Amundi is committed to making its range of ETFs more competitive. The asset manager has announced that it has been adjusting management fees across a wide selection of its passive funds. According to Amundi, this move demonstrates its commitment to “offering investors industry-leading products that combine performance, diversification, and cost efficiency.”

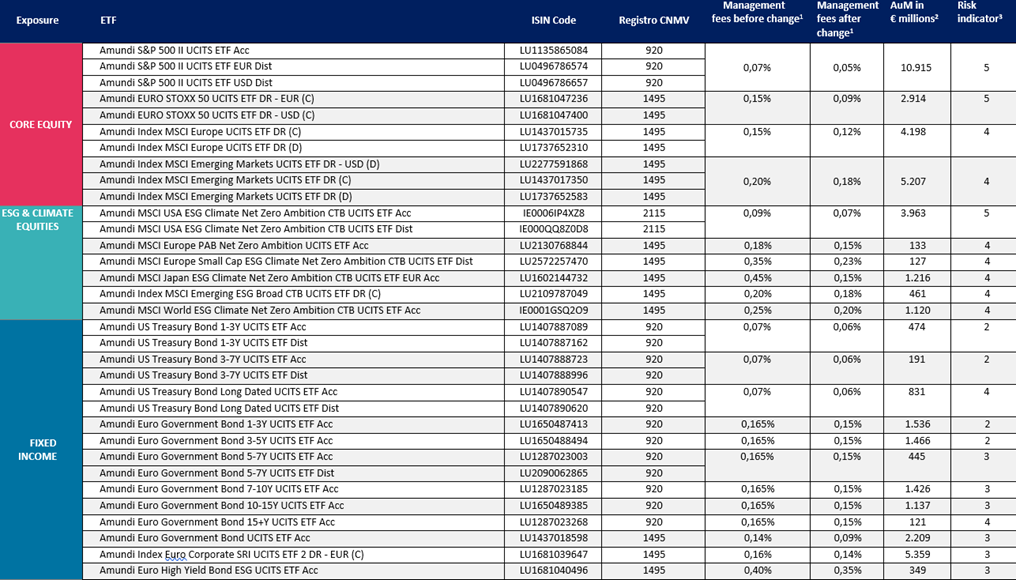

Amundi’s position as a key player in the market allows cost efficiencies to be passed on to investors. They indicate that the fee reductions will apply to key exposures such as traditional and ESG U.S. equities, euro equities, U.S. government debt, and euro credit. This initiative aligns with Amundi’s goal of making diversified investment accessible to all types of investors.

Amundi ETF offers more than 300 ETFs covering various asset classes, geographies, sectors, and themes, enabling investors to find solutions tailored to their specific investment needs and objectives in a competitive manner.

“One of Amundi’s long-term commitments is to ensure that our clients benefit from our adaptability and innovation across our extensive range of ETFs, as well as from our economies of scale. We value the importance of cost efficiency in investment, and these reductions will help investors achieve their investment goals without compromising on quality. By reducing the fees on such a diverse range of ETFs, we are making it easier for investors to benefit from our extensive range of products,” explains Benoit Sorel, Global Head of Amundi ETF, Indexing & Smart Beta.