

3.- Electric vehicle and battery technology ETFs have seen redemptions of $761 million, “likely reflecting caution in the lead-up to the U.S. elections.”