After two years of negotiations, the Finance Ministers of the EU Member States approved in Brussels, the first list of jurisdictions that do not cooperate in tax matters.

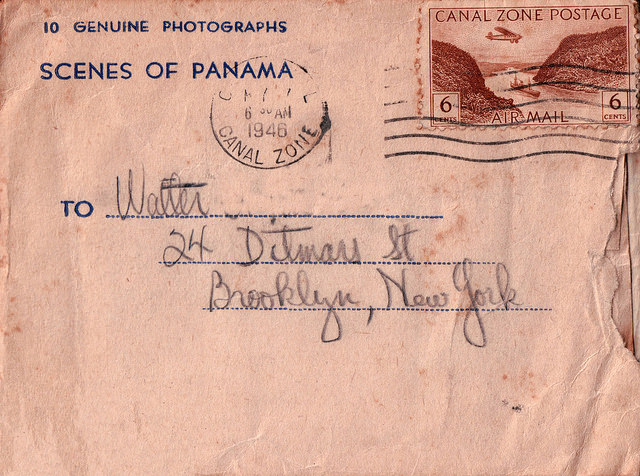

Of the 17 states included in this list of tax havens, there are five from Latin America and the Caribbean: Barbados, Panama, Grenada, Saint Lucia and Trinidad and Tobago. All have been singled out for not making sufficient efforts in the fight against tax evasion and they are also included in the list that the OECD produces each year.

These five are joined by 12 other countries: American Samoa, Bahrain, Guam, South Korea, Macao, the Marshall Islands, Mongolia, Namibia, Palau, Samoa, Tunisia and the United Arab Emirates.

The Bahamas and the British and United States Virgin Islands were supposed to be blacklisted, as were Anguilla, Antigua and Barbuda or Dominica, but the European Union has postponed the analysis until 2018 so that these small Caribbean islands have time to recover from the devastating hurricane season.

In addition, 47 countries have committed to address the deficiencies in their tax systems and meet the required criteria. Uruguay is on this gray list. This is due to its legislation on Free Zones indicated this year as a “harmful legal incentive” by the OECD.

The parliamentary procedure of a reform of the Free Zones Law that subjects companies to greater controls, should finish removing Uruguay from the zone of doubt.

What does it mean to be included in this list?

Recognition of the countries that encourage abusive tax practices, according to the European Commission, should have a real impact on the affected countries, thanks to the new EU legislative measures.

First, following the Commission’s proposals, the EU list is now linked to funding in the context of the European Sustainable Development Fund (EFSF), the European Fund for Strategic Investment (EFSI) and the External Loan Mandate (ELM). Their funds can not be channeled through entities in the listed countries. Only direct investment in these countries (that is, financing of projects on the ground) will be allowed in order to to preserve development and sustainability objectives.

Second, the Commission has proposed that multinationals with activities in these jurisdictions be required to have much stricter reporting requirements. In addition, any fiscal scheme that includes operations in any of the countries included in the EU list will be automatically reported to the tax authorities.

Finally, the Commission has already taken steps for Member States to impose coordinated sanctions on these countries that include measures such as increased monitoring and audits, withholding taxes, special documentation requirements and anti-abuse provisions.

The EU’s reasons

These 17 countries on the blacklist have been identified after finding out that they do not comply with international transparency standards on automatic exchange of information or encourage unfair tax competition.

“Those countries that choose not to have a business tax or to offer a zero rate should ensure that this does not encourage artificial offshore structures without real economic activity,” the Commission explains in its statement.