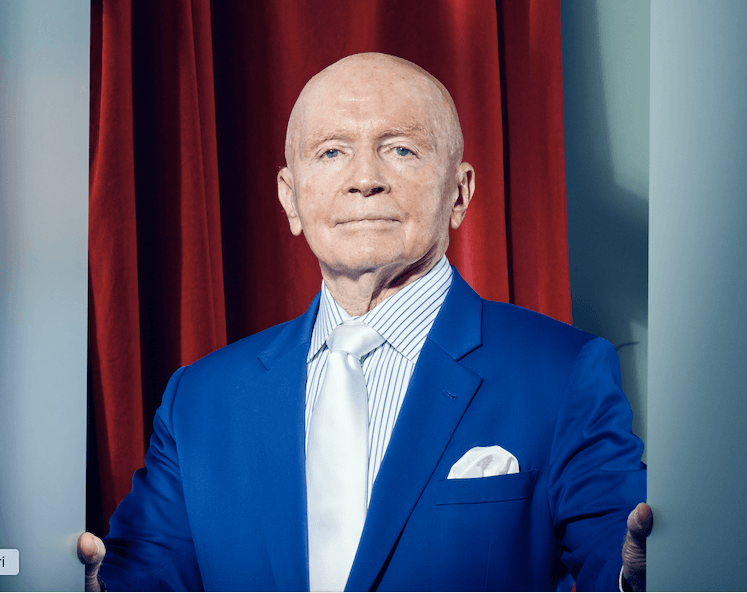

Mark Mobius takes a step back at Mobius Capital Partners. As reported by the firm in a statement sent to the London Stock Exchange, Mark Mobius will leave his post at Mobius Capital Partners in the coming months.

The veteran investor, specialized in emerging markets, will thus step back from the company he founded in 2018 with Carlos Hardenberg.

“Mark Mobius, founding partner, has notified the company and its investment manager, Mobius Capital Partners LLP (MCP), of his intention to retire from the company in the coming months, leaving a legacy of excellence and devotion to MCP and the Company. His contributions have been fundamental to the success of the company, and his approach to investing in emerging markets since the 1980s remains rooted in the investment philosophy of Mobius Capital Partners LLP,” states the company’s announcement.

As clarified in the statement, Hardenberg will lead the firm and continue managing Mobius Investment Trust, so his departure will not imply major changes in the daily operations of the investment firm. “Mobius Investment Trust will continue to be managed by Mobius Capital Partners LLP, which is led by Carlos Hardenberg, with the support of an experienced team of emerging market specialists. Carlos has been investing in emerging markets for over 23 years and has worked closely with Mark Mobius. He has successfully managed national, regional, and global emerging and frontier market portfolios, including the largest emerging market investment fund listed in London, generating significantly superior returns throughout the period,” the document further clarifies.

“Our trajectory over the past five years has been marked by progress, and we are truly grateful for the results achieved. We want to express our deepest gratitude to Mark for his exceptional contribution to emerging market investment throughout his long career and, more recently, to Mobius Capital Partners LLP and Mobius Investment Trust over the past five years. Mark’s dedication has been fundamental to our success. Looking ahead, I intend to promote our most talented employees to the rank of partners. With this, I want to recognize their great performance and commitment to Mobius Capital Partners LLP,” declared Carlos Hardenberg, founding partner.

Mobius has stated that he will focus on “new and exciting” projects in Dubai. “It has been an incredible journey at MobiusCap, where I have witnessed its growth and success, looking ahead I will shift my focus and dedicate more time to new and exciting projects in #Dubai, focusing on investments and consulting in #entrepreneurship. I also have two new books coming out soon, so stay tuned for more updates!” Mobius tweeted on the social network X (ex Twitter).

In the issued statement, Mobius commented: “I am proud of the solid performance of the investment team over the past five years, which demonstrates that a concentrated and differentiated portfolio of high-quality securities can generate exceptional returns. As a shareholder of Mobius Investment Trust, I will closely follow the development of the company and continue to be available to the team and the Board.”

Finally, on behalf of the Board of Directors, Maria Luisa Cicognani, chairwoman of Mobius Investment Trust, stated: “Mark and Carlos have played a decisive role in the success and profitability of Mobius Investment Trust since our IPO, and now that Mark intends to leave the partnership, we would like to express our immense gratitude for his advice and expertise over the years. We look forward to continuing to work with Mark, leveraging his support and vast knowledge of emerging markets, as Mobius Capital Partners LLP progresses with a strong and committed team led by Carlos, whom we are confident will continue to deliver outstanding results to our shareholders.”

Before creating Mobius Capital Partners, Mobius spent more than 30 years at Franklin Templeton Investments, most recently as Executive Chairman of Templeton Emerging Markets Group. He is one of the most reputed investors in the industry and known for over 40 years of working and traveling through emerging and frontier markets. During this time, he has been in charge of actively managed funds totaling more than 50,000 million dollars in assets.