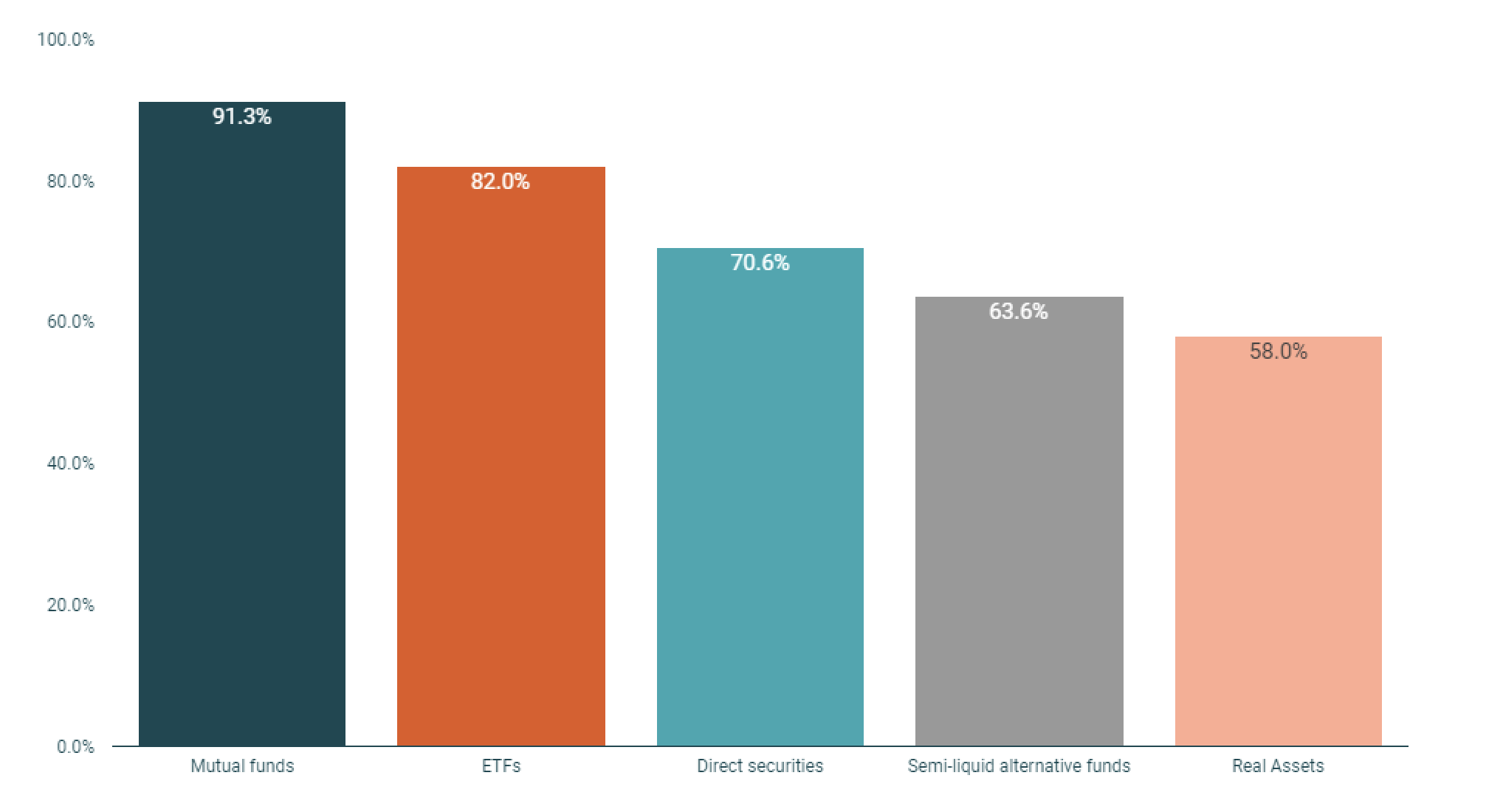

An internal survey conducted by Funds Society confirms that when it comes to choosing assets, our readers in the Americas are predominantly mutual fund buyers, although ETFs and other assets like Direct Securities, semi-liquid alternative funds, and Real Assets have their place in portfolios.

The survey was conducted among readers in the United States (primarily the US Offshore market) and several Latin American countries (Chile, Uruguay, Argentina, Brazil, Mexico, Peru, Colombia, Panama, and the Caribbean).

91.3% of respondents have mutual funds in their portfolios, while 82% have ETFs.

Assets such as Direct Securities have a strong presence among our readers’ investment assets, with 70.6% of respondents to our internal survey holding them.

The chapter on alternative assets is especially relevant in the current context: 63.6% of respondents have invested in semi-liquid alternative funds, but this figure drops to 58% when we talk about Real Assets.

In summary, Funds Society readers are a faithful representation of the Latin American client, both onshore and offshore, who rely on mutual funds as a vehicle to generate value, increasingly complement them with passive strategies, and still view the global rise of alternative assets with some distance.

Insights from the Financial Industry

Several fund selectors and industry professionals confirmed the trend of portfolios in the Americas having funds complemented by ETFs, while increasingly looking at private assets.

Carla Sierra, Head of Investments at Aiva, notes that they align with Funds Society readers in “carefully selecting investment funds as one of the main tools for our portfolios, complementing them with ETFs when it makes sense according to market conditions. Additionally, we have begun exploring semi-liquid alternative products to take advantage of market inefficiencies through non-traditional assets and strategies. These products are gaining relevance and becoming increasingly accessible to retail investors through various managers. We believe it is crucial to start incorporating them into portfolios while educating and ensuring an adequate understanding of these products, as they are not suitable for all clients. Our strategy seeks to continuously adapt to integrate these options, maintaining a prudent and risk-aware approach.”

From BECON, a third-party fund distributor, Florencio Mas notes that he is not surprised by the strong adoption of mutual funds by Funds Society readers because it is a growing segment: “Mutual funds have grown a lot, ETFs somewhat less, unlike in the United States. I would say that in the region, the market is still somewhat green.”

Florencio Mas also observes that the adoption “of liquid and semi-liquid alternatives is growing significantly. More and more private asset managers are coming to the region and offering their products with much more investor-friendly structures. Instead of having capital calls, they can be purchased by placing the order all at once, without filling out subscription documents, with certain liquidity windows, allowing exits monthly or quarterly, and obviously with much more accessible investment minimums. In our case, with Barings and Neuberger Berman, we see very strong demand.”

According to Paulina Espósito, Partner, Head of Sales Latin America at TIGRIS INVESTMENT, “the region has been migrating significantly to the idea of investing in investment funds. Clients initially chose individual bonds or stocks for the confidence that an individual security generated, but later, as they began to understand the product, they also understood the advantages.

This understanding stems from communication that allows for education and being informed. The great work of magazines like Funds Society, the closeness of fund families with advisors, and ongoing communication have led to this being reflected in the numbers.”

“Today, with everything experienced in these post-pandemic years, many advisors have redefined their investment model, understanding that selecting a fund involves not only analyzing numbers but also processes, as results are seen in the long term and must have the ability to manage volatility. Regarding alternative assets, the region is in that educational process not just for the advisor but for the client. Daring to choose a product that operates differently. I understand that the natural path for clients is to opt for liquid alternatives initially and then venture into illiquid ones, and as always, determine what percentage of our investments would be allocated to these types of strategies, and continually rebalance portfolios to achieve the results,” adds Paulina Espósito.