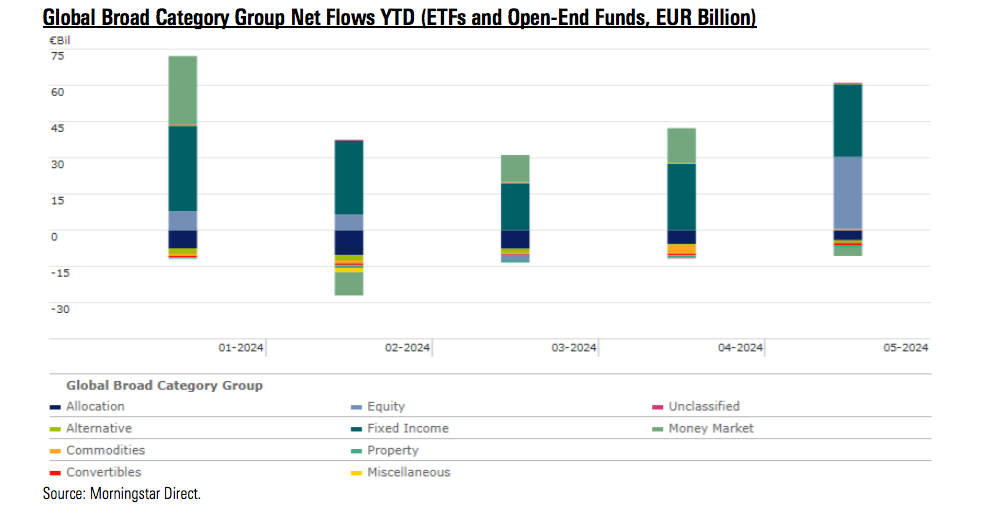

According to the latest data collected by Morningstar, in May, investors showed a positive sentiment, possibly driven by hopes of interest rate cuts and positive macroeconomic data on economic growth, investing 54 billion euros in funds domiciled in Europe. In terms of flows, this figure makes May the best month so far in 2024.

Among the trends observed in May, global equities strongly recovered from the previous month’s losses, with developed markets outperforming emerging markets overall. “Investors continued to anticipate interest rate cuts, despite the US Federal Reserve keeping interest rates unchanged once again in May, with Chairman Jerome Powell indicating that easing was postponed but not canceled. In fact, the decline in US inflation has stalled in recent months, highlighting that the final stretch towards 2% inflation will be difficult for the Fed. Conversely, in Europe, a more moderate narrative emerged, with the market anticipating the European Central Bank meeting in June where a rate cut was widely expected, though the path beyond this remains less clear,” Morningstar explains in its report.

Notably, long-term index funds recorded inflows of 33.1 billion euros in May, compared to the 20.8 billion euros gained by actively managed funds. According to Morningstar, last month, none of the broad global category groups experienced outflows from either passive or active strategies. “The market share of long-term index funds increased to 28.25% in May 2024 from 24.93% in May 2023. Including money market funds, which are dominated by active managers, the market share of index funds stood at 24.57%, compared to 21.78% 12 months earlier,” they indicate.

Regarding the major players, the data shows that global large-cap blend equity funds were by far the best-selling in May, with Mercer Passive Global Equity CCF raising 1.4 billion euros in new net funds during the month. “Global large-cap growth equity funds and US large-cap blend equity funds followed at some distance,” they add.

In the case of passive management, BlackRock’s ETF provider, iShares, topped the list of asset gatherers last month, with net inflows of 8.4 billion euros in May. The iShares Core S&P 500 ETF was the best-seller, attracting 1 billion euros. Capital Group and J.P. Morgan secured the second and third largest inflows in May, with 6 billion euros and 4.6 billion euros, respectively.

Analysis of Flows

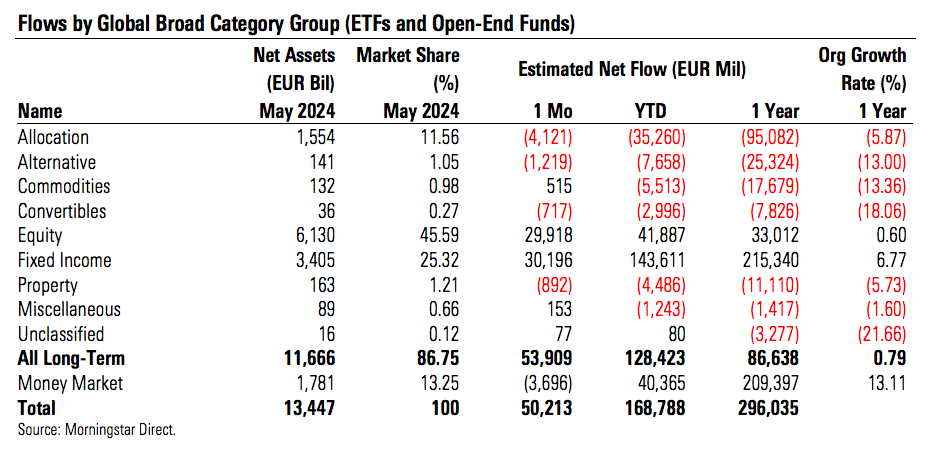

In this context, it is noted that investors showed a very positive sentiment towards equities in May, with equity funds receiving 30 billion euros, the best monthly result in terms of flows since January 2022. “Passive strategies took the majority, with 20.3 billion euros in net inflows during the month. Nonetheless, active equity funds managed to capture 9.7 billion euros, ending a 14-month period of net monthly outflows. Global large-cap equity funds were by far the most sought-after products last month,” they highlight.

Regarding bond funds, they received 30.2 billion euros in May, the eighteenth month of positive flows in the last 19 months. It is noteworthy that both passive and active strategies shared the benefits, with net inflows of 12 billion euros and 18.3 billion euros, respectively. In this regard, the Morningstar report clarifies: the fixed-term bond category was the best-seller in May, followed by very short-term euro bond funds.

In contrast, May data shows that allocation and alternative strategies continued losing assets with net outflows of 4.1 billion euros and 1.2 billion euros, respectively, in May. “Allocation strategies have had only one positive month in terms of flows since December 2022. Meanwhile, alternative funds have experienced net outflows every month since June 2022,” they explain. On the other hand, commodity funds had net inflows of 515 million euros and, finally, money market funds lost 3.7 billion euros last month, “confirming a renewed appetite for risk,” they highlight.

Sustainable Investment

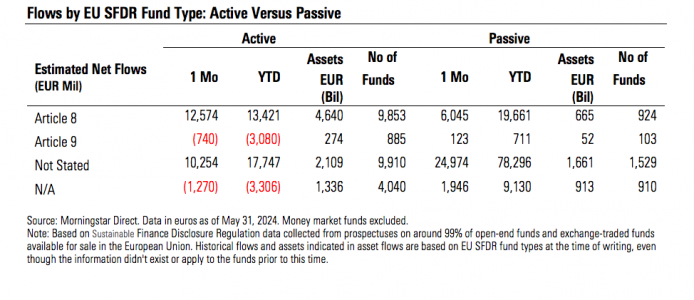

Lastly, the report notes that funds within the scope of Article 8 of the Sustainable Finance Disclosure Regulation had net inflows of 18.7 billion euros in May, the best monthly result since December 2022. “Global large-cap blend equity funds were the main driver, as well as global small- and mid-cap equity products,” it points out. At the same time, funds falling under Article 9 lost 617 million euros in the month.

As Morningstar explains, from an organic growth perspective, Article 8 funds showed an organic growth rate of 0.73% so far this year. On the other hand, products in the Article 9 group had a negative organic growth rate of 2.40% in the same period. Between January and May, funds not considered Article 8 or Article 9 under the SFDR had average organic growth rates ranging from 0.13% to 2.69%.