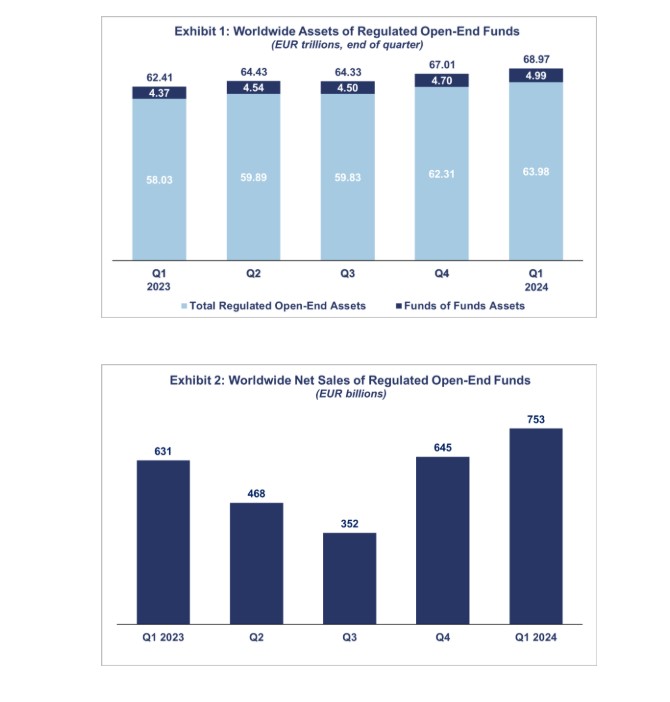

The net assets of investment funds worldwide stood at 69 trillion euros during the first quarter of the year, marking a growth of 2.9%, according to the latest data published by the European Fund and Asset Management Association (EFAMA). When measured in local currency, the net assets in the two largest fund markets, the United States and Europe, increased by 6% and 4.5%, respectively.

Notably, the net assets of fixed-income funds increased by 3.1%, reaching 12.6 trillion euros, while multi-asset funds grew by 3.6%, amounting to 10.5 trillion euros. In the case of money market funds, the growth was lower, at 1.9%, bringing their net assets to 9.6 trillion euros. Conversely, real estate funds and other funds categories saw a decrease in assets under management, with declines of 18% and 13.6%.

At the end of the first quarter of 2024, 45.3% of the net assets in investment funds worldwide were held in equity funds, while fixed-income funds represented 18.2%, multi-asset funds accounted for 15.2%, and money market funds comprised 14%.

“If we look at the breakdown of global investment fund net assets by domicile at the end of the first quarter of 2024, the United States held the largest market share with 52.2%. Europe was in second place with a market share of 30.4%. China (4.7%), Brazil (3.4%), Canada (3.2%), Japan (3.1%), South Korea (1%), India (0.9%), Chinese Taipei (0.3%), and South Africa (0.3%) followed in this ranking,” highlights the EFAMA report.

In total, five European countries are among the ten largest fund domiciles in the world: Luxembourg (with 8% of the world’s investment fund assets), Ireland (6.3%), Germany (3.9%), France (3.4%), and the United Kingdom (2.9%).

Inflows and Outflows

Regarding fund flows, the data show that funds recorded inflows worth 753 billion euros, compared to 645 billion euros in the fourth quarter of 2023. EFAMA notes that long-term funds recorded inflows of 497 billion euros, compared to 312 billion euros in the fourth quarter of 2023. “Globally, equity fund sales increased from 173 billion euros in the fourth quarter of 2023 to 193 billion euros in the first quarter of 2024,” they highlight.

In these first three months of the year, the leadership was taken by fixed-income funds, driven by strong demand in the United States and Europe.

“Global fixed-income vehicles saw record net inflows of 340 billion euros in the first quarter of 2024, the highest level since 2004. This increase was driven by investors anticipating lower interest rates amid slowing inflation and central banks pausing consecutive rate hikes,” says Bernard Delbecque, senior director of Economics and Research at EFAMA.

In contrast, multi-asset funds experienced outflows of 76 billion euros, marking the eighth consecutive quarter of negative net sales. ETFs also performed well, recording net inflows of 361 billion euros in the first quarter of 2024, compared to 350 billion euros in the fourth quarter of 2023.

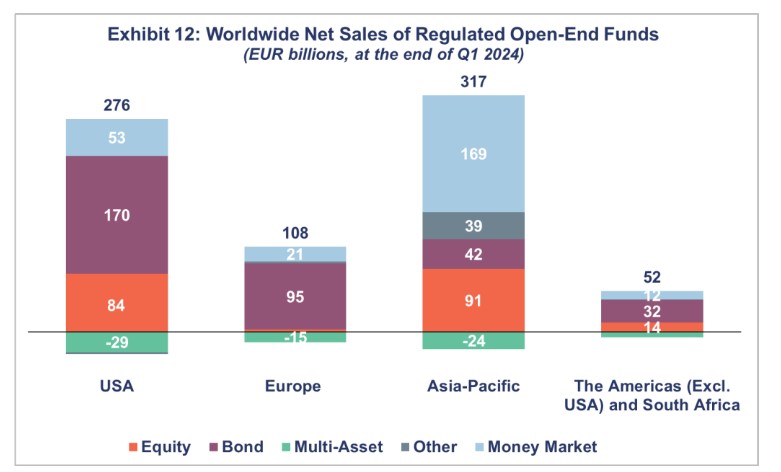

Geographical Analysis

According to EFAMA data, all major regions experienced net inflows. Net inflows amounted to 108 billion euros in Europe, mainly driven by Ireland (31 billion) and France (20 billion). “Conversely, Luxembourg continued to record net outflows, totaling 6 billion euros,” they note.

The United States recorded net inflows of 276 billion euros, and the Asia-Pacific region experienced net inflows worth 317 billion euros, led by China (219 billion), followed by Japan (42 billion), and South Korea (28 billion euros).

“The Americas recorded 52 billion euros in inflows in the first quarter of 2024, compared to 22 billion in the fourth quarter of 2023. Brazil’s net sales turned positive, recording net inflows of 21 billion euros, compared to net outflows of 6 billion euros in the previous quarter. Canada also recorded notable net inflows worth 18 billion euros,” highlights EFAMA in its quarterly report.