Former J.P. Morgan bankers Alexandra Valentin and Juan Carlos Freile joined forces with Phillip Hackleman to establish the multi-family office Tiempo Capital in Miami.

The company has been registered with the SEC as an RIA. However, the partners distinguish between the regulatory status and the services they provide.

“We like to be known as a multi-family office because our work is more selective, both in terms of clients and the operations we undertake,” Valentin told Funds Society.

The firm, which already has approximately $320 million in assets under management, aims to reach $500 million in the next two months, with the goal of reaching $1 billion within the next year, Freile told.

The client profile consists of Latin American families residing both in the U.S. and in the southern region.

“Our work at J.P. Morgan allowed us to develop an excellent relationship with clients from Puerto Rico, and our experience in the industry also helped us forge connections with families from Venezuela, Colombia, Mexico, and Argentina,” added Valentin.

Additionally, the bankers mentioned that Hackleman’s participation as the third partner is crucial for managing investment operations and strategy.

“Phillip has extensive experience in investment matters,” Freile commented.

Regarding custodians, Tiempo Capital will work with J.P. Morgan, “due to the great trust that has been built” during their experience at the firm. However, they also diversify custody with Northern Trust and Morgan Stanley.

A Vision Towards Alternatives

Tiempo Capital emerged from clients’ need to invest in a more diverse range of products than those offered by wirehouses.

Freile described that the multi-family office will create selected and customized portfolios for each client with all types of alternative products. The goal is to expand the universe of alternative offerings that banks have.

For this reason, the firm’s partners mentioned that they will work with direct investments such as Real Estate, Private Equity, among others.

About the Partners

The three partners, Juan Carlos Freile, who serves as CEO, Alexandra Valentin, as Chief Strategy Officer and Head of the Puerto Rico business, and Phillip Hackleman, as Chief Investment Officer, are recognized in the industry for their extensive careers.

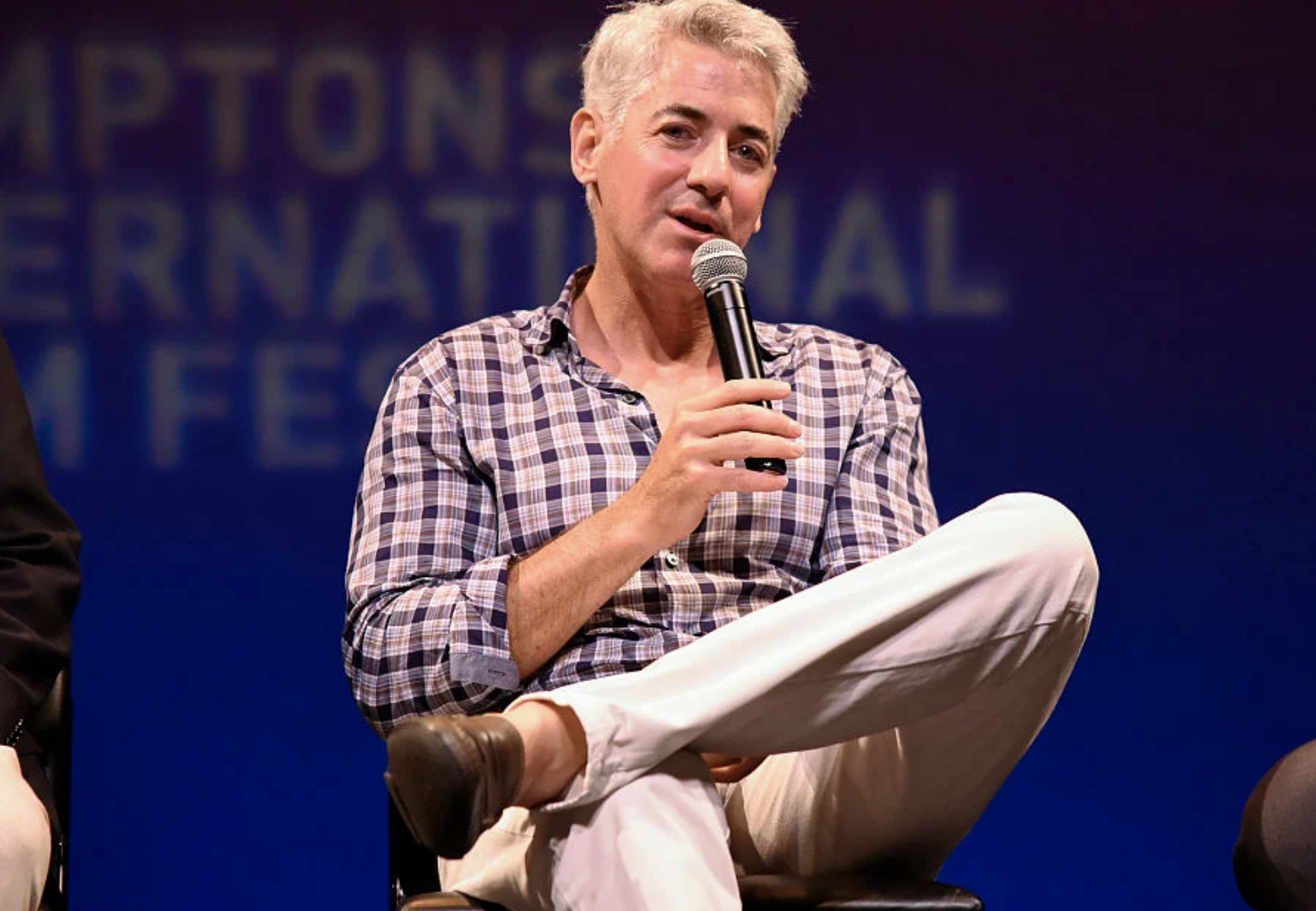

Juan Carlos Freile

Before founding Tiempo Capital, he was an executive director and banker at J.P. Morgan Private Bank, where he advised wealthy individuals and families in the United States, Puerto Rico, and Latin America, managing over $2 billion in client relationships.

During nearly 15 years at J.P. Morgan, he led an integrated team that provided customized wealth management solutions, including investments, wealth structuring, fiduciary services, philanthropy, banking, and credit. Previously, he worked in Investment Banking at Goldman Sachs & Co. in New York, advising and executing for Latin American institutional clients on Fixed Income, Currency, and Commodity trading and hedging solutions.

He obtained his degree in Economics and History cum Laude from Dartmouth College in Hanover. He also studied at University College London as a Research Scholar of early 20th-century financial history. Over the last decade, he achieved the CFA charter holder designation and is a member of the CFA Society of Miami.

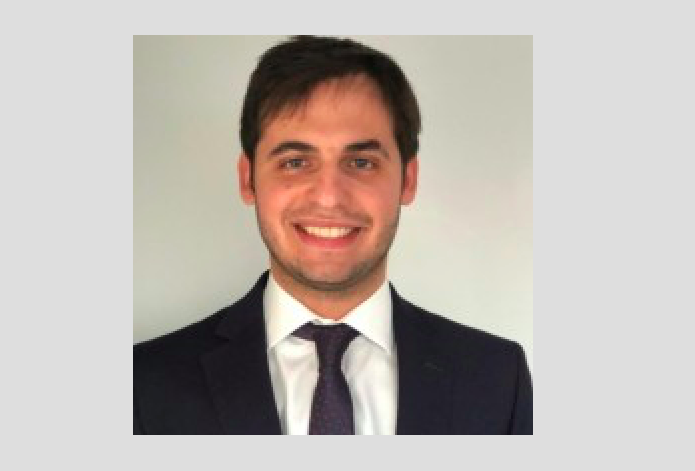

Alexandra Valentin

She was an executive director and banker in the Miami office of J.P. Morgan Private Bank, where she led the expansion of Puerto Rico and the team covering the Island. Under her leadership and guidance, J.P. Morgan became one of the largest custodians of high-net-worth assets on the Island, according to information provided by the firm.

Alexandra began her financial services career in 2003 and spent over a decade covering ultra-high-net-worth families in Latin America at UBS International.

Phillip Hackleman

He has experience managing various strategies, including Long-Short Equity, Global Macro, Classic Asset Allocation, Liability Management through Currency Arbitrage, and Absolute Return Fixed Income.

Before founding Tiempo Capital, he was a portfolio manager at a global multi-family office. He also worked for a Swiss global family office with $5.5 billion in AUM, participating in the investment committee representing the North American office. Previously, Philip worked at a multi-family office of a Fortune 500 founder, focusing on growth capital and real estate investments.