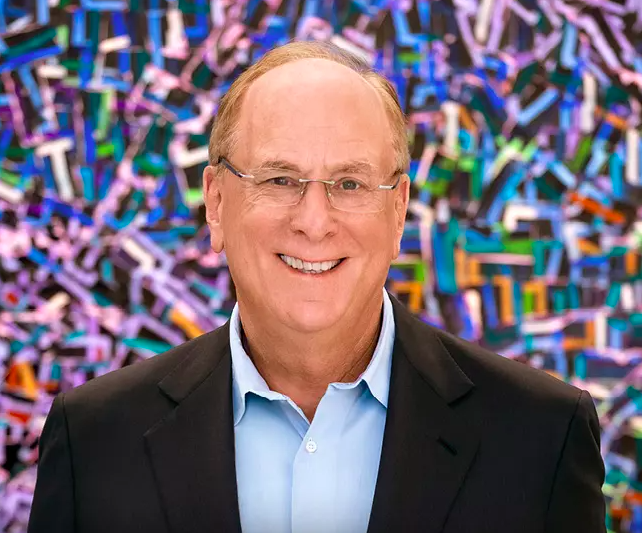

In the context of presenting the second quarter 2024 results, Larry Fink, Chairman and CEO of BlackRock, reiterated the company’s commitment to private markets. This commitment has been bolstered by the acquisition of Preqin earlier this month.

“BlackRock is leveraging the broadest set of opportunities we’ve seen in years, including private markets, Aladdin, and full portfolio solutions across both ETFs and active assets. At the same time, we are opening significant new growth markets for our clients and shareholders with our planned acquisitions of Global Infrastructure Partners and Preqin,” Fink stated.

In this regard, he highlighted that organic growth in this second quarter was driven by private markets, in addition to retail active fixed income and increasing flows into our ETFs, which had their best start to the year in history. “BlackRock generated nearly $140 billion in total net flows in the first half of 2024, including $82 billion in the second quarter, resulting in 3% organic growth in base fees. We are delivering growth at scale, reflected in a 12% increase in operating income and a 160 basis points expansion in margin,” he said regarding the results.

According to Fink, BlackRock’s extensive experience in engaging with companies and governments worldwide sets it apart as a capital partner in private markets, driving a unique deal flow for clients. “We have strong sourcing capabilities and are transforming our private markets platform to bring even more scale and technology benefits to our clients. We are on track to close our planned acquisition of Global Infrastructure Partners in the third quarter of 2024, which is expected to double the base fees of private markets and add approximately $100 billion in infrastructure assets under management. And just a few weeks ago, we announced our agreement to acquire Preqin, a leading provider of private market data,” he emphasized.

Finally, he insisted that “BlackRock is defining a unique and integrated approach to private markets, encompassing investment, technological workflows, and data. We believe this will deepen our client relationships and deliver value to our shareholders through premium and diversified organic revenue growth.”